Israir (TASE:ISRG) Swings to $0.13 EPS in Q3; Interest Coverage Doubts Persist

Reviewed by Simply Wall St

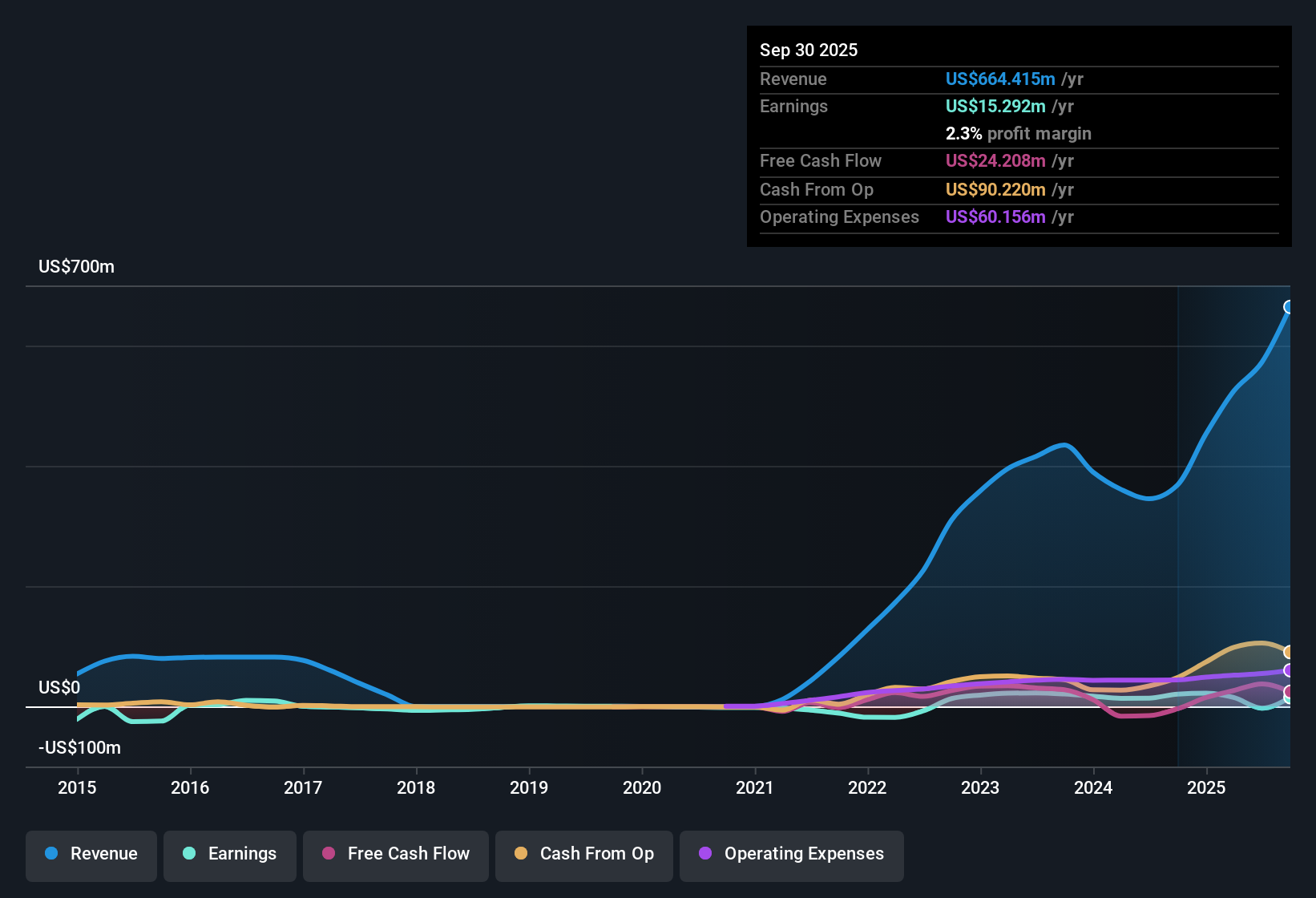

Israir Group (TASE:ISRG) just released its Q3 2025 financial results, reporting revenue of $258.3 million and EPS of $0.13 USD for the quarter. Looking at recent history, the company saw revenue move from $133.0 million in Q4 2024 to $258.3 million in Q3 2025, while EPS moved from -$0.02165 in Q4 2024 to $0.13 this quarter. Margins remain in focus as investors weigh the implications of these headline figures against Israir’s ongoing drive for profitability.

See our full analysis for Israir Group.Now, we are putting these numbers side by side with the market’s dominant narratives to see which beliefs hold up and which myths just got busted.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow 42.5% Yearly

- Israir Group managed to shrink its overall losses by 42.5% each year over the past five years, even though the company remained unprofitable over the last twelve months.

- What stands out is the effort to manage the bottom line despite the absence of a clear earnings or revenue growth trend in the data, with the trailing twelve month net income totaling $15.3 million. This highlights ongoing volatility while also indicating some progress on loss reduction.

To see how the latest results and margin swings measure up versus investor expectations, check out the full consensus narrative for insight into the broader story. 📊 Read the full Israir Group Consensus Narrative.

Valuation Deep Discount: 95.2%

- Israir Group's current share price of $1.84 trades at a striking 95.2% discount to its DCF fair value of $10.82, backed up by a price-to-sales ratio of just 0.2x. This is substantially lower than both the peer average of 1.3x and the Asian Airlines industry average of 0.7x.

- Market watchers highlight that such a steep valuation gap creates a classic value scenario but caution that the discount alone is not a safety net given continuing unprofitability. The data does not show a consistent return to profit or sales growth, leaving the value case highly dependent on potential future improvements that have yet to materialize.

Interest Coverage Remains a Risk

- One persistent concern is that interest payments are not well covered by earnings, as revealed in the most recent risk summary. This puts pressure on Israir's financial flexibility even as headline losses narrow.

- The risk analysis notes that, while value investors may be drawn to the low multiples and DCF discount, weak coverage of financial obligations stands out as a key factor keeping sentiment cautious, especially for those worried about liquidity and the possibility of future solvency challenges.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Israir Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Israir Group’s narrowing losses are offset by persistent unprofitability and concerns around weak coverage of interest payments. This leaves its balance sheet under scrutiny.

If you want to spot companies with stronger financial footing and fewer debt worries, check out solid balance sheet and fundamentals stocks screener (1942 results) now for healthier balance sheets and greater stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ISRG

Israir Group

Operates as an international tourism and aviation company in Israel.

Good value with imperfect balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026