How Investors Are Reacting To El Al Israel Airlines (TASE:ELAL) Rising Sales But Lower Per-Share Earnings

Reviewed by Sasha Jovanovic

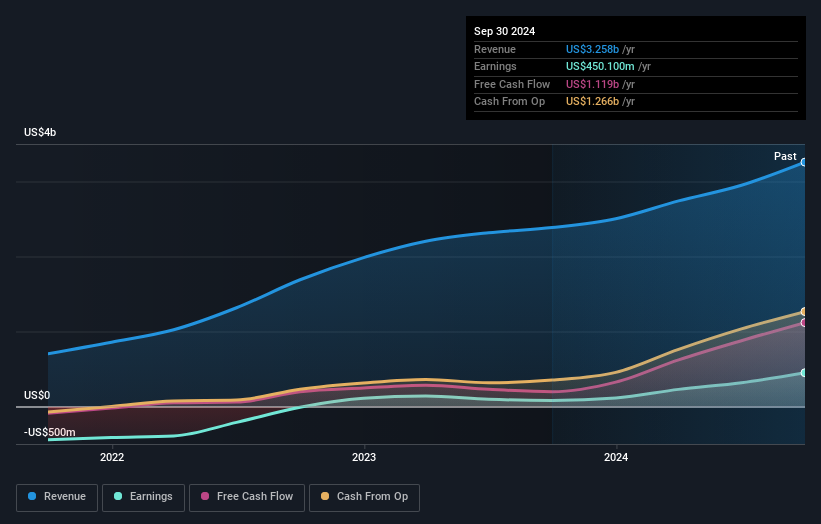

- El Al Israel Airlines recently reported its third quarter and nine-month results for the period ended September 30, 2025, with third quarter sales rising to US$1.07 billion and net income reaching US$198.6 million.

- Despite improved quarterly revenue and profit, the airline saw earnings per share from continuing operations decrease, highlighting ongoing margin or share count pressures.

- We’ll explore how the disconnect between stronger revenue and lower per-share earnings shapes El Al Israel Airlines’ investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is El Al Israel Airlines' Investment Narrative?

To be a shareholder in El Al Israel Airlines right now, you need to believe that the company can sustain its recent revenue growth despite profitability pressures showing up in its latest financial results. The third quarter highlighted robust sales rising to US$1.07 billion, but also saw a dip in earnings per share, indicating either ongoing margin challenges or increased share count. This shift in the earnings picture may alter some short-term catalysts, especially if operational costs or competitive pressures remain elevated. The latest results could prompt a closer look at whether current pricing power and load factors are strong enough to support margins as the industry faces shifting demand and potential cost volatility. While headline revenue growth is often a catalyst for optimism, this new report puts an even greater focus on underlying profitability and how any dilution might shape the business outlook, making these points central for anyone with shares or considering exposure to El Al now. Yet, the fresh data also raises questions about margin trends that investors should consider.

Despite retreating, El Al Israel Airlines' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on El Al Israel Airlines - why the stock might be worth over 8x more than the current price!

Build Your Own El Al Israel Airlines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your El Al Israel Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free El Al Israel Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate El Al Israel Airlines' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if El Al Israel Airlines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ELAL

El Al Israel Airlines

Provides passenger and cargo transportation services.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives