- Israel

- /

- Renewable Energy

- /

- TASE:KEN

Exploring Undiscovered Gems in the Middle East In April 2025

Reviewed by Simply Wall St

As the Middle East markets rebound in line with global shares, buoyed by gains in key indices such as Dubai's and Saudi Arabia's, investors are closely watching for opportunities amid ongoing economic challenges like tariff risks and recession fears. In this environment, identifying promising stocks requires a focus on companies with strong fundamentals that can navigate these uncertainties while capitalizing on regional growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Sure Global Tech | NA | 13.90% | 18.91% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

National Company for Learning and Education (SASE:4291)

Simply Wall St Value Rating: ★★★★☆☆

Overview: National Company for Learning and Education operates a network of educational institutions across various levels in Saudi Arabia, with a market capitalization of SAR 7.10 billion.

Operations: The primary revenue streams for National Company for Learning and Education include Al-Rayan Schools (SAR 96.96 million), Al Qairwan Schools (SAR 91.19 million), and Ar Rawabi Schools (SAR 90.94 million). The company generates income through its diverse portfolio of educational institutions, with each school contributing to the overall financial performance.

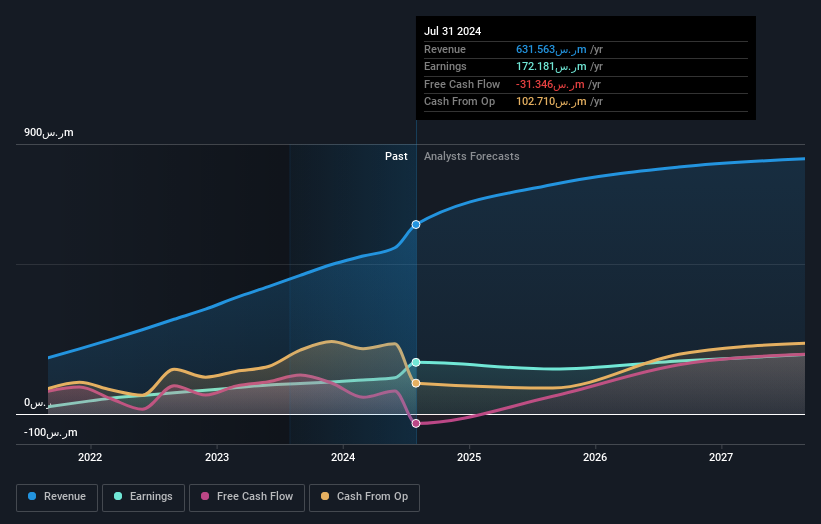

With a promising trajectory, National Company for Learning and Education reported second-quarter sales of SAR 164.06 million, up from SAR 141.04 million the previous year, alongside net income rising to SAR 40.11 million from SAR 33.99 million. The company's earnings per share increased to SAR 0.93 compared to last year's SAR 0.79, reflecting strong performance in the education sector with earnings growth of 71.9% over the past year, outpacing industry averages significantly at just over three times that rate (25%). Despite lacking positive free cash flow recently, its debt-to-equity ratio improved from 8.2% to a healthier level of 4% over five years.

Kenon Holdings (TASE:KEN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kenon Holdings Ltd. is an owner, developer, and operator of power generation facilities with a market capitalization of ₪6.29 billion, operating in Israel, the United States, and internationally through its subsidiaries.

Operations: Kenon generates revenue primarily from its subsidiaries, with OPC Israel contributing $624.96 million and CPV Group adding $126.35 million. The company's financial performance is influenced by these revenue streams across different regions.

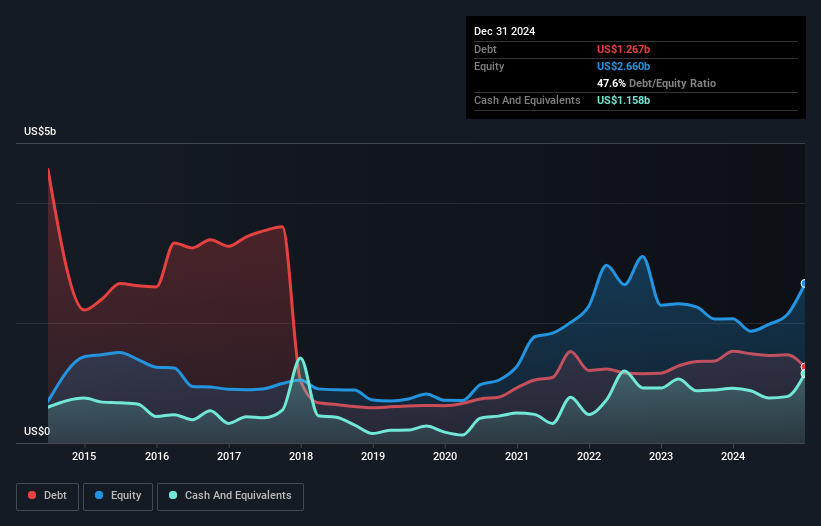

Kenon Holdings, a notable player in the Middle East's investment landscape, has shown significant financial improvement. The company reported a net income of $597.67 million for 2024, bouncing back from a loss of $235.98 million the previous year. Its debt to equity ratio impressively dropped from 87% to 48% over five years, indicating better financial management. Despite trading at 65% below its estimated fair value, Kenon's interest payments are not well covered by EBIT (1x coverage). Recently, it declared an interim cash dividend of $250 million and repurchased shares worth $48 million under its buyback program.

- Click to explore a detailed breakdown of our findings in Kenon Holdings' health report.

Gain insights into Kenon Holdings' past trends and performance with our Past report.

NextVision Stabilized Systems (TASE:NXSN)

Simply Wall St Value Rating: ★★★★★★

Overview: NextVision Stabilized Systems, Ltd. specializes in the development, manufacturing, and marketing of stabilized day and night cameras for ground and aerial vehicles, with a market cap of ₪7.07 billion.

Operations: NextVision generates revenue primarily from its electronic security devices segment, amounting to $114.93 million.

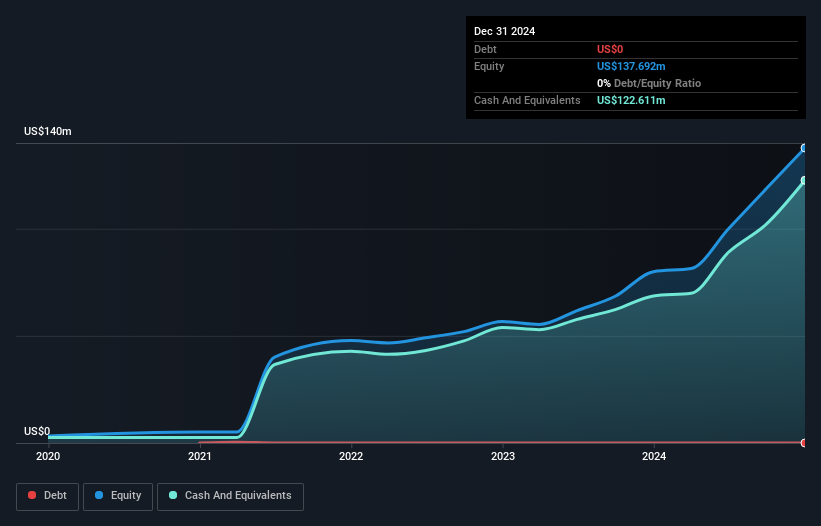

NextVision Stabilized Systems stands out with impressive earnings growth of 140.8% over the past year, significantly outpacing the Electronic industry average of 10.7%. The company is debt-free, which enhances its financial stability and eliminates concerns about interest coverage. Despite a highly volatile share price in recent months, NextVision trades at a compelling 48% below its estimated fair value. Recent earnings announcements highlighted sales reaching US$114.93 million and net income soaring to US$66.4 million for the full year ending December 2024, underscoring its strong performance and potential as an attractive investment opportunity in the Middle East market.

Where To Now?

- Click this link to deep-dive into the 246 companies within our Middle Eastern Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kenon Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:KEN

Kenon Holdings

Through its subsidiaries, operates as an owner, developer, and operator of power generation facilities in Israel and the United States.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion