- Israel

- /

- Renewable Energy

- /

- TASE:ENRG

Returns Are Gaining Momentum At Energix - Renewable Energies (TLV:ENRG)

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, we've noticed some promising trends at Energix - Renewable Energies (TLV:ENRG) so let's look a bit deeper.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Energix - Renewable Energies, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

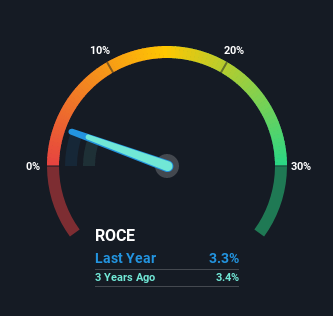

0.033 = ₪115m ÷ (₪3.8b - ₪303m) (Based on the trailing twelve months to December 2020).

Thus, Energix - Renewable Energies has an ROCE of 3.3%. Ultimately, that's a low return and it under-performs the Renewable Energy industry average of 7.4%.

See our latest analysis for Energix - Renewable Energies

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Energix - Renewable Energies, check out these free graphs here.

The Trend Of ROCE

We're glad to see that ROCE is heading in the right direction, even if it is still low at the moment. The data shows that returns on capital have increased substantially over the last five years to 3.3%. The amount of capital employed has increased too, by 325%. So we're very much inspired by what we're seeing at Energix - Renewable Energies thanks to its ability to profitably reinvest capital.

Our Take On Energix - Renewable Energies' ROCE

To sum it up, Energix - Renewable Energies has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

If you want to know some of the risks facing Energix - Renewable Energies we've found 3 warning signs (2 are concerning!) that you should be aware of before investing here.

While Energix - Renewable Energies may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Energix - Renewable Energies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:ENRG

Energix - Renewable Energies

Through its subsidiaries, engages in the initiation, development, financing, establishing, construction, management, and operation of facilities for the production, storage, and sale of electricity from renewable energy sources in Israel, Poland, and the United States.

Slight risk and overvalued.

Market Insights

Community Narratives