- India

- /

- Auto Components

- /

- NSEI:ENDURANCE

If EPS Growth Is Important To You, Endurance Technologies (NSE:ENDURANCE) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Endurance Technologies (NSE:ENDURANCE). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Endurance Technologies

Endurance Technologies' Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's easy to see why many investors focus in on EPS growth. Endurance Technologies' EPS skyrocketed from ₹38.36 to ₹51.25, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 34%.

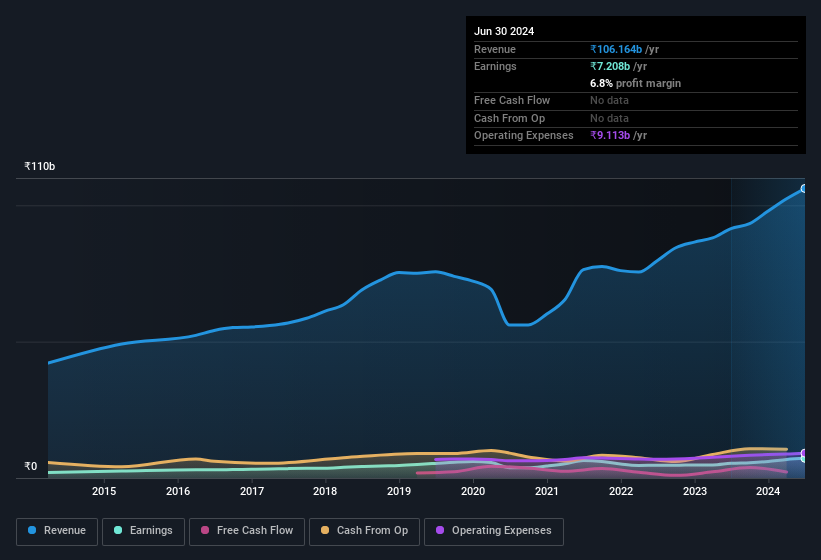

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Endurance Technologies maintained stable EBIT margins over the last year, all while growing revenue 16% to ₹106b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Endurance Technologies?

Are Endurance Technologies Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Endurance Technologies shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that company insider Aswinsriram Alagarsamy bought ₹4.0m worth of shares at an average price of around ₹2,681. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Endurance Technologies.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Endurance Technologies insiders own more than a third of the company. Indeed, with a collective holding of 63%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling ₹221b. That means they have plenty of their own capital riding on the performance of the business!

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Endurance Technologies' CEO, Anurang Jain, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Endurance Technologies with market caps between ₹168b and ₹537b is about ₹49m.

The CEO of Endurance Technologies was paid just ₹70.0 in total compensation for the year ending March 2024. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Endurance Technologies Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Endurance Technologies' strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. These things considered, this is one stock worth watching. Still, you should learn about the 1 warning sign we've spotted with Endurance Technologies.

Keen growth investors love to see insider activity. Thankfully, Endurance Technologies isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Endurance Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ENDURANCE

Endurance Technologies

Manufactures and supplies automotive components for original equipment manufacturers in India and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026