How NICE’s Raised 2025 Revenue Guidance at TASE:NICE Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- NICE Ltd. recently raised its full-year 2025 revenue guidance to a new range of US$2.93 billion to US$2.95 billion, with cloud revenue growth expectations also increased, following strong third-quarter results where both revenue and net income climbed compared to the prior year.

- The upward revision of financial forecasts appears closely linked to operational improvements and cloud segment momentum, signaling enhanced confidence in the company's future performance.

- We'll examine how the increased full-year revenue forecast signals improved confidence in NICE’s long-term earnings and growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

NICE Investment Narrative Recap

To own NICE, you need to believe in ongoing demand for AI-powered cloud customer experience solutions and the company's ability to capture a growing share of this market. The newly increased 2025 revenue guidance and raised cloud growth expectations reinforce the case for strong operational momentum, but do not fully resolve near-term questions about gross margin recovery, currently the biggest risk, especially as margin expansion remains contingent on scale and operating leverage.

Among NICE's recent announcements, the global partnership with Tata Communications stands out, directly supporting the cloud growth highlighted in its revised guidance. By expanding its reach and unlocking enterprise opportunities in contact center transformation, this collaboration can enhance both customer engagement and recurring revenue, aligning closely with NICE's most important catalysts for short-term and long-term growth.

By contrast, investors should also be aware that cloud segment growth, while robust, has yet to fully offset …

Read the full narrative on NICE (it's free!)

NICE's outlook anticipates $3.6 billion in revenue and $741.0 million in earnings by 2028. This projection relies on an 8.5% annual revenue growth rate and an increase in earnings of $203.9 million from the current $537.1 million.

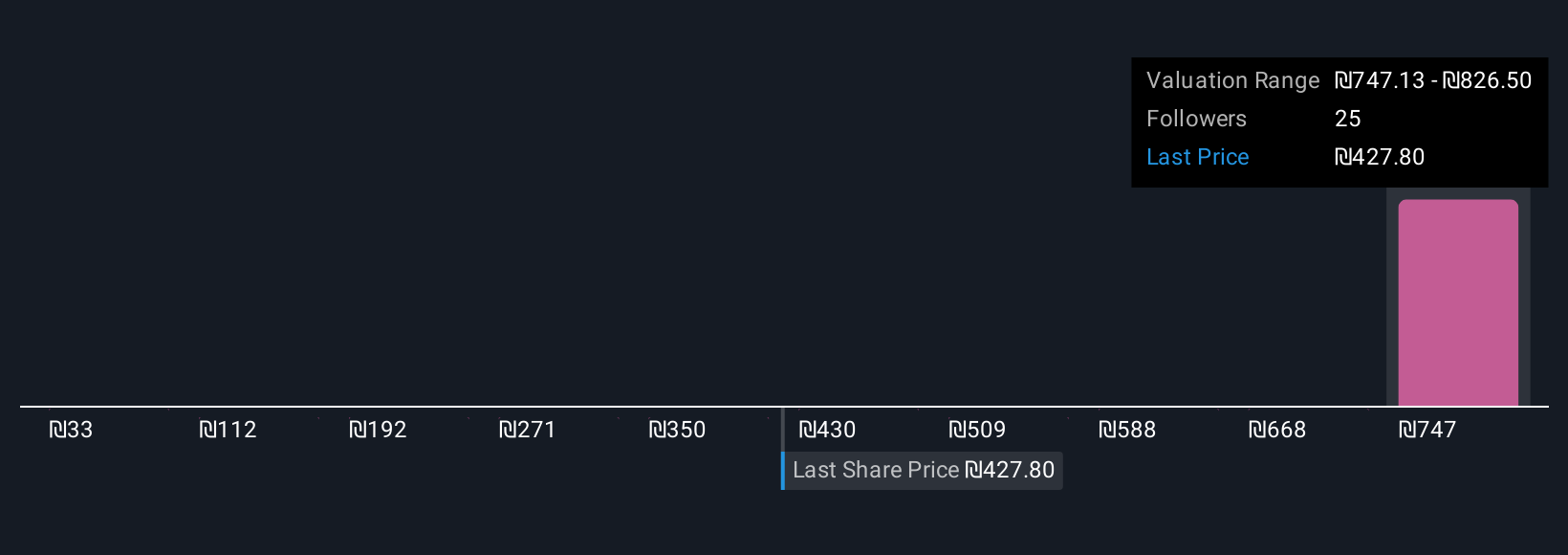

Uncover how NICE's forecasts yield a ₪750.02 fair value, a 77% upside to its current price.

Exploring Other Perspectives

Six estimates from the Simply Wall St Community spread fair values for NICE from US$32.83 to US$829.97 per share. While many are focused on recurring cloud revenue acceleration, opinions differ widely on the extent to which margin pressure may influence future performance.

Explore 6 other fair value estimates on NICE - why the stock might be worth less than half the current price!

Build Your Own NICE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NICE research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free NICE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NICE's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NICE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NICE

NICE

Provides AI-powered cloud platforms for customer engagement, and financial crime and compliance worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives