El Al (TASE:ELAL): Assessing Valuation After Mixed Q3 Earnings and Nine-Month Performance

Reviewed by Simply Wall St

El Al Israel Airlines (TASE:ELAL) just released its third quarter and nine-month earnings, and the numbers are getting investors talking. Quarterly sales and net income edged higher, while longer-term earnings and net income slipped.

See our latest analysis for El Al Israel Airlines.

El Al’s recent earnings reveal a business still in the midst of transformation, and that is showing up in the share price action. After a strong 81% share price return so far this year, recent momentum has cooled, with a 4% slide over the past week after the quarterly update. Even so, El Al’s longer-term investors have seen an impressive 83% total return over the past year and nearly 380% across three years, highlighting the outsized rewards for those who weathered previous ups and downs.

If you’re interested in unearthing more opportunities beyond El Al, now is a great moment to expand your search and discover fast growing stocks with high insider ownership

With such robust long-term returns but mixed recent results, the real question is whether El Al is trading at a bargain or if investors have already factored future growth into the stock price.

Price-to-Earnings of 5.1x: Is it justified?

El Al's shares are trading at a price-to-earnings ratio of 5.1x, noticeably lower than comparable airline peers in both regional and industry contexts. With its last close at ₪14.53, the market currently values El Al's recent earnings more conservatively than is typical in the sector.

The price-to-earnings (P/E) ratio measures what investors are willing to pay for each unit of earnings, often reflecting market expectations of future growth or confidence. For a profitable airline like El Al, this ratio is a key barometer of whether investors see continued runway for performance or are hesitant due to industry volatility.

This 5.1x multiple is not just a standalone figure; it is significantly below both the Asian Airlines industry average of 10.6x and the peer group average of 7.3x. Such a gap suggests that El Al may be undervalued by the market, especially given its continued profitability and improving margins. If the market re-aligns its expectations, there is potential for the multiple to move closer to those industry averages.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 5.1x (UNDERVALUED)

However, ongoing market volatility and industry-specific challenges, such as fluctuating demand or regulatory shifts, could quickly alter El Al's current valuation outlook.

Find out about the key risks to this El Al Israel Airlines narrative.

Another View: Discounted Cash Flow Perspective

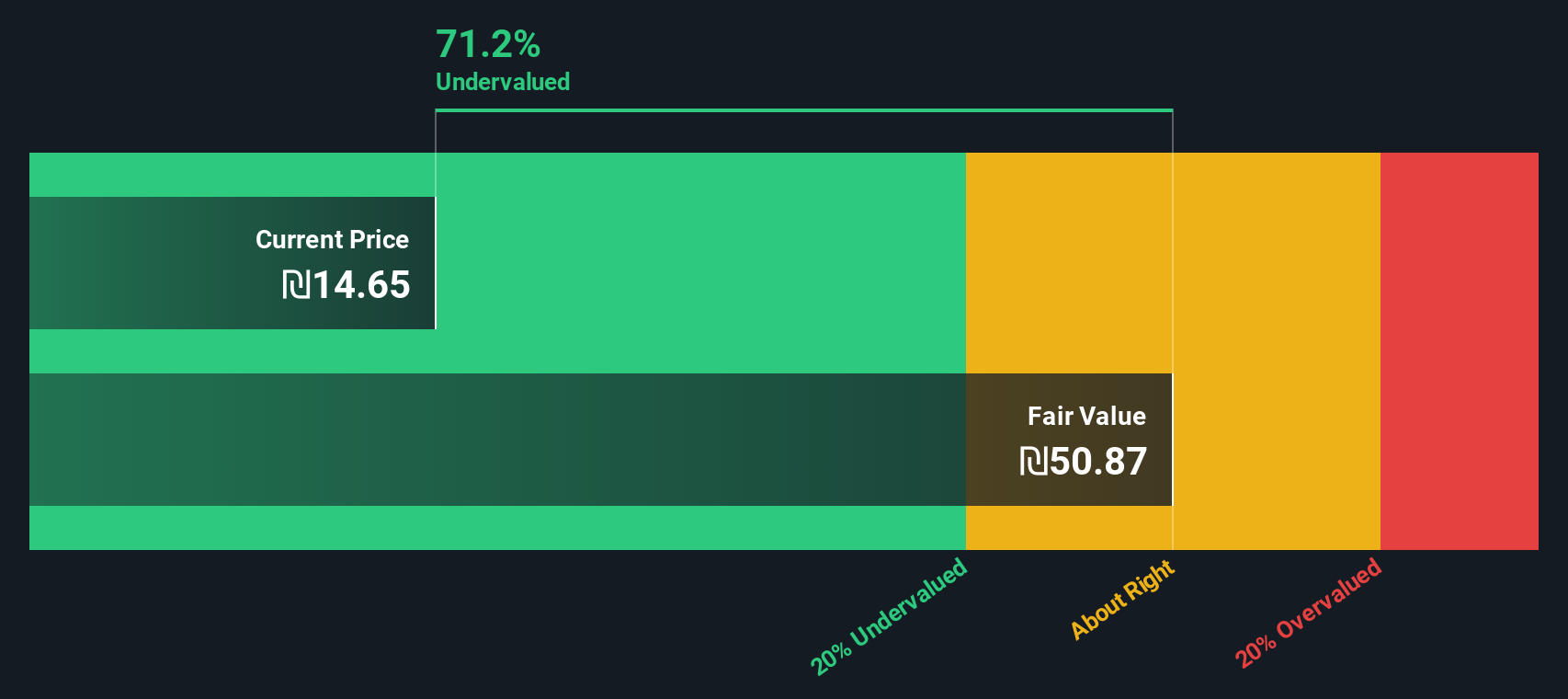

Taking a step back from valuations based on earnings, our SWS DCF model shows an even bigger disconnect. El Al's share price sits nearly 72% below our estimate of its fair value, suggesting a far deeper undervaluation than what earnings multiples alone indicate. Could the market be overlooking the airline's true potential, or is there risk in what those cash flows can actually deliver?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out El Al Israel Airlines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own El Al Israel Airlines Narrative

If you see things differently or want to dive deeper into the numbers, you can quickly develop your own view and uncover the story that matters to you. Do it your way

A great starting point for your El Al Israel Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for tomorrow’s winners to pass you by. Smart investors use the right tools to spot opportunity and stay ahead of the curve. Start building your competitive edge now.

- Uncover high-yield income potential by tapping into these 16 dividend stocks with yields > 3% offering strong payouts for your portfolio.

- Get ahead of the AI boom by pinpointing forward-thinking companies within these 25 AI penny stocks that are redefining the tech landscape.

- Capture value where others overlook it by targeting these 879 undervalued stocks based on cash flows primed for growth based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if El Al Israel Airlines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ELAL

El Al Israel Airlines

Provides passenger and cargo transportation services.

Flawless balance sheet and good value.

Market Insights

Community Narratives