- Israel

- /

- Electronic Equipment and Components

- /

- TASE:SNCM

Suny Cellular Communication (TLV:SNCM) Has A Pretty Healthy Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Suny Cellular Communication Ltd (TLV:SNCM) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Suny Cellular Communication

How Much Debt Does Suny Cellular Communication Carry?

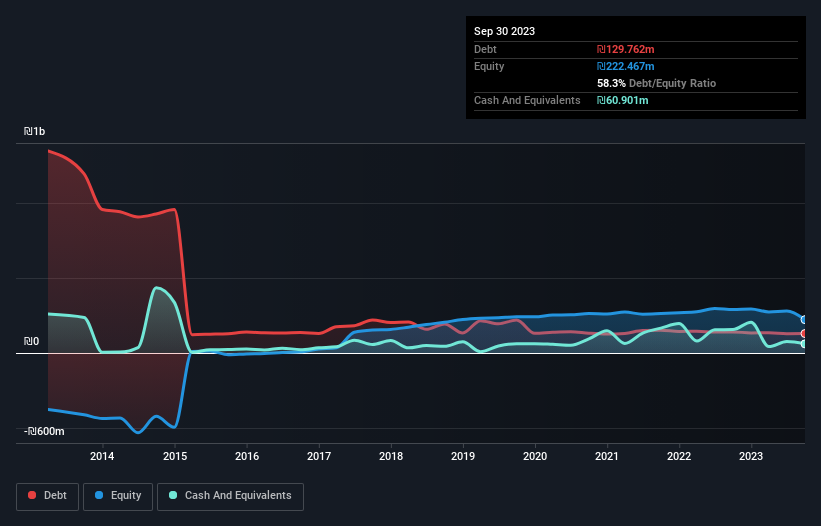

You can click the graphic below for the historical numbers, but it shows that Suny Cellular Communication had ₪129.8m of debt in September 2023, down from ₪140.8m, one year before. On the flip side, it has ₪60.9m in cash leading to net debt of about ₪68.9m.

How Strong Is Suny Cellular Communication's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Suny Cellular Communication had liabilities of ₪96.9m due within 12 months and liabilities of ₪149.6m due beyond that. Offsetting this, it had ₪60.9m in cash and ₪263.3m in receivables that were due within 12 months. So it can boast ₪77.7m more liquid assets than total liabilities.

This excess liquidity is a great indication that Suny Cellular Communication's balance sheet is almost as strong as Fort Knox. With this in mind one could posit that its balance sheet means the company is able to handle some adversity.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Suny Cellular Communication has net debt of just 1.4 times EBITDA, suggesting it could ramp leverage without breaking a sweat. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. The modesty of its debt load may become crucial for Suny Cellular Communication if management cannot prevent a repeat of the 39% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. There's no doubt that we learn most about debt from the balance sheet. But it is Suny Cellular Communication's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Suny Cellular Communication recorded free cash flow worth a fulsome 93% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

Happily, Suny Cellular Communication's impressive interest cover implies it has the upper hand on its debt. But the stark truth is that we are concerned by its EBIT growth rate. Zooming out, Suny Cellular Communication seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Suny Cellular Communication is showing 3 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SNCM

Suny Cellular Communication

Engages in importing and marketing cell phones, accessories, and storage devices in Israel.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion