What NICE (TASE:NICE)'s South Africa CXone Mpower Local Cloud Launch Means For Shareholders

Reviewed by Sasha Jovanovic

- In December 2025, NICE launched its AI-powered CXone Mpower platform on locally hosted cloud infrastructure in South Africa, supported by redundant data centers in Cape Town and Johannesburg to serve regulated sectors and large enterprises.

- By keeping both applications and voice traffic within South Africa, NICE is directly addressing data governance, latency, and call quality requirements that are critical for banks and other highly regulated industries across the region.

- We’ll now examine how the locally hosted CXone Mpower rollout, aimed at regulated South African enterprises, could influence NICE’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

NICE Investment Narrative Recap

To own NICE, you need to believe its AI powered CX and compliance platforms can keep converting large, complex customers to recurring cloud revenue, despite mixed sentiment around AI software stocks. The South African CXone Mpower launch fits the existing sovereign cloud and international expansion thesis, but does not appear to change the key near term catalyst of cloud growth execution or the main risks around margin pressure and the pace of large deal ramp.

Among recent announcements, the expanded global partnerships with hyperscalers and large platforms, such as Salesforce, AWS and RingCentral, are most relevant, because they sit alongside moves like the South African rollout and shape how much NICE can benefit from AI driven CX demand while still facing the longer term risk of being commoditized or displaced by those same partners.

Yet, investors should also be aware that NICE’s reliance on large tech partners could...

Read the full narrative on NICE (it's free!)

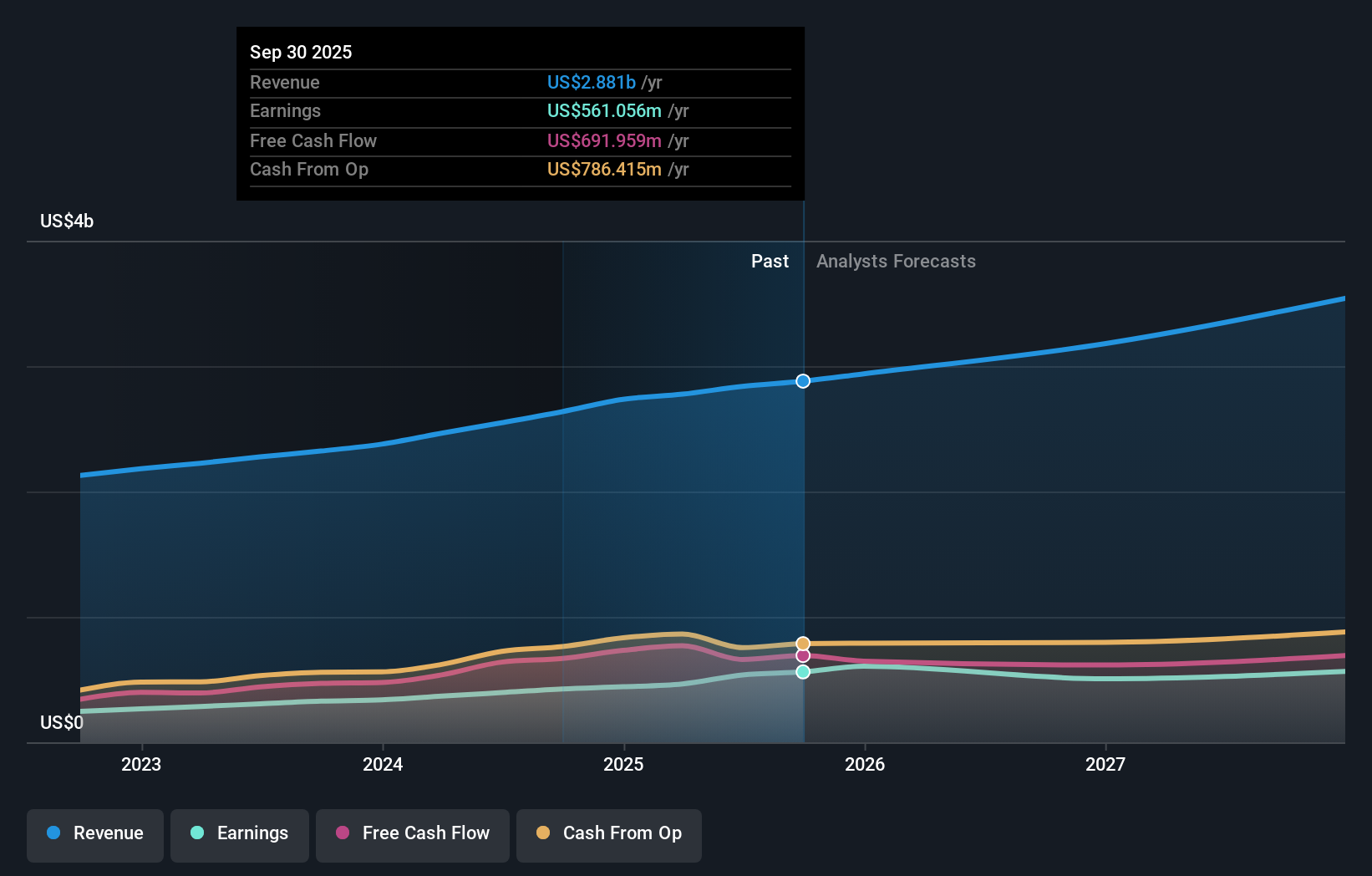

NICE's narrative projects $3.6 billion revenue and $741.0 million earnings by 2028.

Uncover how NICE's forecasts yield a ₪750.02 fair value, a 111% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community see NICE’s fair value between ₪493.32 and ₪750.02, showing a wide range of expectations. You should weigh those views against the risk that AI regulation and compliance costs may affect how quickly platforms like CXone Mpower translate into sustainable earnings growth.

Explore 5 other fair value estimates on NICE - why the stock might be worth just ₪493.32!

Build Your Own NICE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NICE research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NICE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NICE's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NICE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NICE

NICE

Provides AI-powered cloud platforms for customer engagement, and financial crime and compliance worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion