- Israel

- /

- Renewable Energy

- /

- TASE:PRIM

Prime Energy (TASE:PRIM): Losses Deepen Despite Q3 Revenue Doubling, Challenging Bullish Recovery Narratives

Reviewed by Simply Wall St

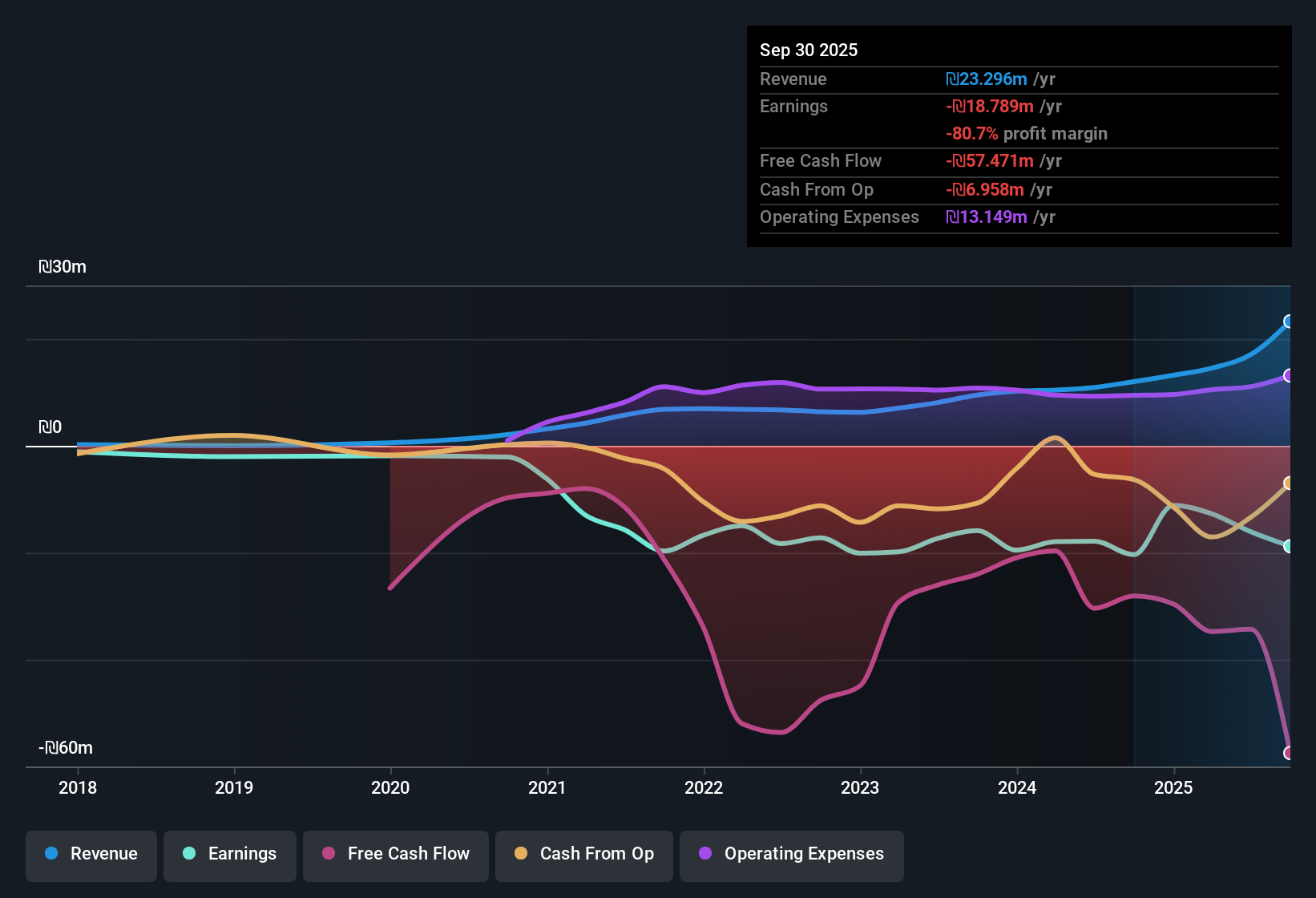

Prime Energy P.E (TASE:PRIM) just released its Q3 2025 results, reporting revenue of 10.458 million ILS and a basic EPS of -0.238 ILS for the quarter. Over recent periods, the company has seen total revenue rise from 3.212 million ILS in Q4 2024 to 10.458 million ILS in Q3 2025, while EPS has consistently stayed in negative territory. Margins remain under pressure, keeping investor focus on whether these persistent losses can eventually be reversed.

See our full analysis for Prime Energy P.E.Next, we will weigh these latest figures against the broader narratives investors are following, highlighting where perceptions match reality and where surprises emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Grow Despite Doubling Revenue

- Net income (excluding extra items) in Q3 2025 came in at -7.823 million ILS, bringing trailing twelve month losses to -18.789 million ILS, compared to -11.131 million ILS a year prior.

- Recent market analysis highlights that, despite scaling revenue, earnings quality has shown no sign of improvement and the negative margin trend has become more entrenched:

- Bears point to a five-year trend with annual losses rising at 8% per year, underlining the worsening profitability.

- The increasing losses, even as revenue advances, challenge any claim of an earnings turnaround in the near term.

Valuation Stands Out Against Industry Norms

- Prime Energy’s Price-To-Sales Ratio sits at 17.2, well above the Asian Renewable Energy industry average of 2.2 and its peer average of 13.7. This suggests sales are being valued at a significant premium.

- This valuation premium, as identified by market observers, raises questions in light of ongoing losses and the absence of positive profit momentum:

- The elevated ratio signals investors are paying considerably more for each shekel of revenue compared to sector peers, even though the company has yet to show improved margins.

- With persistent negative net income and no visible path to profitability, the current valuation places extra pressure on future results to justify the premium.

Persistent Negative EPS Trend

- Trailing twelve month basic EPS deteriorated to -0.624579 ILS by Q3 2025, declining from -0.37713 ILS a year earlier. The company has remained in loss-per-share territory each quarter, except for a small positive in Q4 2024.

- General market opinion underscores that, without an improving trend in EPS or net income, investor attention remains focused on when, if at all, the company can break out of this pattern:

- The failure to maintain even short-term EPS improvements reinforces cautious outlooks on near-term profitability.

- There is no concrete sign in the data of a reversal in the negative EPS trajectory, leaving the timing of any earnings recovery uncertain.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Prime Energy P.E's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rising revenue, Prime Energy’s mounting losses, negative earnings trend, and steep valuation highlight real challenges to achieving sustainable profits.

If you want companies with stronger fundamentals and fairer prices, turn to these 928 undervalued stocks based on cash flows to discover other stocks where earnings and value are more closely aligned.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PRIM

Prime Energy P.E

Engages in the initiating, planning, developing, financing, constructing, managing, licensing, and operating of solar energy projects in Israel and internationally.

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success