Here's Why Shareholders May Want To Be Cautious With Increasing Atul Auto Limited's (NSE:ATULAUTO) CEO Pay Packet

In the past three years, shareholders of Atul Auto Limited (NSE:ATULAUTO) have seen a loss on their investment. Per share earnings growth is also poor, despite revenues growing. Shareholders will have a chance to take their concerns to the board at the next AGM on 27 September 2022 and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

View our latest analysis for Atul Auto

Comparing Atul Auto Limited's CEO Compensation With The Industry

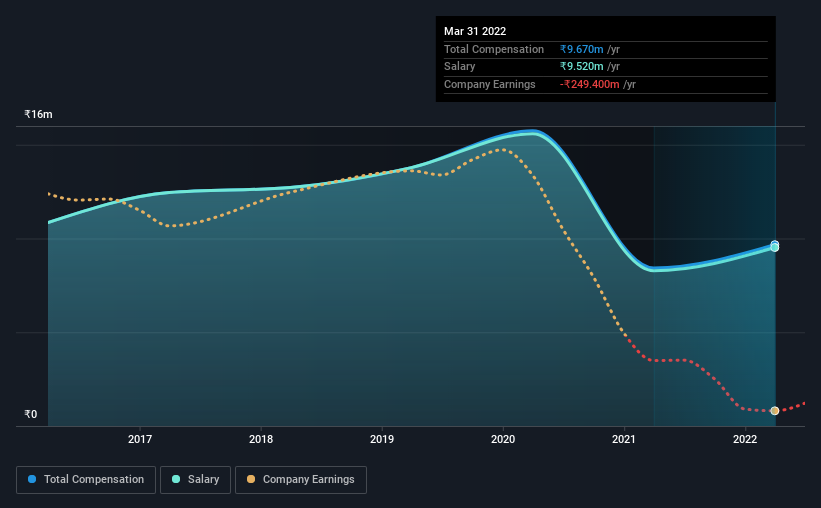

At the time of writing, our data shows that Atul Auto Limited has a market capitalization of ₹4.5b, and reported total annual CEO compensation of ₹9.7m for the year to March 2022. That's a notable increase of 15% on last year. In particular, the salary of ₹9.52m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under ₹16b, the reported median total CEO compensation was ₹9.7m. This suggests that Atul Auto remunerates its CEO largely in line with the industry average. Moreover, Jayantibhai Chandra also holds ₹772m worth of Atul Auto stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹9.5m | ₹8.3m | 98% |

| Other | ₹150k | ₹150k | 2% |

| Total Compensation | ₹9.7m | ₹8.4m | 100% |

On an industry level, around 74% of total compensation represents salary and 26% is other remuneration. Atul Auto is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Atul Auto Limited's Growth

Over the last three years, Atul Auto Limited has shrunk its earnings per share by 114% per year. In the last year, its revenue is up 28%.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Atul Auto Limited Been A Good Investment?

With a three year total loss of 13% for the shareholders, Atul Auto Limited would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Atul Auto pays its CEO a majority of compensation through a salary. The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 3 warning signs for Atul Auto (2 are significant!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ATULAUTO

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026