- Israel

- /

- Electronic Equipment and Components

- /

- TASE:PCBT

Middle East's Hidden Treasures Albaraka Türk Katilim Bankasi And 2 Other Promising Small Caps

Reviewed by Simply Wall St

As most Gulf stock markets see gains amid steady oil prices, the Middle East is capturing investor interest with its dynamic financial landscape. In this environment, identifying promising small-cap stocks like Albaraka Türk Katilim Bankasi can be key to uncovering potential opportunities, as these companies often thrive on regional economic shifts and sector-specific growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Payton Industries | NA | 3.44% | 14.24% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Albaraka Türk Katilim Bankasi (IBSE:ALBRK)

Simply Wall St Value Rating: ★★★★★★

Overview: Albaraka Türk Katilim Bankasi A.S. offers a range of banking products and services in Turkey, with a market capitalization of TRY20.58 billion.

Operations: The bank generates revenue primarily from its Commercial and Corporate segment, contributing TRY39.57 billion, followed by the Treasury segment at TRY24.32 billion and the Retail segment at TRY9.67 billion.

Albaraka Türk Katilim Bankasi, a notable player in the Middle East, showcases robust financial health with total assets of TRY421.4 billion and equity of TRY23.9 billion. The bank's earnings growth over the past year was an impressive 122.7%, outpacing the industry average of 13.6%. With a price-to-earnings ratio at just 1.7x compared to the TR market's 18.3x, it offers significant value potential. Bad loans are kept in check at 1.5%, supported by a sufficient allowance for bad loans at 149%. However, future earnings are forecasted to decline significantly by an average of 50.4% annually over three years, posing challenges ahead.

- Click to explore a detailed breakdown of our findings in Albaraka Türk Katilim Bankasi's health report.

Gain insights into Albaraka Türk Katilim Bankasi's past trends and performance with our Past report.

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Value Rating: ★★★★★★

Overview: Anadolu Hayat Emeklilik Anonim Sirketi offers private pension and insurance products in Turkey, with a market capitalization of TRY44.85 billion.

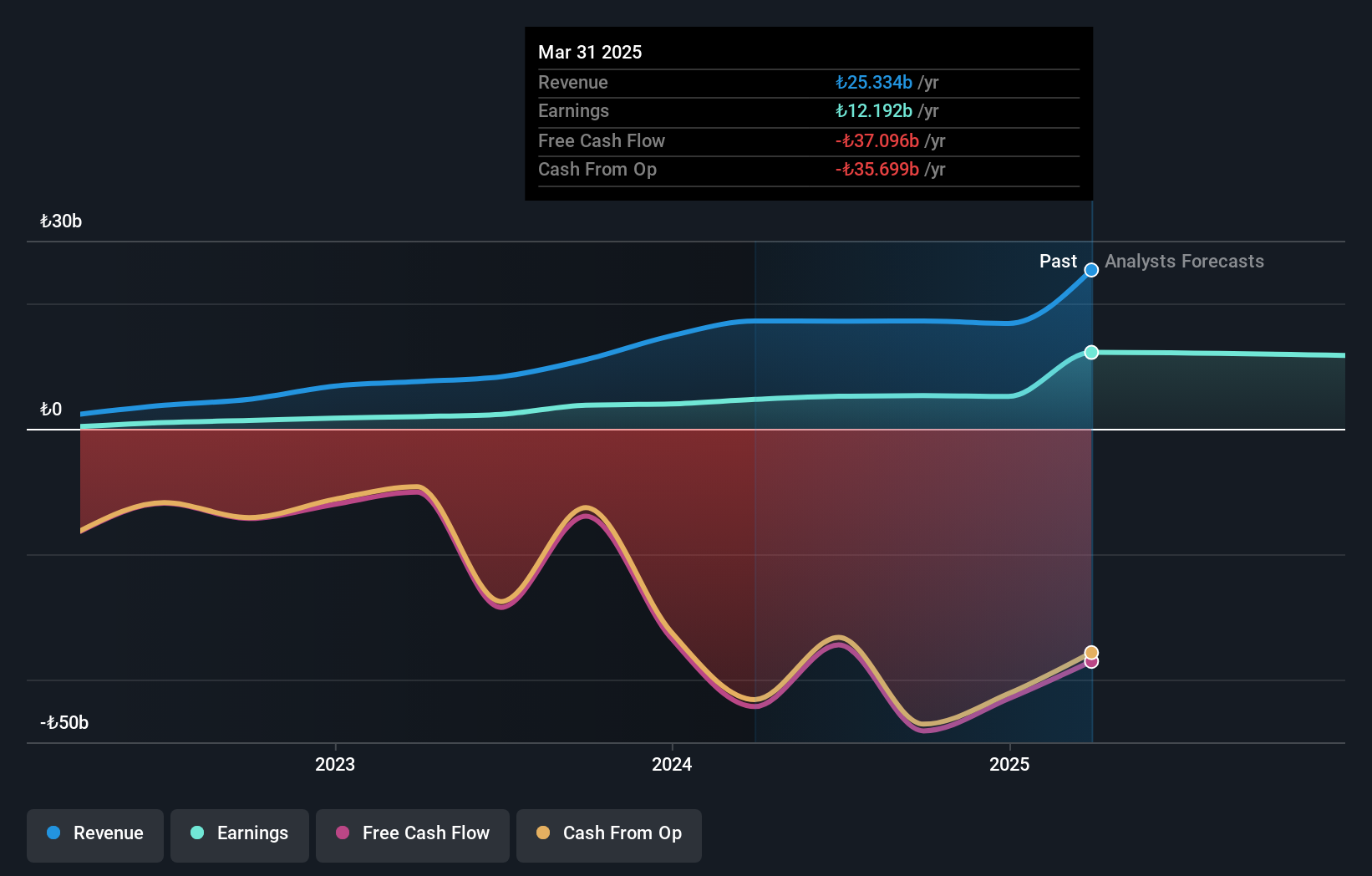

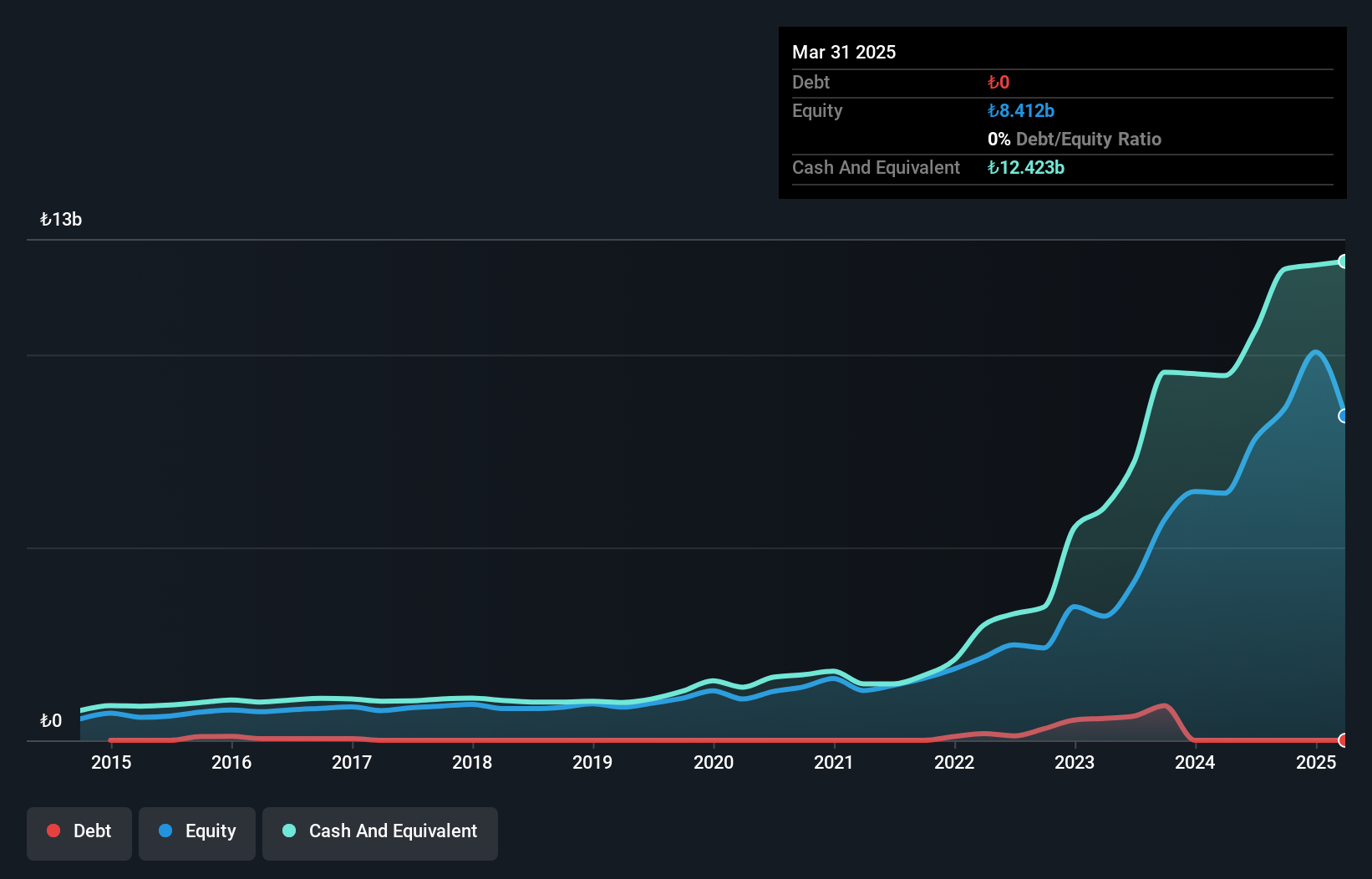

Operations: Anadolu Hayat Emeklilik generates revenue primarily from its Life segment, which contributes TRY26.16 billion, and its Retirement segment, with TRY7.40 billion. The Non-Life segment adds a smaller portion at TRY7.31 million.

Anadolu Hayat Emeklilik showcases robust financial health with no debt over the past five years, which is quite a feat in today's market. The company's earnings surged by 103.9% last year, outpacing the insurance industry's growth of 83.8%. Its price-to-earnings ratio of 7.3x is notably lower than the TR market's average of 18.3x, indicating potential undervaluation. Recent reports highlight a net income increase to TRY 1,550 million for Q3 from TRY 777 million last year and nine-month earnings reaching TRY 4,074 million compared to TRY 2,998 million previously. This strong performance reflects its high-quality earnings and efficient operations in the sector.

P.C.B. Technologies (TASE:PCBT)

Simply Wall St Value Rating: ★★★★★☆

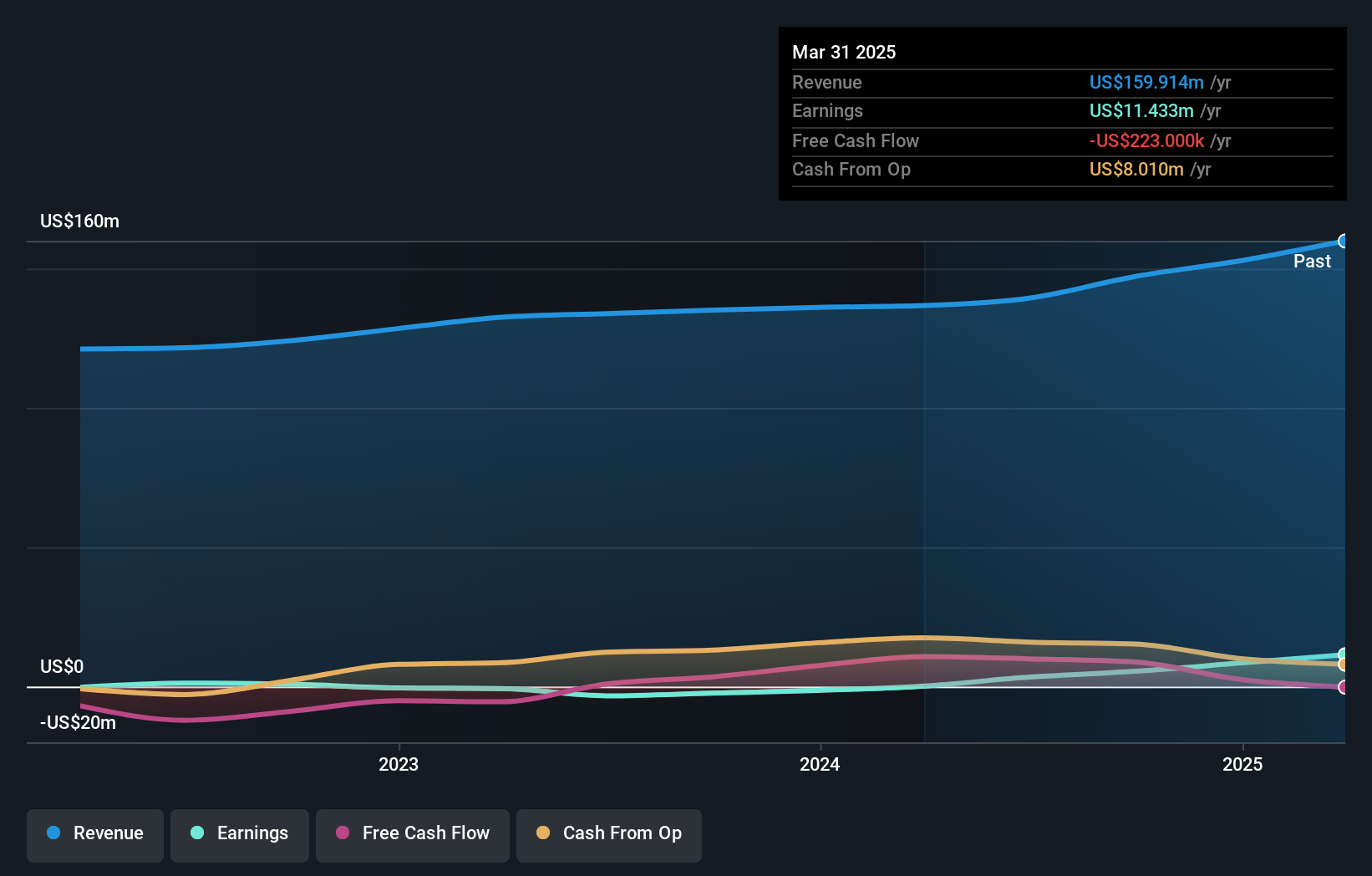

Overview: P.C.B. Technologies Ltd operates in the production, sale, marketing, and repair of printed circuit boards and beddings both in Israel and internationally, with a market capitalization of ₪853.48 million.

Operations: The company generates revenue primarily from Electronics Packaging ($102.82 million) and Printed Circuit Boards and Substrates ($82.06 million), with a smaller contribution from Miniaturization of Electronic Systems ($6.97 million).

P.C.B. Technologies, a smaller player in the electronics sector, has shown impressive earnings growth of 127.9% over the past year, significantly outpacing the industry average of 15.2%. The company's net debt to equity ratio sits at a satisfactory 14.1%, indicating sound financial management despite an increase from 0% to 19.2% over five years. Recent earnings announcements highlight robust performance with third-quarter sales reaching US$47.84 million and net income climbing to US$4.18 million from US$2.51 million last year, reflecting high-quality past earnings and strong operational execution within its niche market segment.

Taking Advantage

- Gain an insight into the universe of 183 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PCBT

P.C.B. Technologies

Engages in the production, sale, marketing, and repair of printed circuit boards (PCB) and beddings in Israel and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion