- India

- /

- Electrical

- /

- NSEI:EXICOM

Abans Holdings And Two More Undiscovered Gems In India

Reviewed by Simply Wall St

The Indian market has shown robust performance, appreciating by 1.2% over the last week and an impressive 45% over the past 12 months, with earnings expected to grow by 16% annually. In such a thriving environment, identifying stocks like Abans Holdings that have not yet caught the broader market's attention can offer unique opportunities for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Kokuyo Camlin | 21.96% | 11.97% | 59.14% | ★★★★★★ |

| Le Travenues Technology | 8.99% | 36.48% | 63.83% | ★★★★★★ |

| NGL Fine-Chem | 12.35% | 15.70% | 9.76% | ★★★★★★ |

| BLS E-Services | NA | 43.93% | 59.81% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| Force Motors | 23.24% | 17.79% | 29.78% | ★★★★★☆ |

| Nibe | 33.91% | 81.20% | 80.04% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.41% | 6.90% | 11.82% | ★★★★☆☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.86% | 55.93% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Abans Holdings (NSEI:AHL)

Simply Wall St Value Rating: ★★★★★☆

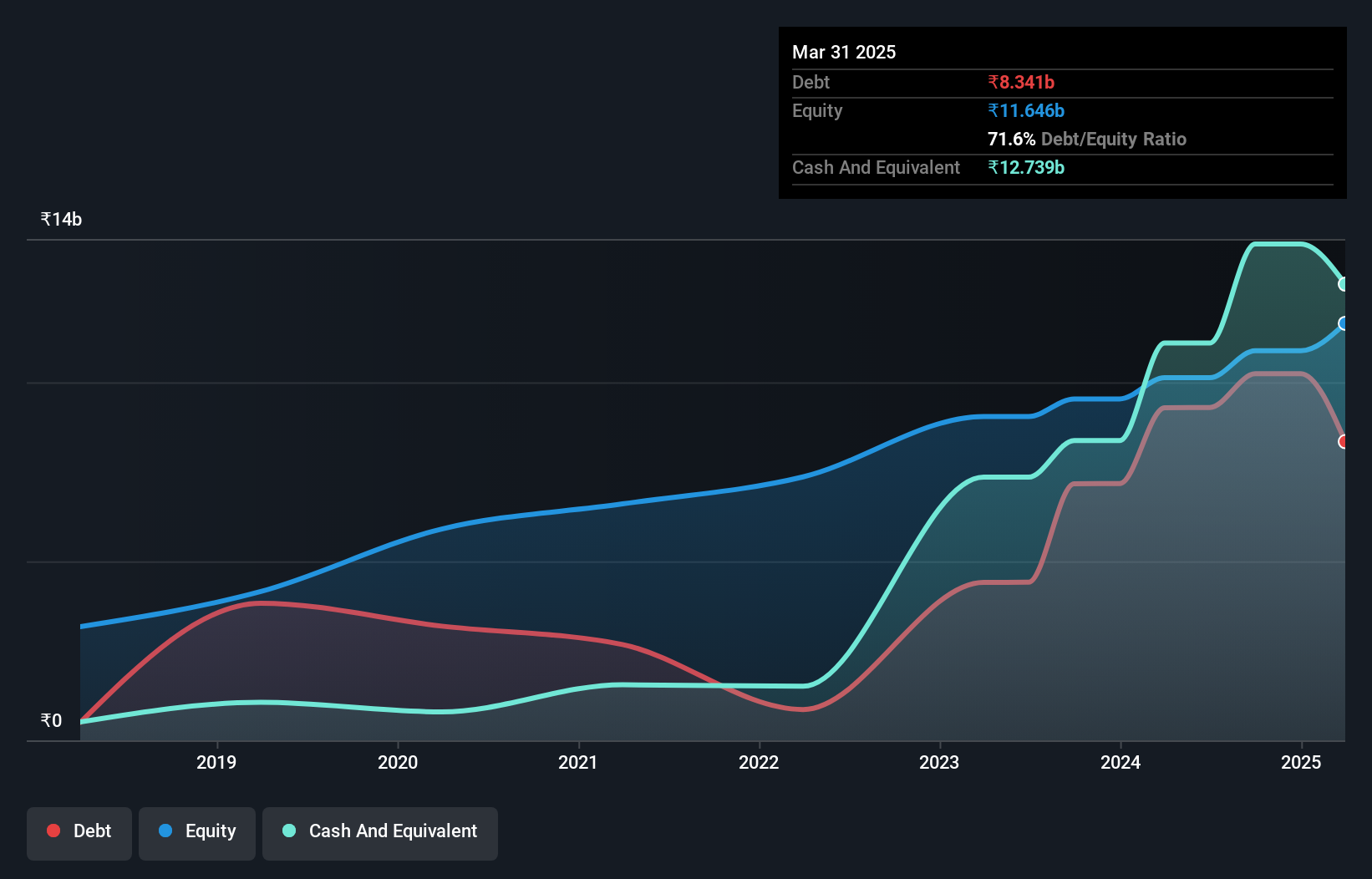

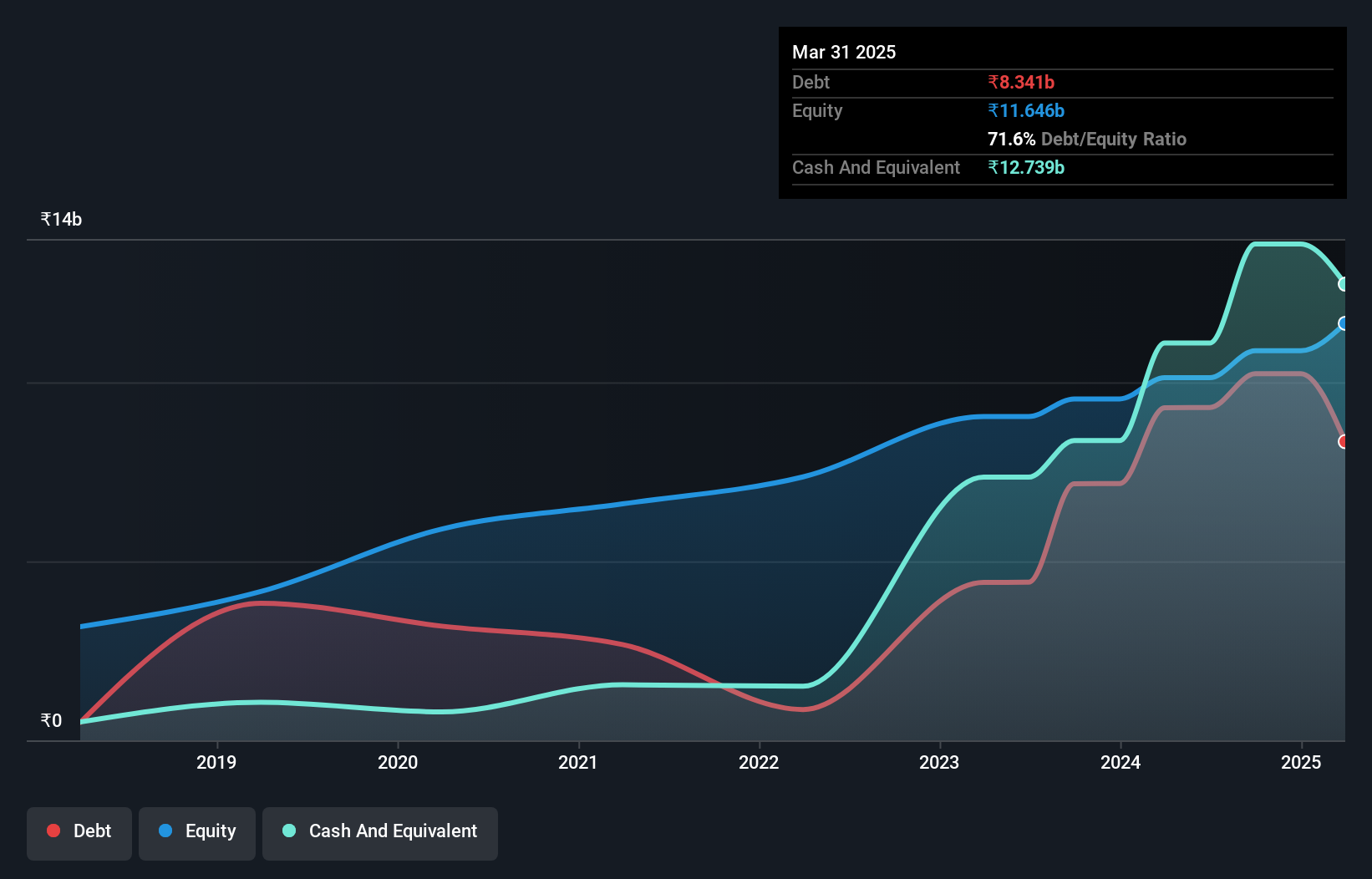

Overview: Abans Holdings Limited, together with its subsidiaries, operates as a non-banking finance company in India and internationally, with a market capitalization of ₹26.83 billion.

Operations: The company operates primarily in agency business and lending activities, generating significant revenue from internal treasury operations (₹12.44 billion). Over recent periods, it has observed a notable increase in gross profit margin, rising from 7.68% in 2018 to 16.83% by mid-2024, reflecting improved operational efficiency or potentially higher-margin revenue streams.

Abans Holdings, an emerging player in the Indian market, showcases robust financial health with a debt to equity ratio improvement from 92.1% to 91.7% over five years. Its earnings have surged by 17.7% annually during this period, underpinned by a strong EBIT coverage of interest payments at 4.1 times. Recently, the firm reported annual revenue growth to INR 13.8 billion and net income of INR 818 million, reflecting a strategic trajectory that could intrigue savvy investors looking for growth-oriented opportunities.

- Click here to discover the nuances of Abans Holdings with our detailed analytical health report.

Gain insights into Abans Holdings' historical performance by reviewing our past performance report.

Abans Holdings (NSEI:AHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Abans Holdings Limited, together with its subsidiaries, operates as a non-banking finance company in India and internationally, with a market capitalization of ₹26.83 billion.

Operations: The company operates primarily in agency business and lending activities, generating significant revenue from internal treasury operations (₹12.44 billion). Over recent periods, it has observed a notable increase in gross profit margin, rising from 7.68% in 2018 to 16.83% by mid-2024, reflecting improved operational efficiency or potentially higher-margin revenue streams.

Abans Holdings, an emerging player in the Indian market, showcases robust financial health with a debt to equity ratio improvement from 92.1% to 91.7% over five years. Its earnings have surged by 17.7% annually during this period, underpinned by a strong EBIT coverage of interest payments at 4.1 times. Recently, the firm reported annual revenue growth to INR 13.8 billion and net income of INR 818 million, reflecting a strategic trajectory that could intrigue savvy investors looking for growth-oriented opportunities.

- Click here to discover the nuances of Abans Holdings with our detailed analytical health report.

Gain insights into Abans Holdings' historical performance by reviewing our past performance report.

ASK Automotive (NSEI:ASKAUTOLTD)

