- Turkey

- /

- Construction

- /

- IBSE:GLRMK

Undiscovered Gems in Middle East 3 Promising Stocks with Strong Potential

Reviewed by Simply Wall St

As the Middle East markets experience a positive momentum with UAE shares rising and Dubai's benchmark index reaching its highest levels since 2008, investors are keenly watching the outcome of U.S.-China trade talks for potential impacts on global economic prospects. In this dynamic environment, identifying promising stocks often involves looking at companies with strong fundamentals and growth potential that can thrive amidst evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Alfa Solar Enerji Sanayi ve Ticaret | 38.29% | -32.50% | -4.61% | ★★★★★☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Gulermak Aglr Sanayi Insaat ve Taahhut (IBSE:GLRMK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gulermak Aglr Sanayi Insaat ve Taahhut A.S. operates in the construction and engineering industry, with a market cap of TRY43.71 billion.

Operations: GLRMK generates revenue primarily from three geographical segments: East (TRY6.30 billion), West (TRY24.48 billion), and Turkey (TRY8.38 billion). The company experiences a deduction in total revenue due to eliminations amounting to TRY7.81 billion, impacting its overall financial performance.

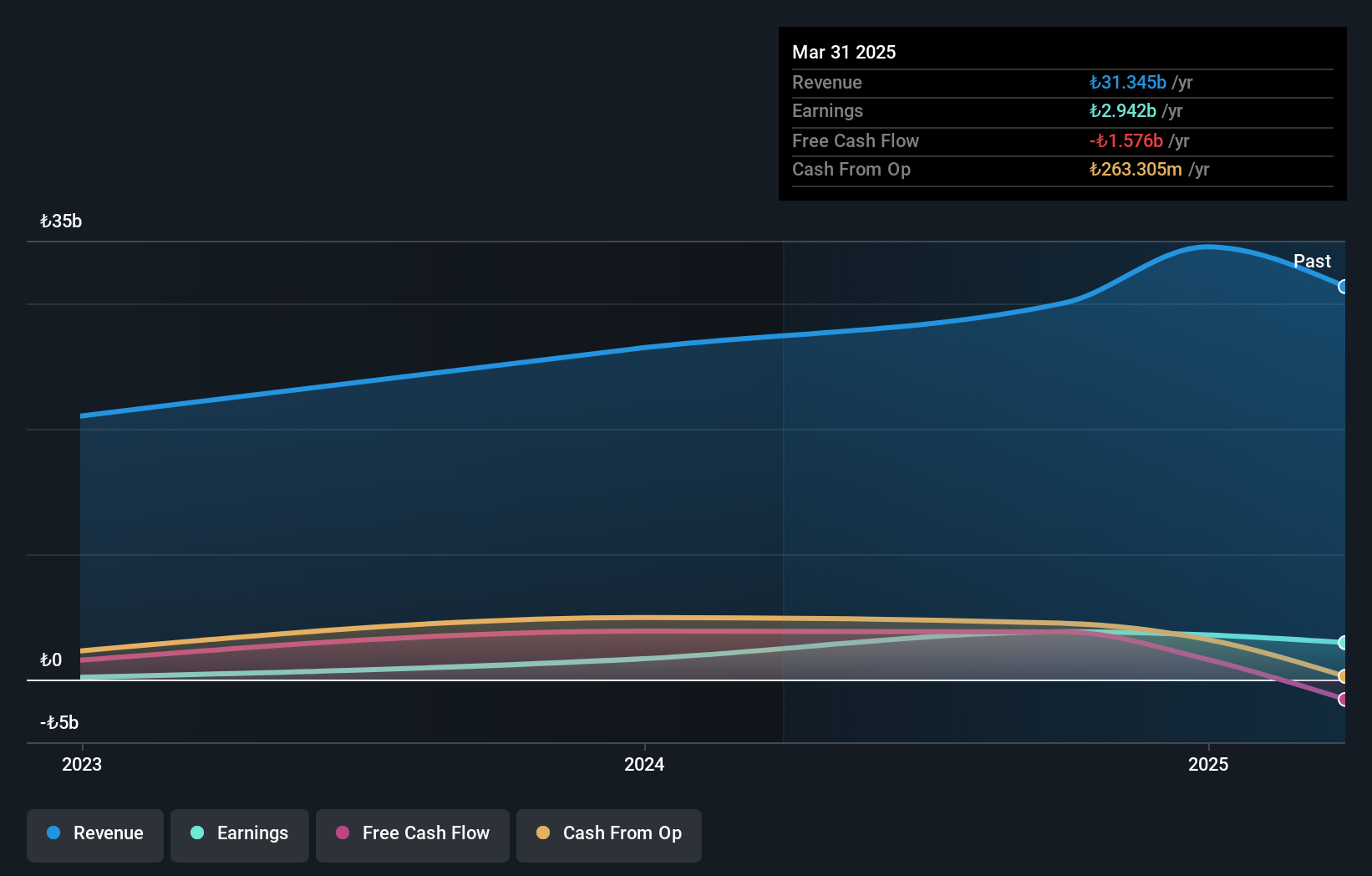

Gulermak Aglr Sanayi Insaat ve Taahhut, a notable player in the Middle East construction sector, has demonstrated robust earnings growth of 23.7% over the past year, outpacing the industry average of 16.1%. Despite a dip in Q1 2025 sales to TRY 6,835.73 million from TRY 10,004.92 million last year and net income falling to TRY 1,162.15 million from TRY 1,789.25 million, its annual performance remains strong with FY2024 sales at TRY 34.51 billion and net income at TRY 3.57 billion compared to previous figures of TRY 26.46 billion and TRY 1.64 billion respectively; this showcases its resilience amidst challenges.

- Take a closer look at Gulermak Aglr Sanayi Insaat ve Taahhut's potential here in our health report.

Learn about Gulermak Aglr Sanayi Insaat ve Taahhut's historical performance.

Ray Sigorta Anonim Sirketi (IBSE:RAYSG)

Simply Wall St Value Rating: ★★★★★★

Overview: Ray Sigorta Anonim Sirketi operates in the non-life insurance sector in Turkey with a market capitalization of TRY38.32 billion.

Operations: Ray Sigorta Anonim Sirketi generates revenue primarily from accident insurance, contributing TRY10.46 billion, followed by fire insurance at TRY1.42 billion. The company's financial performance can be analyzed through its net profit margin trends over time.

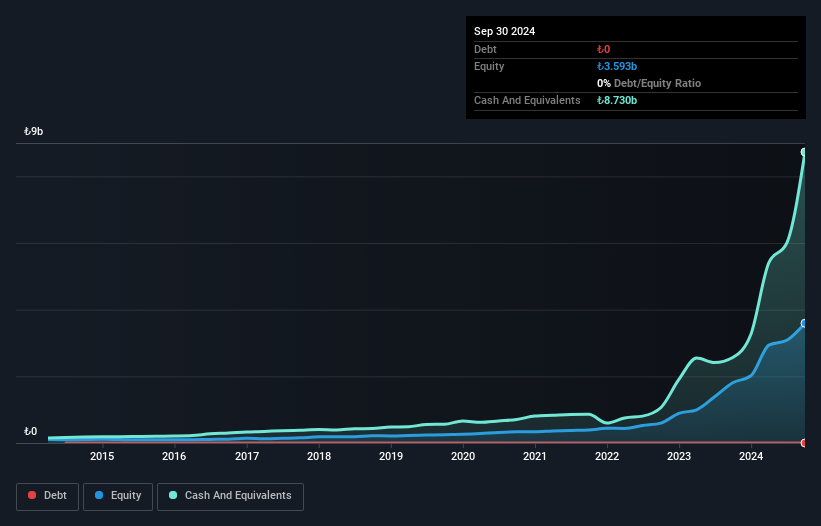

Ray Sigorta, a nimble player in the insurance sector, has seen its earnings grow 70.8% annually over the past five years, yet recent figures show a net income of TRY 812.65 million for Q1 2025, down from TRY 924.17 million last year. Despite this dip and lower profit margins at 12.8% compared to last year's 28.3%, the company remains debt-free and boasts high-quality earnings with positive free cash flow indicators. The company's basic earnings per share also slipped to TRY 5 from TRY 6 year-on-year, indicating some challenges amid robust industry growth rates of over double its own recent performance increase of 23.3%.

Kenon Holdings (TASE:KEN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kenon Holdings Ltd. is a company that owns, develops, and operates power generation facilities in Israel and the United States, with a market capitalization of ₪6.79 billion.

Operations: Kenon Holdings generates revenue primarily through its subsidiaries, with OPC Israel contributing $625.96 million and CPV Group adding $134.35 million.

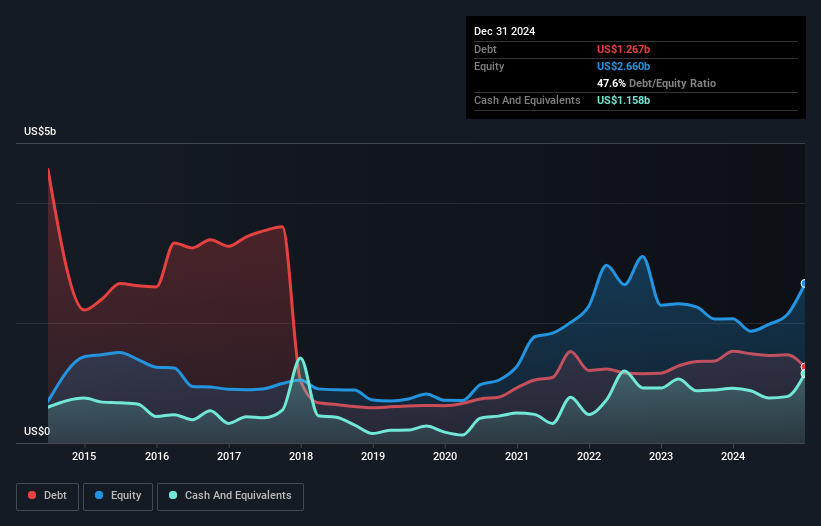

Kenon Holdings, a nimble player in the Middle East market, has seen its debt to equity ratio improve significantly from 93% to 46.9% over five years, indicating stronger financial health. Despite becoming profitable recently with net income of US$12 million for Q1 2025 compared to US$8 million a year ago, its interest coverage remains tight at just 1.1x EBIT. The company’s shares are trading at a substantial discount of 63.4% below estimated fair value and it recently completed share buybacks totaling US$48 million, reflecting confidence in its future prospects despite challenges with free cash flow positivity.

- Delve into the full analysis health report here for a deeper understanding of Kenon Holdings.

Examine Kenon Holdings' past performance report to understand how it has performed in the past.

Seize The Opportunity

- Take a closer look at our Middle Eastern Undiscovered Gems With Strong Fundamentals list of 223 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:GLRMK

Gulermak Aglr Sanayi Insaat ve Taahhut

Gulermak Aglr Sanayi Insaat ve Taahhut A.S.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives