- India

- /

- Auto Components

- /

- NSEI:BHARATGEAR

Bharat Gears Limited (NSE:BHARATGEAR) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

The Bharat Gears Limited (NSE:BHARATGEAR) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

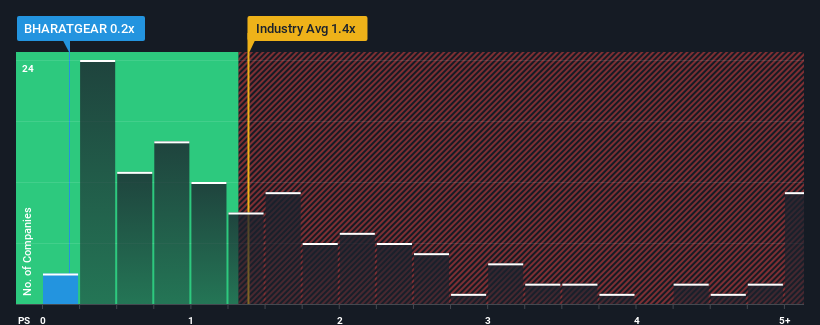

Since its price has dipped substantially, when close to half the companies operating in India's Auto Components industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Bharat Gears as an enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Bharat Gears

How Has Bharat Gears Performed Recently?

For example, consider that Bharat Gears' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Bharat Gears will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Bharat Gears' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.2% decrease to the company's top line. As a result, revenue from three years ago have also fallen 9.7% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 8.1% shows it's an unpleasant look.

In light of this, it's understandable that Bharat Gears' P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Bharat Gears' recently weak share price has pulled its P/S back below other Auto Components companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Bharat Gears confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Bharat Gears you should know about.

If you're unsure about the strength of Bharat Gears' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Bharat Gears might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BHARATGEAR

Bharat Gears

Manufactures and supplies automotive gear in India, the United States, Mexico, Spain, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success