Simply Wall St Value Rating: ★★★★☆☆

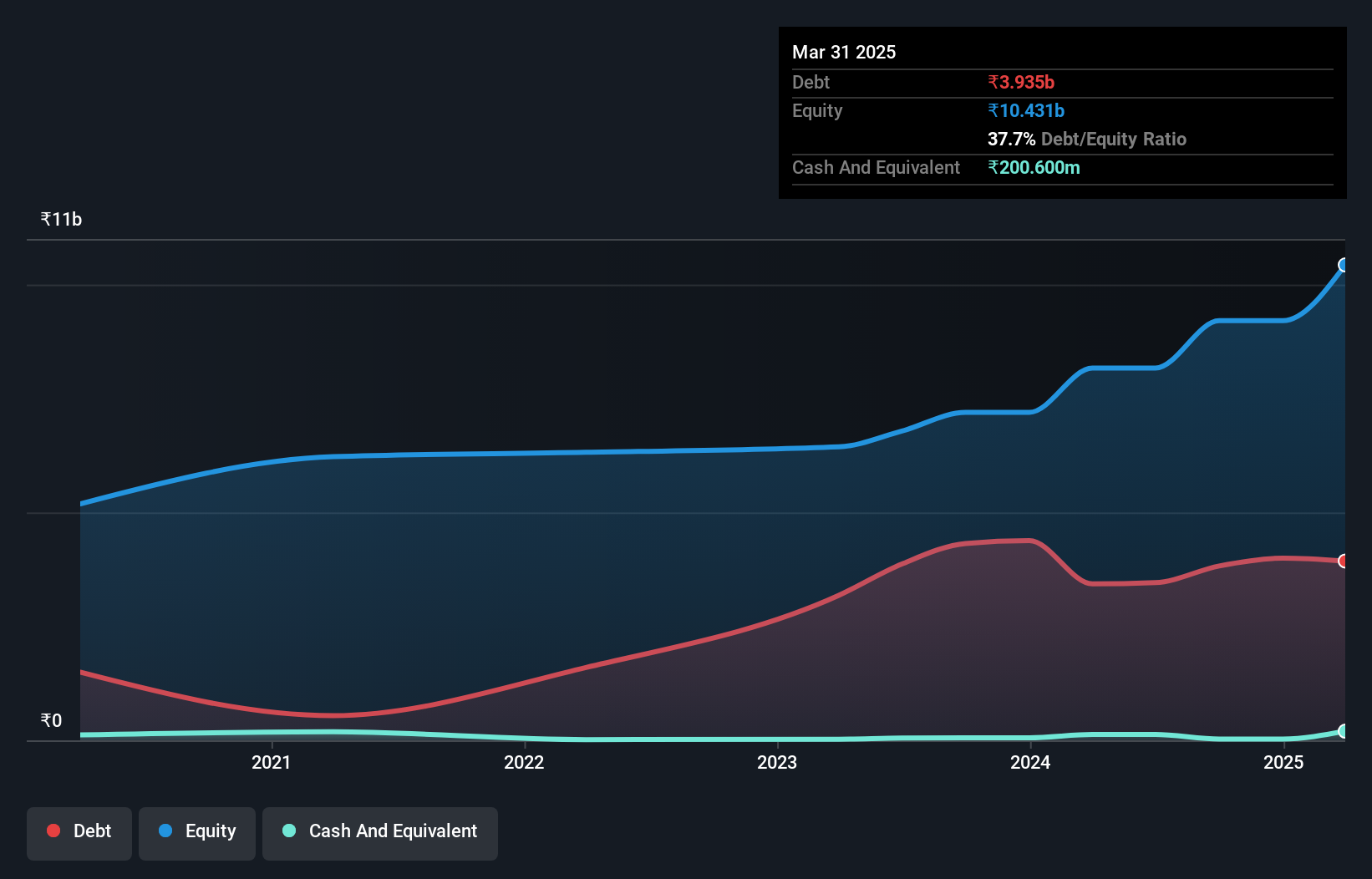

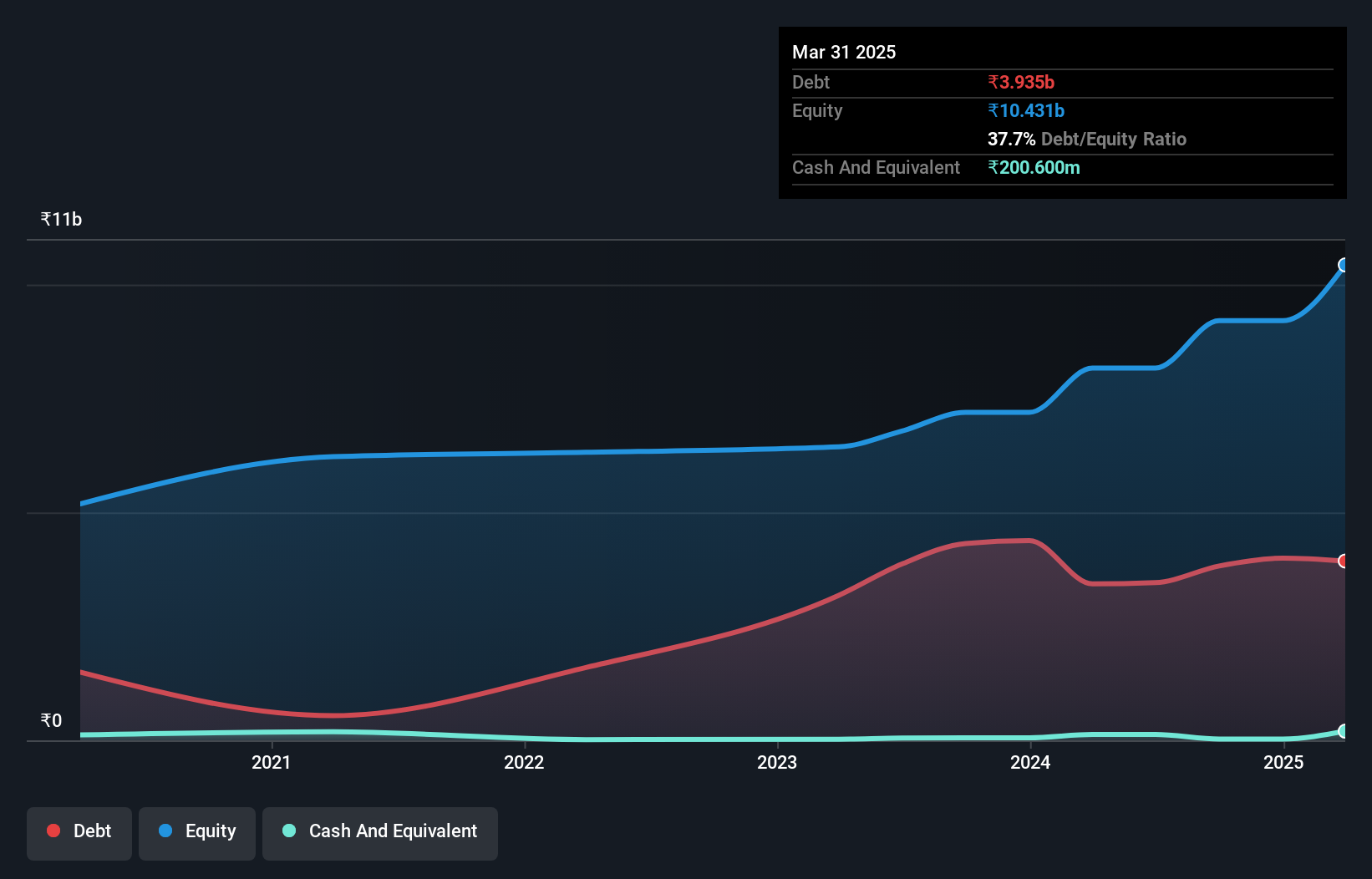

Overview: ASK Automotive Limited is an Indian company engaged in the manufacturing and selling of auto components for the automobile industry, with a market capitalization of ₹76.42 billion.

Operations: The company specializes in manufacturing auto components, generating a revenue of ₹29.95 billion as of the latest reported period. It has observed a gross profit margin increase to 31.99% during the same timeframe, reflecting efficiency improvements in production or cost management strategies.

ASK Automotive, a noteworthy player in the Auto Components sector, has demonstrated robust financial performance with earnings growth of 41.3% over the past year, outpacing its industry's growth of 23.2%. Despite a high net debt-to-equity ratio of 40.5%, the company's interest payments are well covered by EBIT at 8.1 times coverage. Looking ahead, earnings are projected to grow by 29.27% annually, supported by strategic initiatives like a new joint venture aimed at expanding its market reach in aftermarket parts for passenger cars.

- Click here and access our complete health analysis report to understand the dynamics of ASK Automotive.

Assess ASK Automotive's past performance with our detailed historical performance reports.

ASK Automotive (NSEI:ASKAUTOLTD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ASK Automotive Limited is an Indian company engaged in the manufacturing and selling of auto components for the automobile industry, with a market capitalization of ₹76.42 billion.

Operations: The company specializes in manufacturing auto components, generating a revenue of ₹29.95 billion as of the latest reported period. It has observed a gross profit margin increase to 31.99% during the same timeframe, reflecting efficiency improvements in production or cost management strategies.

ASK Automotive, a noteworthy player in the Auto Components sector, has demonstrated robust financial performance with earnings growth of 41.3% over the past year, outpacing its industry's growth of 23.2%. Despite a high net debt-to-equity ratio of 40.5%, the company's interest payments are well covered by EBIT at 8.1 times coverage. Looking ahead, earnings are projected to grow by 29.27% annually, supported by strategic initiatives like a new joint venture aimed at expanding its market reach in aftermarket parts for passenger cars.

- Click here and access our complete health analysis report to understand the dynamics of ASK Automotive.

Assess ASK Automotive's past performance with our detailed historical performance reports.

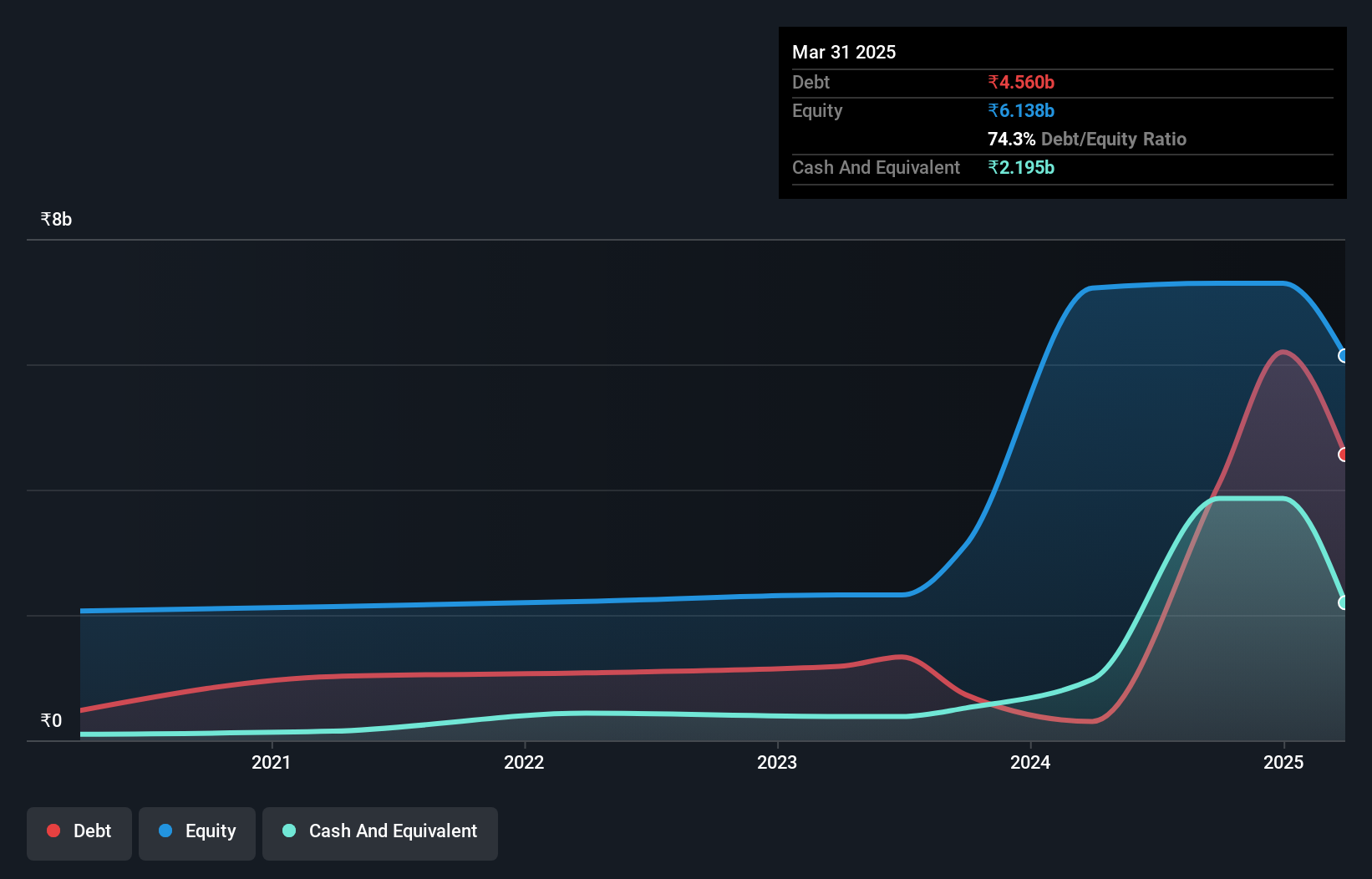

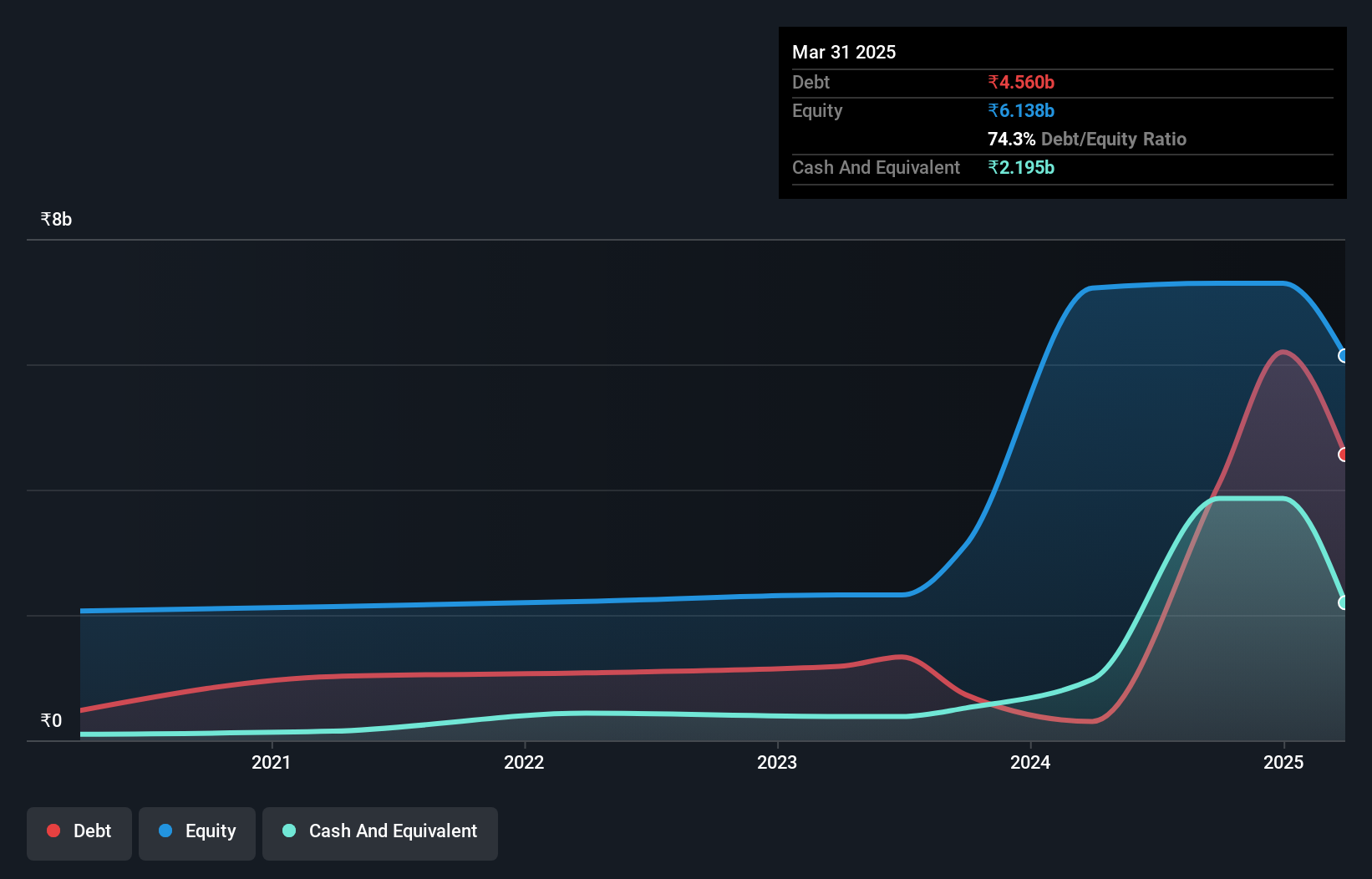

Exicom Tele-Systems (NSEI:EXICOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Exicom Tele-Systems Limited is engaged in the manufacturing and sale of electric vehicle chargers for various applications across both domestic and international markets, with a market capitalization of ₹55.98 billion.

Operations: The company generates its revenue primarily from the telecom sector, which contributed ₹7.91 billion, significantly more than the power segment's ₹2.74 billion. Over recent periods, it has seen a rising gross profit margin, reaching 24.79% by mid-2024, reflecting improved operational efficiency in managing its cost of goods sold which stood at ₹8.11 billion at the end of 2024.

Exicom Tele-Systems, an emerging contender in India's tech sector, has marked a striking 102.2% earnings growth this past year, outpacing the electrical industry's 29.2% increase. With a net debt-to-equity ratio at a manageable 11.1%, the firm maintains financial stability. Recent product launches like the Harmony Gen 1.5 DC Fast Chargers highlight their focus on innovation and user experience, catering to diverse charging needs with features that enhance operational efficiency and accessibility for all users.

- Unlock comprehensive insights into our analysis of Exicom Tele-Systems stock in this health report.

Examine Exicom Tele-Systems' past performance report to understand how it has performed in the past.

Exicom Tele-Systems (NSEI:EXICOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Exicom Tele-Systems Limited is engaged in the manufacturing and sale of electric vehicle chargers for various applications across both domestic and international markets, with a market capitalization of ₹55.98 billion.

Operations: The company generates its revenue primarily from the telecom sector, which contributed ₹7.91 billion, significantly more than the power segment's ₹2.74 billion. Over recent periods, it has seen a rising gross profit margin, reaching 24.79% by mid-2024, reflecting improved operational efficiency in managing its cost of goods sold which stood at ₹8.11 billion at the end of 2024.

Exicom Tele-Systems, an emerging contender in India's tech sector, has marked a striking 102.2% earnings growth this past year, outpacing the electrical industry's 29.2% increase. With a net debt-to-equity ratio at a manageable 11.1%, the firm maintains financial stability. Recent product launches like the Harmony Gen 1.5 DC Fast Chargers highlight their focus on innovation and user experience, catering to diverse charging needs with features that enhance operational efficiency and accessibility for all users.

- Unlock comprehensive insights into our analysis of Exicom Tele-Systems stock in this health report.

Examine Exicom Tele-Systems' past performance report to understand how it has performed in the past.

Next Steps

- Unlock more gems! Our Indian Undiscovered Gems With Strong Fundamentals screener has unearthed 455 more companies for you to explore.Click here to unveil our expertly curated list of 458 Indian Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Exicom Tele-Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:EXICOM

Exicom Tele-Systems

Manufactures and sells electric vehicle chargers and lithium-ion batteries in India and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion