- India

- /

- Auto Components

- /

- NSEI:DIVGIITTS

Divgi TorqTransfer Systems Limited's (NSE:DIVGIITTS) Share Price Matching Investor Opinion

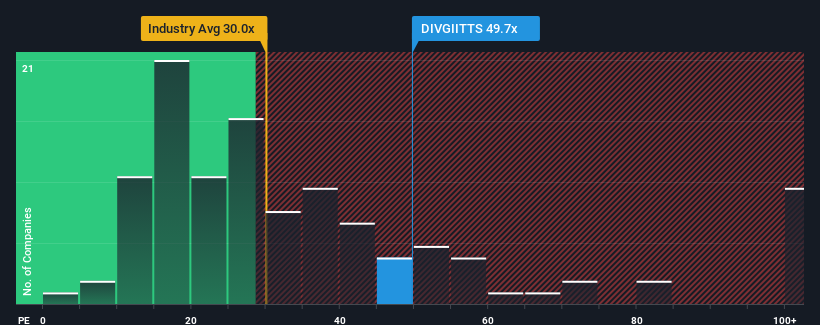

Divgi TorqTransfer Systems Limited's (NSE:DIVGIITTS) price-to-earnings (or "P/E") ratio of 49.7x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 29x and even P/E's below 16x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Divgi TorqTransfer Systems hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Divgi TorqTransfer Systems

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Divgi TorqTransfer Systems would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 19%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 39% over the next year. With the market only predicted to deliver 24%, the company is positioned for a stronger earnings result.

With this information, we can see why Divgi TorqTransfer Systems is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Divgi TorqTransfer Systems maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Divgi TorqTransfer Systems you should be aware of.

Of course, you might also be able to find a better stock than Divgi TorqTransfer Systems. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DIVGIITTS

Divgi TorqTransfer Systems

Engages in the manufacture and sale of transfer cases, automatic locking hubs, and synchronizers and components to automotive original equipment manufacturers and other customers.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026