- Israel

- /

- Renewable Energy

- /

- TASE:MSKE

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Meshek Energy - Renewable Energies Ltd.'s (TLV:MSKE) CEO For Now

Key Insights

- Meshek Energy - Renewable Energies to hold its Annual General Meeting on 4th of August

- CEO Avner Arad's total compensation includes salary of ₪1.52m

- Total compensation is 903% above industry average

- Meshek Energy - Renewable Energies' EPS grew by 89% over the past three years while total shareholder return over the past three years was 34%

Under the guidance of CEO Avner Arad, Meshek Energy - Renewable Energies Ltd. (TLV:MSKE) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 4th of August. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Meshek Energy - Renewable Energies

Comparing Meshek Energy - Renewable Energies Ltd.'s CEO Compensation With The Industry

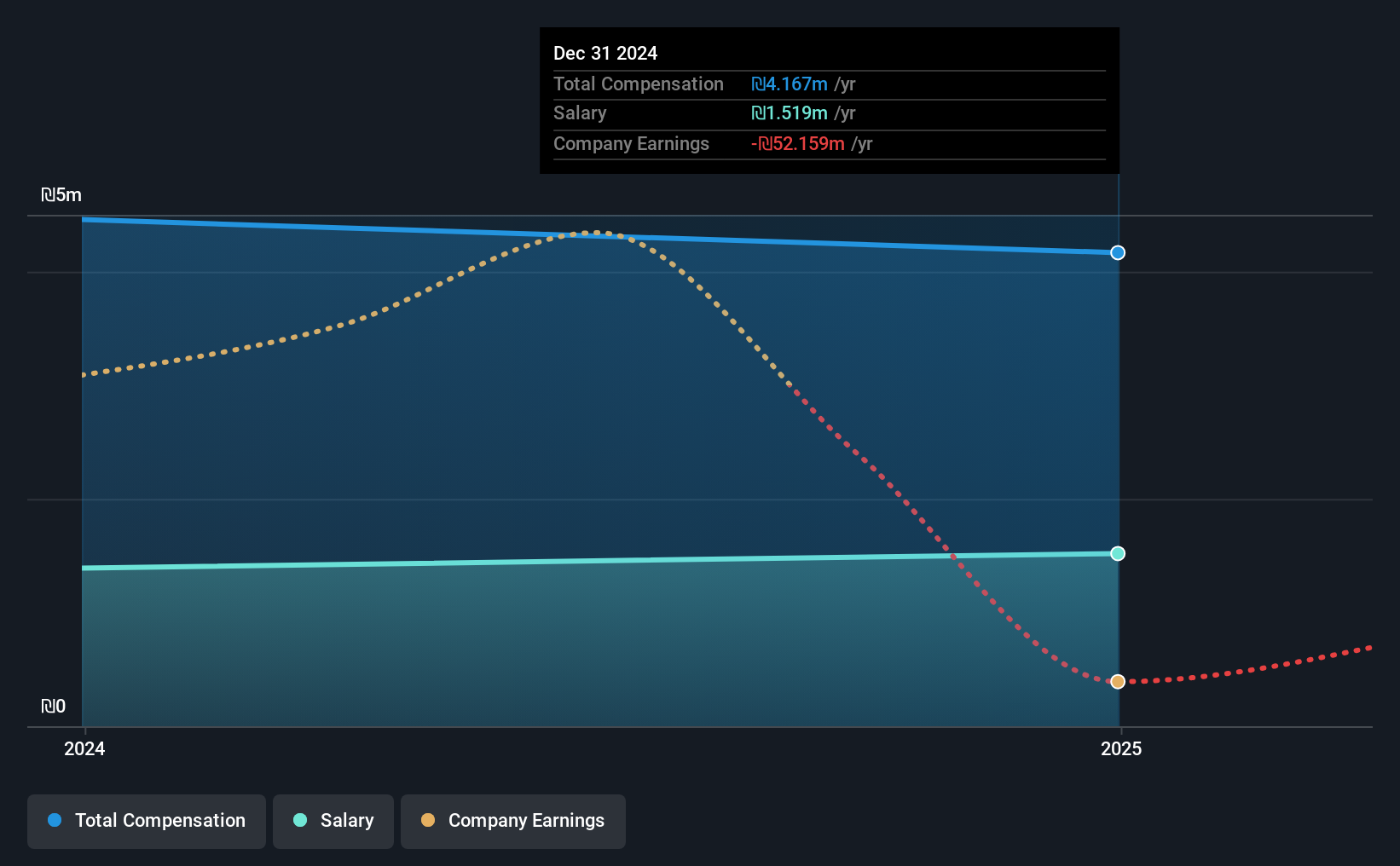

At the time of writing, our data shows that Meshek Energy - Renewable Energies Ltd. has a market capitalization of ₪3.1b, and reported total annual CEO compensation of ₪4.2m for the year to December 2024. That's slightly lower by 6.5% over the previous year. We think total compensation is more important but our data shows that the CEO salary is lower, at ₪1.5m.

For comparison, other companies in the Israel Renewable Energy industry with market capitalizations ranging between ₪1.3b and ₪5.4b had a median total CEO compensation of ₪416k. Hence, we can conclude that Avner Arad is remunerated higher than the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₪1.5m | ₪1.4m | 36% |

| Other | ₪2.6m | ₪3.1m | 64% |

| Total Compensation | ₪4.2m | ₪4.5m | 100% |

On an industry level, around 46% of total compensation represents salary and 54% is other remuneration. Meshek Energy - Renewable Energies sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Meshek Energy - Renewable Energies Ltd.'s Growth

Over the past three years, Meshek Energy - Renewable Energies Ltd. has seen its earnings per share (EPS) grow by 89% per year. It achieved revenue growth of 35% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Meshek Energy - Renewable Energies Ltd. Been A Good Investment?

Most shareholders would probably be pleased with Meshek Energy - Renewable Energies Ltd. for providing a total return of 34% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Meshek Energy - Renewable Energies that you should be aware of before investing.

Switching gears from Meshek Energy - Renewable Energies, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MSKE

Meshek Energy - Renewable Energies

Engages in the renewable energy business.

Imperfect balance sheet with minimal risk.

Market Insights

Community Narratives