Israir Group Ltd (TLV:ISRG) Surges 26% Yet Its Low P/E Is No Reason For Excitement

Israir Group Ltd (TLV:ISRG) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 67% in the last year.

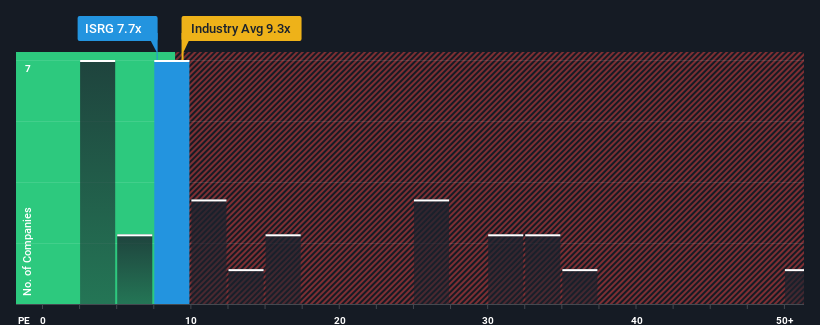

Although its price has surged higher, Israir Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.7x, since almost half of all companies in Israel have P/E ratios greater than 14x and even P/E's higher than 21x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Earnings have risen firmly for Israir Group recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Israir Group

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Israir Group's to be considered reasonable.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the market, which is predicted to deliver 15% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Israir Group's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The latest share price surge wasn't enough to lift Israir Group's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Israir Group maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Israir Group that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ISRG

Good value with imperfect balance sheet.

Market Insights

Community Narratives