Increases to My Size, Inc.'s (TLV:MYSZ) CEO Compensation Might Cool off for now

Shareholders of My Size, Inc. (TLV:MYSZ) will have been dismayed by the negative share price return over the last three years. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. These are some of the concerns that shareholders may want to bring up at the next AGM held on 30 December 2021. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for My Size

Comparing My Size, Inc.'s CEO Compensation With the industry

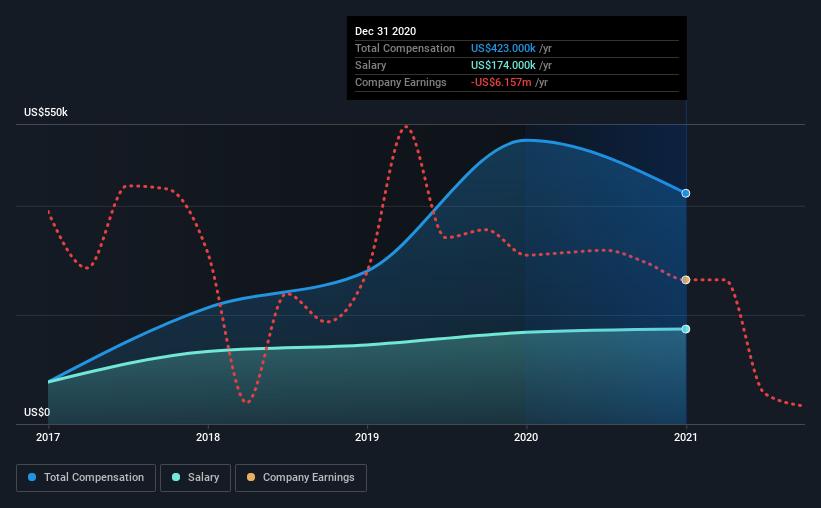

According to our data, My Size, Inc. has a market capitalization of ₪47m, and paid its CEO total annual compensation worth US$423k over the year to December 2020. We note that's a decrease of 19% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$174k.

In comparison with other companies in the industry with market capitalizations under ₪630m, the reported median total CEO compensation was US$315k. Accordingly, our analysis reveals that My Size, Inc. pays Ronen Luzon north of the industry median. Furthermore, Ronen Luzon directly owns ₪229k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$174k | US$168k | 41% |

| Other | US$249k | US$352k | 59% |

| Total Compensation | US$423k | US$520k | 100% |

Talking in terms of the industry, salary represented approximately 83% of total compensation out of all the companies we analyzed, while other remuneration made up 17% of the pie. In My Size's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at My Size, Inc.'s Growth Numbers

My Size, Inc. has seen its earnings per share (EPS) increase by 43% a year over the past three years. In the last year, its revenue is down 47%.

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has My Size, Inc. Been A Good Investment?

The return of -95% over three years would not have pleased My Size, Inc. shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 7 warning signs (and 4 which are potentially serious) in My Size we think you should know about.

Important note: My Size is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MYSZ

My Size

An omnichannel e-commerce platform, provides AI-driven software as a service measurement solution for fashion ecommerce companies in Israel and Spain.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

The "Rare Disease Monopoly" – Commercial Execution Play

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026