- Israel

- /

- Electronic Equipment and Components

- /

- TASE:HIPR

Middle East Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As geopolitical tensions continue to influence the Middle Eastern markets, recent retreats in key Gulf indices highlight the region's current economic volatility. Amidst these fluctuations, identifying stocks with strong fundamentals and resilience becomes crucial for investors looking to navigate this complex landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Hiper Global (TASE:HIPR)

Simply Wall St Value Rating: ★★★★★☆

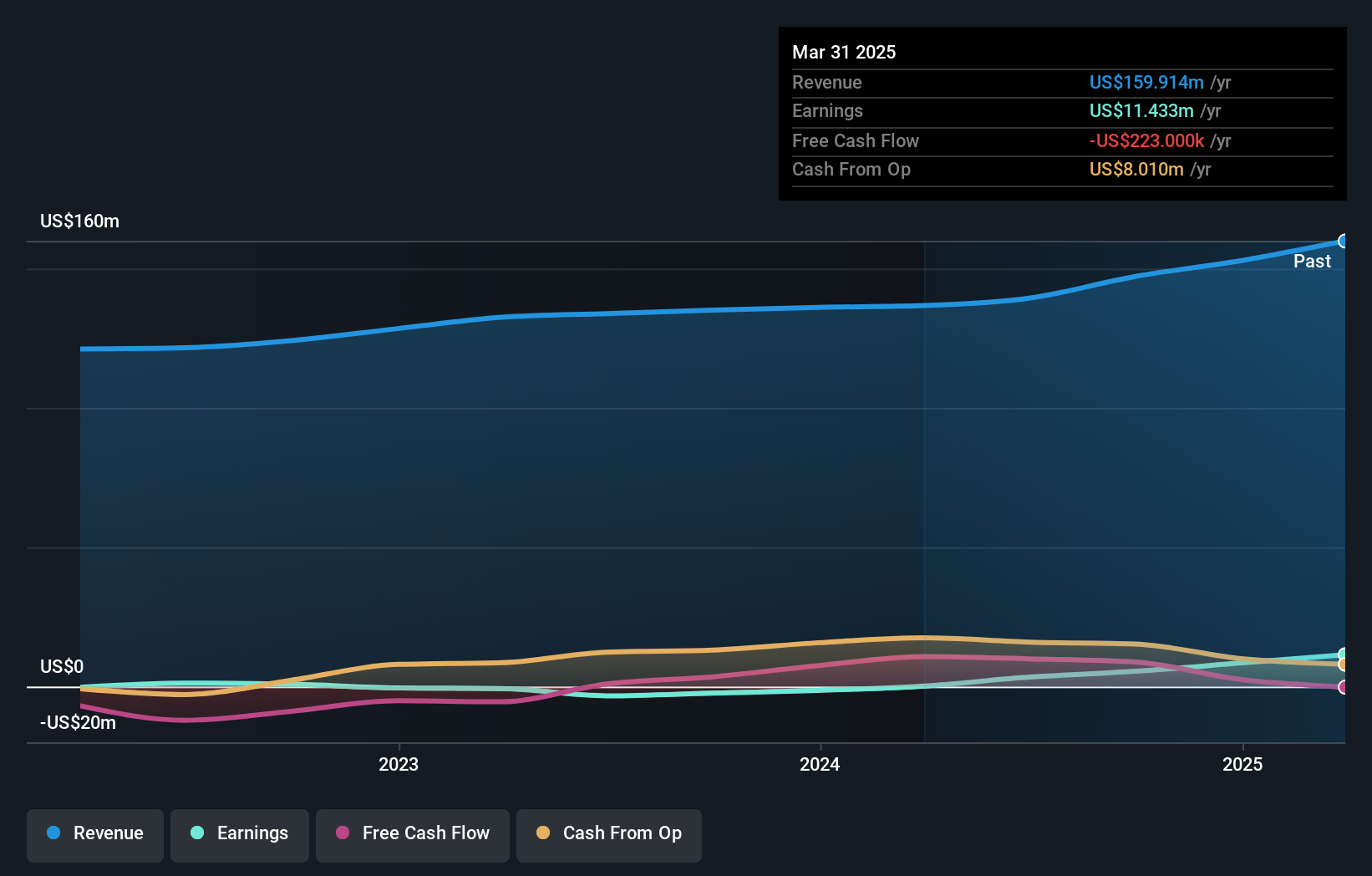

Overview: Hiper Global Ltd. specializes in delivering computing solutions to OEM customers and has a market capitalization of ₪880.79 million.

Operations: Hiper Global Ltd. generates revenue primarily from its OEM activity, amounting to $268.34 million. The company has a market capitalization of ₪880.79 million.

Hiper Global, a nimble player in the electronics sector, has shown resilience despite recent challenges. Over the past five years, their debt to equity ratio impressively dropped from 53.5% to 29%, reflecting prudent financial management. The company's interest payments are comfortably covered by EBIT at 16.9 times, indicating solid earnings quality. However, recent earnings reveal a dip with sales at US$80 million compared to US$86 million last year and net income sliding slightly to US$4.67 million from US$5 million previously. Despite these hurdles, Hiper remains profitable with a satisfactory net debt to equity ratio of 22.8%.

- Click to explore a detailed breakdown of our findings in Hiper Global's health report.

Understand Hiper Global's track record by examining our Past report.

Max Stock (TASE:MAXO)

Simply Wall St Value Rating: ★★★★★☆

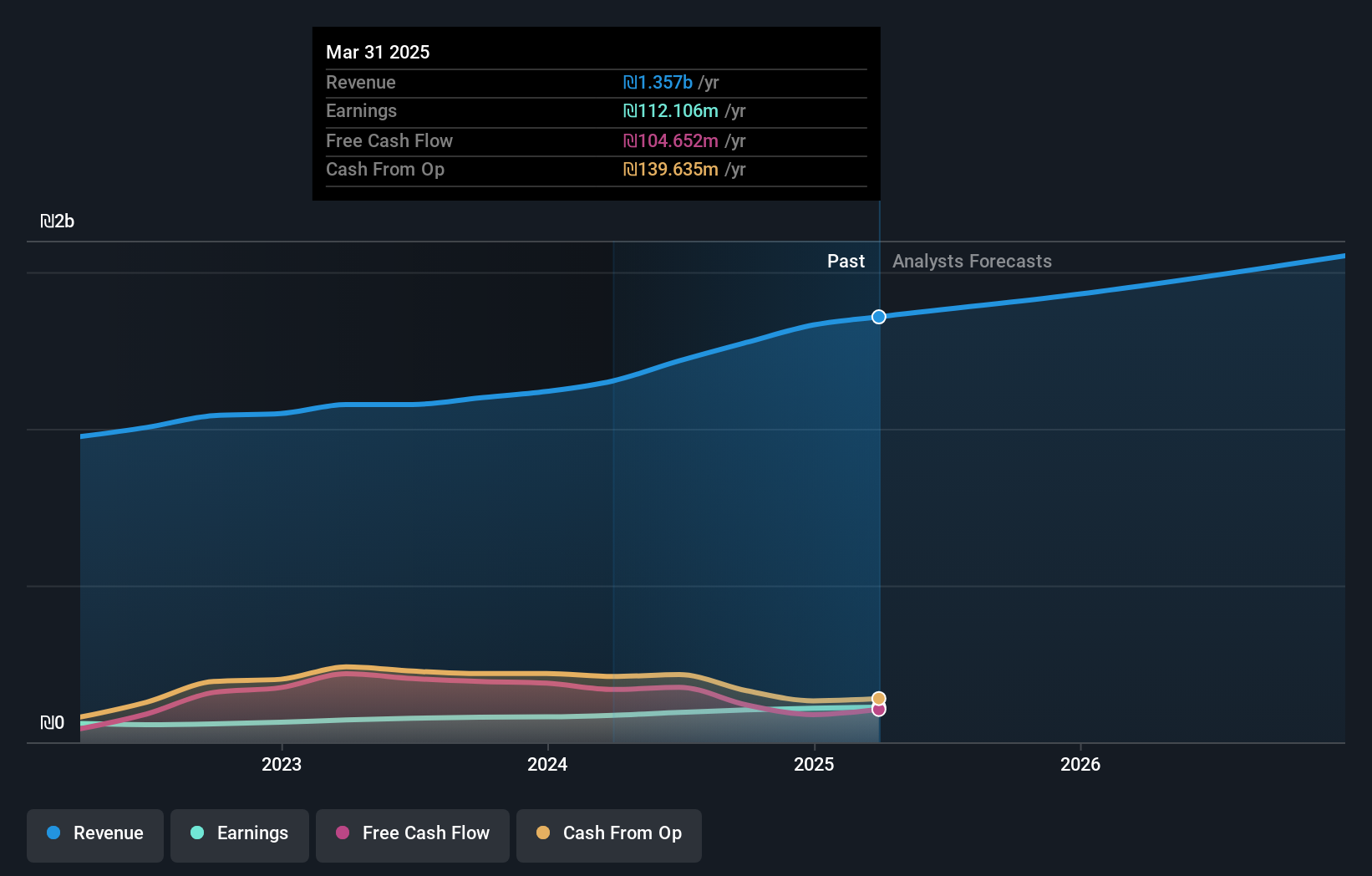

Overview: Max Stock Ltd. operates a network of discount stores across Israel and has a market capitalization of ₪2.19 billion.

Operations: Max Stock generates revenue primarily from its retail trade segment, amounting to ₪1.36 billion. The company's financial performance is characterized by a focus on cost-effective operations within its discount store framework.

Max Stock, a promising player in the retail sector, has demonstrated robust financial health with a debt to equity ratio dropping sharply from 356.4% to 19.5% over five years. Their earnings growth of 30.3% outpaces the industry average decline of -4.7%, reflecting strong market positioning and operational efficiency. With interest payments comfortably covered by EBIT at an impressive 8x, financial stability seems assured. The company’s price-to-earnings ratio stands at an attractive 19.5x, undercutting the industry average of 24.4x, suggesting potential value for investors seeking growth opportunities in emerging markets like Israel's TA-125 Index inclusion indicates increasing recognition and confidence in its trajectory.

- Delve into the full analysis health report here for a deeper understanding of Max Stock.

Gain insights into Max Stock's historical performance by reviewing our past performance report.

P.C.B. Technologies (TASE:PCBT)

Simply Wall St Value Rating: ★★★★★☆

Overview: P.C.B. Technologies Ltd is involved in the production, sale, marketing, and repair of printed circuit boards and beddings both in Israel and internationally, with a market cap of ₪877.46 million.

Operations: P.C.B. Technologies generates revenue primarily from Zivod Electronics and Printed Circuit Board segments, contributing $89.94 million and $78.27 million respectively. The company also earns from Miniaturization of Electronic Systems, adding $4.94 million to its revenue streams.

P.C.B. Technologies, a nimble player in the electronics sector, has shown impressive growth with earnings surging 5616% over the past year, vastly outpacing the industry average of 10%. Despite a volatile share price recently, their debt management appears prudent; interest payments are well covered by EBIT at 13.2 times. The net debt to equity ratio stands at a satisfactory 7.9%, indicating manageable leverage levels. Recent earnings reported for Q1 2025 highlight robust sales of US$40.93 million and net income of US$4.55 million, both significantly improved from last year's figures, reflecting its strong operational performance and potential for continued success.

- Take a closer look at P.C.B. Technologies' potential here in our health report.

Assess P.C.B. Technologies' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Click this link to deep-dive into the 217 companies within our Middle Eastern Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hiper Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:HIPR

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion