- Israel

- /

- Electronic Equipment and Components

- /

- TASE:TEDE

These 4 Measures Indicate That Tedea Technological Development and Automation (TLV:TEDE) Is Using Debt Extensively

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Tedea Technological Development and Automation Ltd. (TLV:TEDE) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out the opportunities and risks within the IL Electronic industry.

What Is Tedea Technological Development and Automation's Debt?

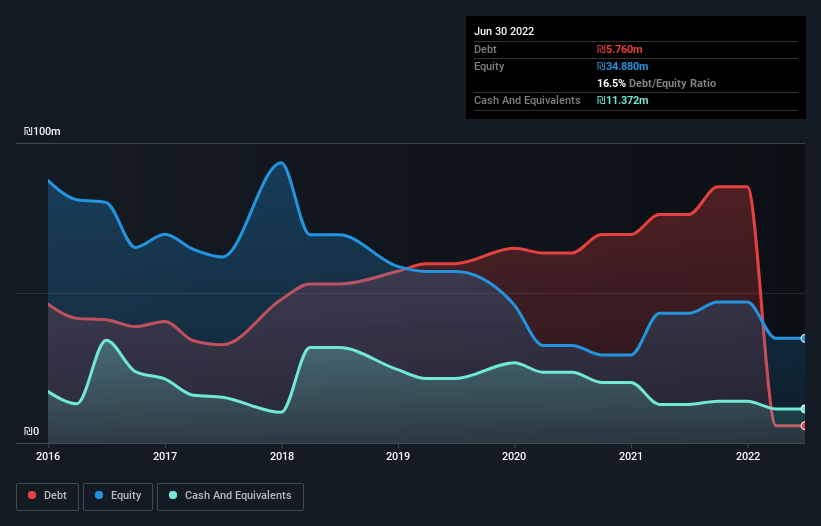

As you can see below, Tedea Technological Development and Automation had ₪5.76m of debt at June 2022, down from ₪76.1m a year prior. But it also has ₪11.4m in cash to offset that, meaning it has ₪5.61m net cash.

How Strong Is Tedea Technological Development and Automation's Balance Sheet?

According to the last reported balance sheet, Tedea Technological Development and Automation had liabilities of ₪140.0m due within 12 months, and liabilities of ₪6.76m due beyond 12 months. On the other hand, it had cash of ₪11.4m and ₪202.0k worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₪135.2m.

When you consider that this deficiency exceeds the company's ₪90.2m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. Tedea Technological Development and Automation boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

Although Tedea Technological Development and Automation made a loss at the EBIT level, last year, it was also good to see that it generated ₪23m in EBIT over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Tedea Technological Development and Automation's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Tedea Technological Development and Automation may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last year, Tedea Technological Development and Automation burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing Up

While Tedea Technological Development and Automation does have more liabilities than liquid assets, it also has net cash of ₪5.61m. Despite its cash we think that Tedea Technological Development and Automation seems to struggle to convert EBIT to free cash flow, so we are wary of the stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Tedea Technological Development and Automation (of which 1 doesn't sit too well with us!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Tedea Technological Development and Automation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:TEDE

Tedea Technological Development and Automation

Through its subsidiaries, manufactures, imports, markets, and sells building materials in Israel.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion