- Israel

- /

- Telecom Services and Carriers

- /

- TASE:BCOM

Discovering Hidden Potential in Three Unique Small Caps

Reviewed by Simply Wall St

In the wake of recent market shifts, small-cap stocks have garnered attention as the Russell 2000 Index led gains with an impressive surge, reflecting investor optimism about potential economic growth and regulatory changes following the U.S. election. As these smaller companies navigate a landscape influenced by tax policy adjustments and Federal Reserve actions, identifying stocks with strong fundamentals and growth prospects becomes crucial for uncovering hidden potential in this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wema Bank | 53.09% | 32.38% | 56.06% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Aktieselskabet Schouw (CPSE:SCHO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aktieselskabet Schouw & Co. is an industrial conglomerate based in Denmark with international operations, and it has a market capitalization of DKK13.49 billion.

Operations: Schouw & Co. generates revenue through diverse segments, with BioMar contributing DKK17.27 billion and GPV providing DKK9.68 billion, among others like HydraSpecma and Fibertex Nonwovens. The conglomerate's revenue model is supported by multiple industries, reflecting its broad operational scope across different markets.

Aktieselskabet Schouw, a smaller player in the market, has shown resilience with earnings growing by 23% over the past year, surpassing the food industry average of 18.4%. Despite a high net debt to equity ratio of 53.3%, interest payments are well covered by EBIT at 4.5 times. The company repurchased shares worth DKK 117.59 million this year, indicating confidence in its valuation as it trades at a significant discount to estimated fair value. Recent results show net income rising to DKK 245 million from DKK 216 million last year, reflecting strong operational performance amidst sales fluctuations.

- Delve into the full analysis health report here for a deeper understanding of Aktieselskabet Schouw.

Gain insights into Aktieselskabet Schouw's past trends and performance with our Past report.

B Communications (TASE:BCOM)

Simply Wall St Value Rating: ★★★★☆☆

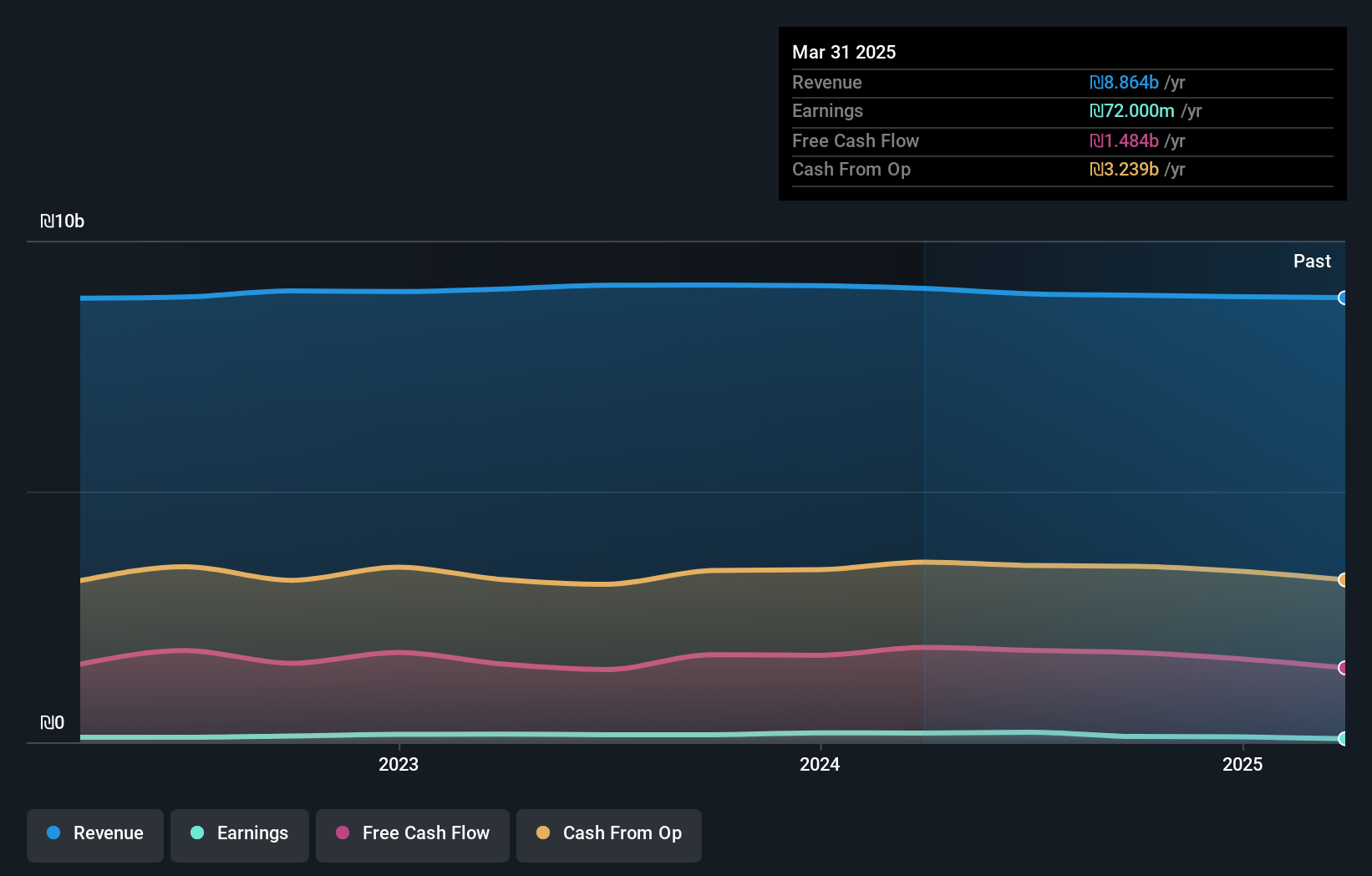

Overview: B Communications Ltd. operates through its subsidiaries to offer a variety of telecommunications services to both business and private customers in Israel, with a market cap of ₪1.58 billion.

Operations: Revenue is primarily derived from landline domestic communications (₪4.34 billion), cellular communication (₪2.29 billion), and multi-channel TV services (₪1.28 billion).

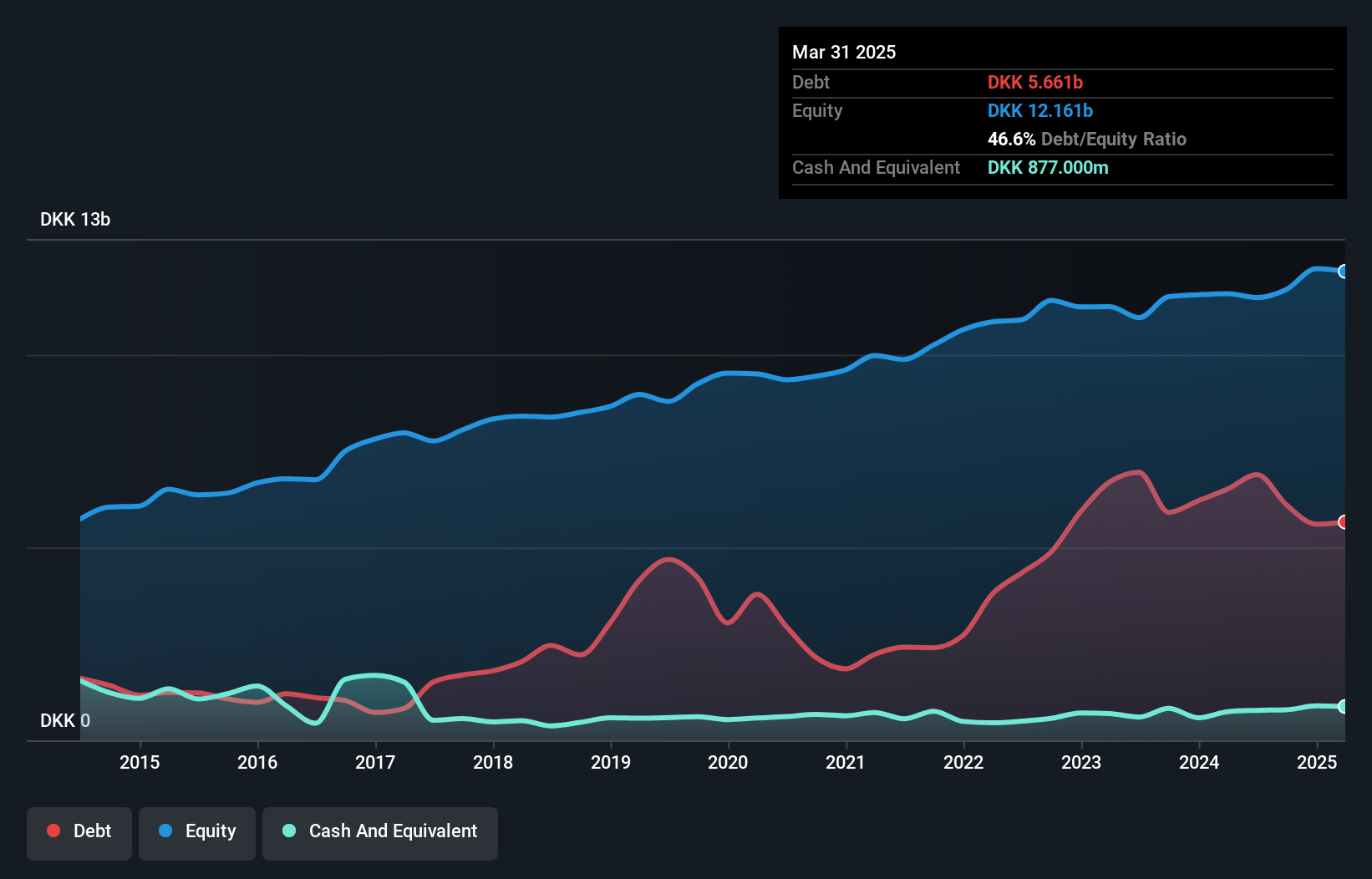

B Communications, a small player in the telecom sector, recently saw its earnings jump by 34%, outpacing the industry's 3% growth. Despite trading at a striking 91% below estimated fair value, the company faces challenges with a high net debt to equity ratio of 257%. On the bright side, interest payments are well covered by EBIT at five times coverage. Notably, BCOM has turned around its financial position from negative shareholder equity five years ago to positive today. However, being removed from the TA-125 Index might impact investor sentiment moving forward.

Fox-Wizel (TASE:FOX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fox-Wizel Ltd. is involved in the design, procurement, marketing, and distribution of a wide range of products including clothing, fashion accessories, underwear, footwear, home fashion items, and baby and children's products with a market capitalization of ₪3.91 billion.

Operations: Fox-Wizel generates revenue primarily from its Sports segment, including Nike and Foot Locker operations, which accounts for ₪2.11 billion, followed by Fashion and Home Fashion in Israel at ₪1.97 billion. The company's net profit margin is a key metric to consider when evaluating its financial performance over time.

Fox-Wizel, a dynamic player in the specialty retail sector, has shown impressive growth with earnings up 20.1% over the past year, outpacing industry averages. Despite this progress, its EBIT only covers interest payments 2.7 times, indicating room for improvement in managing debt obligations. The company has significantly reduced its debt to equity ratio from 91.1% to 50.2% over five years and boasts high-quality earnings while trading at a significant discount of 86% below estimated fair value. Recent reports highlight robust financial performance with second-quarter sales reaching ILS 1,587 million and net income climbing to ILS 95 million compared to last year's figures of ILS 1,328 million and ILS 66 million respectively.

- Click here and access our complete health analysis report to understand the dynamics of Fox-Wizel.

Examine Fox-Wizel's past performance report to understand how it has performed in the past.

Key Takeaways

- Click through to start exploring the rest of the 4661 Undiscovered Gems With Strong Fundamentals now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:BCOM

B Communications

Through its subsidiaries, provides a range of telecommunications services for business and private customers in Israel.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives