Stock Analysis

- India

- /

- Auto Components

- /

- NSEI:AUTOIND

Autoline Industries (NSE:AUTOIND) delivers shareholders solid 44% CAGR over 3 years, surging 12% in the last week alone

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a really great company, you can more than double your money. To wit, the Autoline Industries Limited (NSE:AUTOIND) share price has flown 199% in the last three years. That sort of return is as solid as granite. It's also up 14% in about a month. But this could be related to good market conditions -- stocks in its market are up 6.4% in the last month.

Since the stock has added ₹554m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Autoline Industries

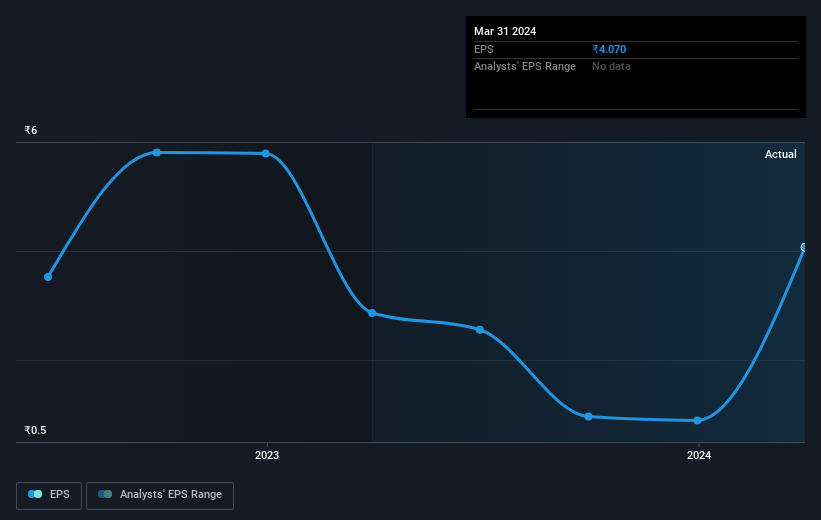

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During three years of share price growth, Autoline Industries moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Autoline Industries' key metrics by checking this interactive graph of Autoline Industries's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Autoline Industries has rewarded shareholders with a total shareholder return of 97% in the last twelve months. That's better than the annualised return of 22% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Autoline Industries better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Autoline Industries (including 2 which don't sit too well with us) .

Of course Autoline Industries may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Autoline Industries is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Autoline Industries is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:AUTOIND

Autoline Industries

Manufactures and sells sheet metal stampings, welded assemblies, and modules for original equipment manufacturers and other automobile companies in India.

Acceptable track record and slightly overvalued.