- Israel

- /

- Electronic Equipment and Components

- /

- TASE:TLSY

Investors Shouldn't Be Too Comfortable With Telsys' (TLV:TLSY) Earnings

Despite announcing strong earnings, Telsys Ltd.'s (TLV:TLSY) stock was sluggish. Our analysis uncovered some concerning factors that we believe the market might be paying attention to.

See our latest analysis for Telsys

Examining Cashflow Against Telsys' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

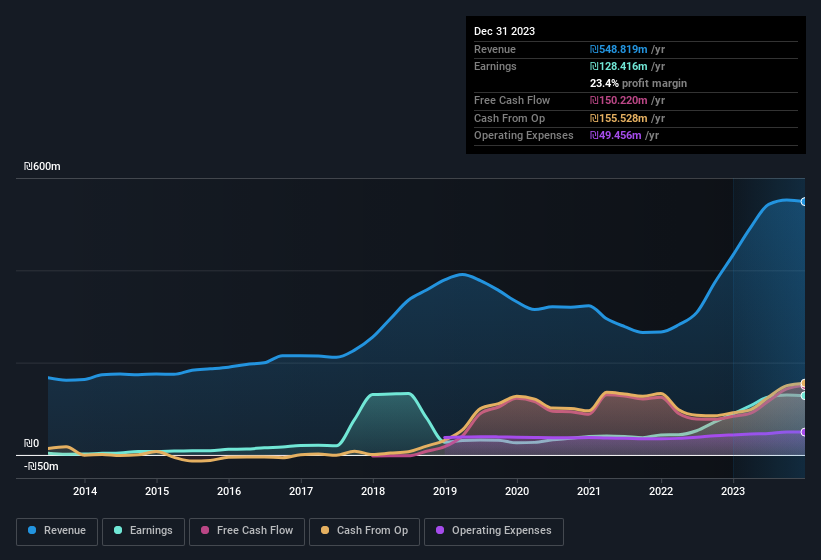

Over the twelve months to December 2023, Telsys recorded an accrual ratio of -0.10. That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. To wit, it produced free cash flow of ₪150m during the period, dwarfing its reported profit of ₪128.4m. Telsys' free cash flow improved over the last year, which is generally good to see. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Telsys.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Telsys increased the number of shares on issue by 31% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Telsys' EPS by clicking here.

How Is Dilution Impacting Telsys' Earnings Per Share (EPS)?

As you can see above, Telsys has been growing its net income over the last few years, with an annualized gain of 220% over three years. In comparison, earnings per share only gained 201% over the same period. And at a glance the 44% gain in profit over the last year impresses. But in comparison, EPS only increased by 38% over the same period. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Telsys can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Telsys' Profit Performance

At the end of the day, Telsys is diluting shareholders which will dampen earnings per share growth, but its accrual ratio showed it can back up its profits with free cash flow. Having considered these factors, we don't think Telsys' statutory profits give an overly harsh view of the business. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. While conducting our analysis, we found that Telsys has 2 warning signs and it would be unwise to ignore these.

Our examination of Telsys has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Telsys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:TLSY

Telsys

Telsys Ltd. markets and distributes electronic components and open tools in Israel.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion