- Israel

- /

- Electronic Equipment and Components

- /

- TASE:NYAX

Market Might Still Lack Some Conviction On Nayax Ltd. (TLV:NYAX) Even After 27% Share Price Boost

Nayax Ltd. (TLV:NYAX) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

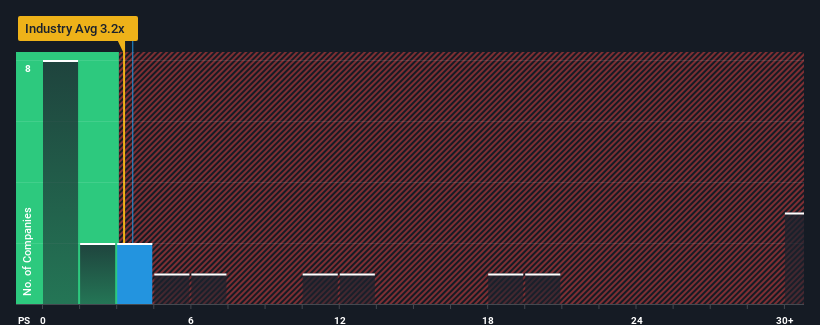

In spite of the firm bounce in price, there still wouldn't be many who think Nayax's price-to-sales (or "P/S") ratio of 3.6x is worth a mention when the median P/S in Israel's Electronic industry is similar at about 3.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Nayax

What Does Nayax's P/S Mean For Shareholders?

There hasn't been much to differentiate Nayax's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Nayax will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Nayax's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 40%. The latest three year period has also seen an excellent 179% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 34% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 30%, which is noticeably less attractive.

With this information, we find it interesting that Nayax is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Nayax's P/S Mean For Investors?

Its shares have lifted substantially and now Nayax's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Nayax's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Nayax with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nayax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:NYAX

Nayax

A fintech company, develops a complete solution for automated self-service retailers, commerce, and other merchants in the United States, Europe, the United Kingdom, Australia, Israel, and rest of the world.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives