Discovering 3 Undiscovered Gems in India for Potential Growth

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat, yet it is up 45% over the past year with earnings expected to grow by 17% per annum over the next few years. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can lead to promising investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 22.04% | 60.31% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| BLS E-Services | 1.67% | 15.04% | 51.58% | ★★★★★☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 20.01% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

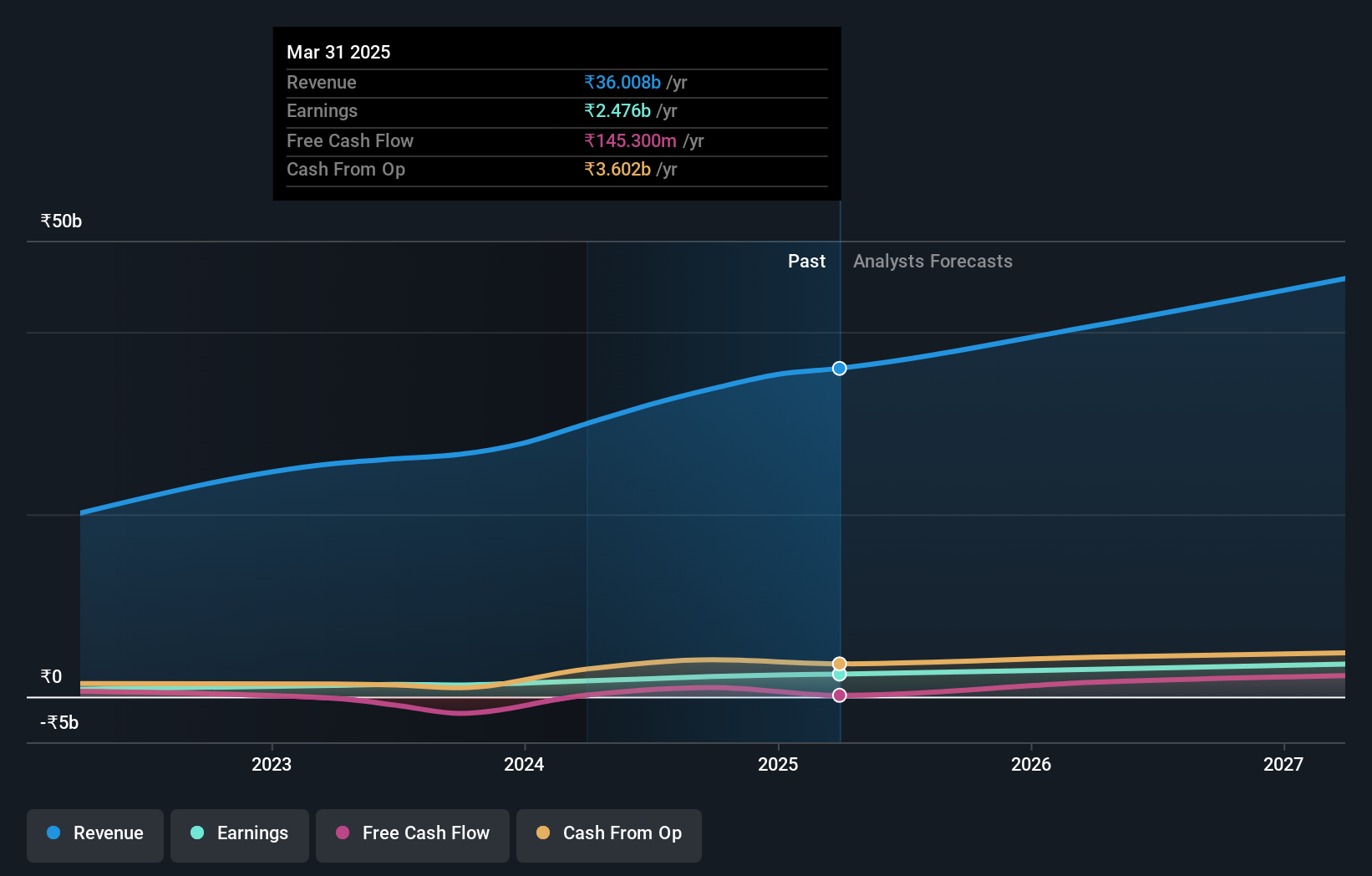

ASK Automotive (NSEI:ASKAUTOLTD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ASK Automotive Limited, through its subsidiary, manufactures and sells auto components for the automobiles industry in India and has a market cap of ₹92.44 billion.

Operations: ASK Automotive Limited generates revenue primarily from the manufacturing of auto components, amounting to ₹32.00 billion. The company has a market cap of ₹92.44 billion.

ASK Automotive has shown impressive growth, with earnings rising 44.8% last year, outpacing the Auto Components industry’s 20.1%. The company reported Q1 2024 sales of ₹8.62 billion, up from ₹6.57 billion a year ago, and net income of ₹568 million compared to ₹348 million previously. Despite a high net debt to equity ratio at 40.8%, interest payments are well covered by EBIT at 8.6x coverage, indicating strong financial health and quality earnings.

- Click here to discover the nuances of ASK Automotive with our detailed analytical health report.

Review our historical performance report to gain insights into ASK Automotive's's past performance.

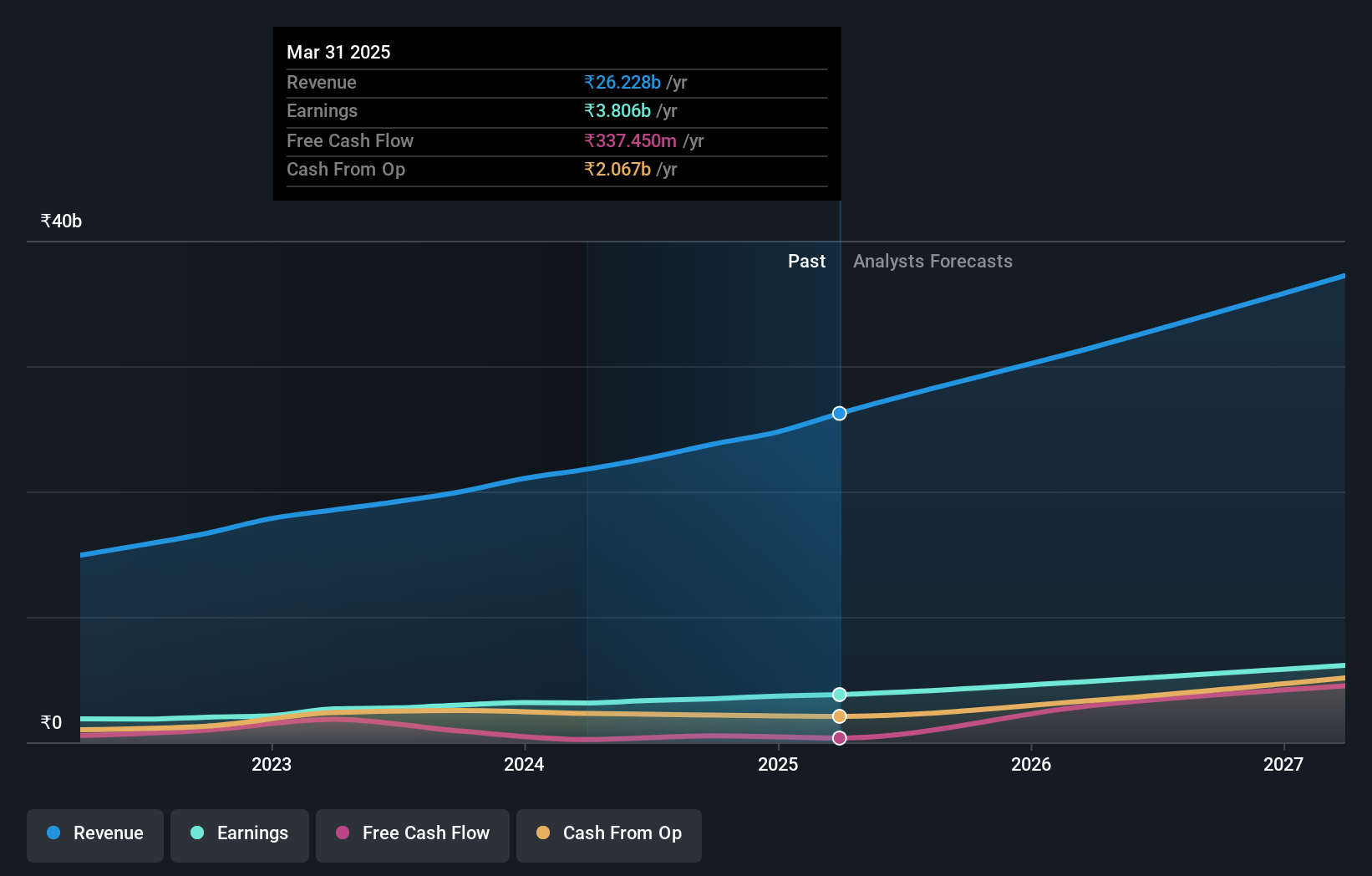

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research and development, manufacturing, marketing, and sale of generic pharmaceutical formulations globally and has a market cap of ₹108.78 billion.

Operations: Marksans Pharma's revenue from the pharmaceutical segment stands at ₹22.68 billion. The company has a market cap of ₹108.78 billion.

Marksans Pharma, a promising player in the Indian pharmaceutical sector, has shown robust earnings growth of 21.7% over the past year, outpacing industry averages. The company’s debt to equity ratio improved from 19.9% to 11.7% in five years, indicating prudent financial management. Its net income for Q1 FY25 was INR 887.52 million, up from INR 686.58 million a year ago. Marksans is also exploring M&A opportunities to expand into Europe and recently received a positive inspection report from the USFDA for its Goa facility.

- Click to explore a detailed breakdown of our findings in Marksans Pharma's health report.

Explore historical data to track Marksans Pharma's performance over time in our Past section.

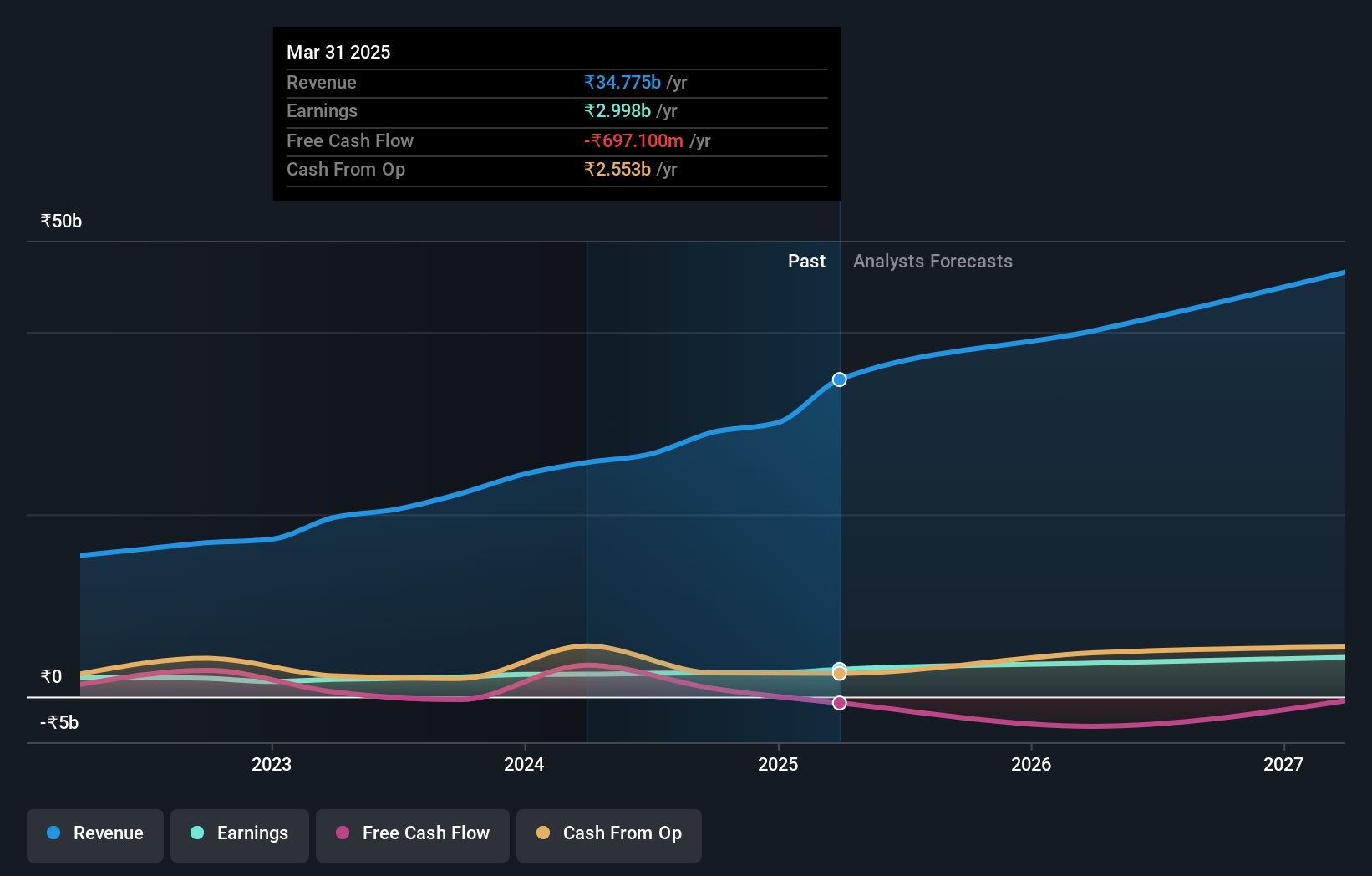

RailTel Corporation of India (NSEI:RAILTEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: RailTel Corporation of India Limited offers broadband telecom and multimedia networks and services both domestically and internationally, with a market cap of ₹161.11 billion.

Operations: RailTel generates revenue primarily from Telecommunications (₹13.02 billion) and Project Work Services (₹13.57 billion).

RailTel Corporation of India, a promising small-cap stock, has shown significant growth with earnings increasing 14.1% annually over the past five years and a notable 27.2% rise in the last year alone. The company repurchased shares recently and maintains more cash than its total debt, ensuring financial stability. Recent contracts include a ₹709 million project for Eastern Railway and a ₹527 million service order from Uttar Pradesh Police, highlighting its expanding footprint in domestic projects.

Taking Advantage

- Click through to start exploring the rest of the 470 Indian Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MARKSANS

Marksans Pharma

Engages in the research, manufacturing, marketing, and sale of pharmaceutical formulations in the United States, North America, Europe, the United Kingdom, Australia, New Zealand, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives