Middle East Hidden Gems Including Aura Investments And 2 Promising Small Caps

Reviewed by Simply Wall St

As the Middle East markets experience a modest uplift, buoyed by stronger oil prices that counterbalance mixed earnings reports, investors are increasingly eyeing small-cap stocks for potential opportunities. In this environment, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that can thrive despite broader economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.71% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Aura Investments (TASE:AURA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aura Investments Ltd., with a market cap of ₪6.16 billion, operates in the residential real estate sector by locating, initiating, planning, and constructing projects both in Israel and internationally.

Operations: Aura Investments generates revenue primarily from its residential construction segment, amounting to ₪1.54 billion. The company does not report any significant income from other segments.

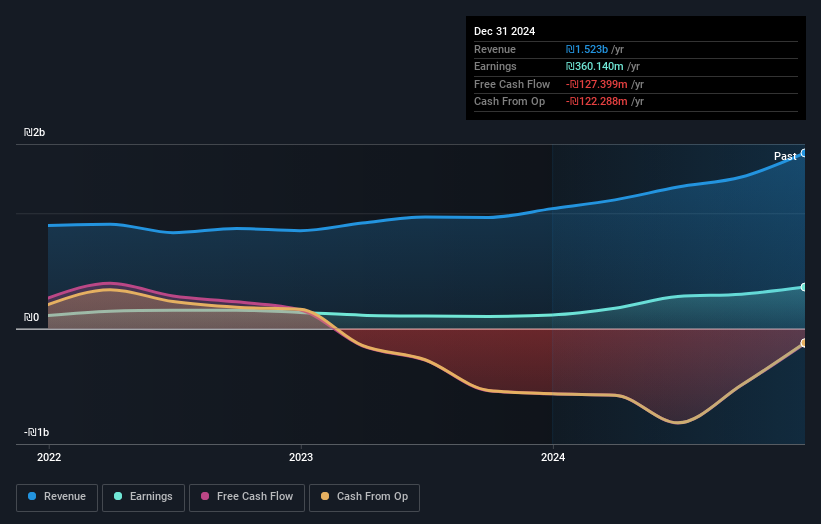

Aura Investments, a nimble player in the real estate sector, has seen its earnings soar by 99.6% over the past year, outpacing the industry average of 36.3%. Despite this impressive growth, its net income for Q1 2025 was ILS 73.82 million, slightly below last year's ILS 83.2 million. The company's debt situation is noteworthy; although it reduced its debt-to-equity ratio from 343% to a more manageable 196.8% over five years, the current net debt-to-equity ratio of 188.7% remains high but interest payments are well covered with EBIT at a robust 7.4x coverage.

- Navigate through the intricacies of Aura Investments with our comprehensive health report here.

Gain insights into Aura Investments' past trends and performance with our Past report.

Malam - Team (TASE:MLTM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Malam - Team Ltd is an Israeli company that offers information technology services, with a market capitalization of ₪2.49 billion.

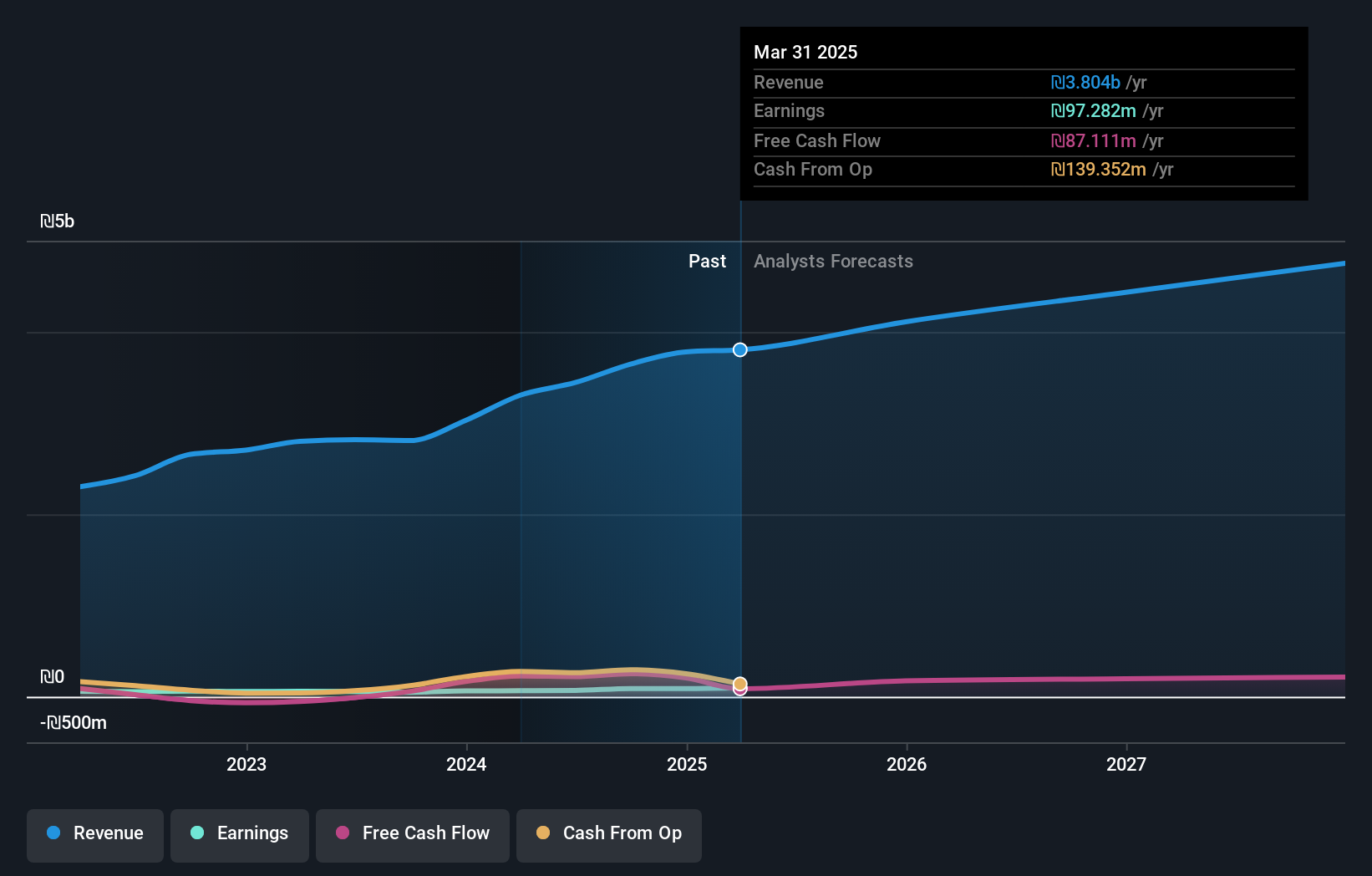

Operations: Malam - Team generates revenue primarily from hardware and cloud infrastructure (₪2.07 billion) and software, projects, and business solutions (₪1.44 billion). The company also derives income from salary services, human resources, and long-term savings (₪327.87 million), as well as a smaller contribution from its establishment and investment sector in start-up companies (₪4.05 million).

Malam - Team, a nimble player in the IT sector, has shown impressive earnings growth of 48.9% over the past year, outpacing the industry average of 25.1%. Despite a high net debt to equity ratio at 44.9%, their interest payments are well covered by EBIT at 4.1 times, indicating solid financial management. Recent first-quarter results reveal sales of ILS 1 billion and net income rising to ILS 30 million from ILS 21 million last year, with basic earnings per share increasing to ILS 1.37 from ILS 0.97 previously, showcasing robust performance amidst challenges in managing debt levels effectively.

- Click to explore a detailed breakdown of our findings in Malam - Team's health report.

Explore historical data to track Malam - Team's performance over time in our Past section.

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Value Rating: ★★★★★★

Overview: Palram Industries (1990) Ltd is a company that manufactures and sells thermoplastic sheets, panel systems, and finished products both in Israel and internationally, with a market capitalization of ₪1.88 billion.

Operations: Palram generates revenue primarily from its Polycarbonate Sector, contributing ₪966.35 million, followed by the PVC Sector at ₪445.42 million. The Home Finished Products and Sales and Display Stands sectors add ₪254.45 million and ₪222.65 million, respectively, to the revenue stream.

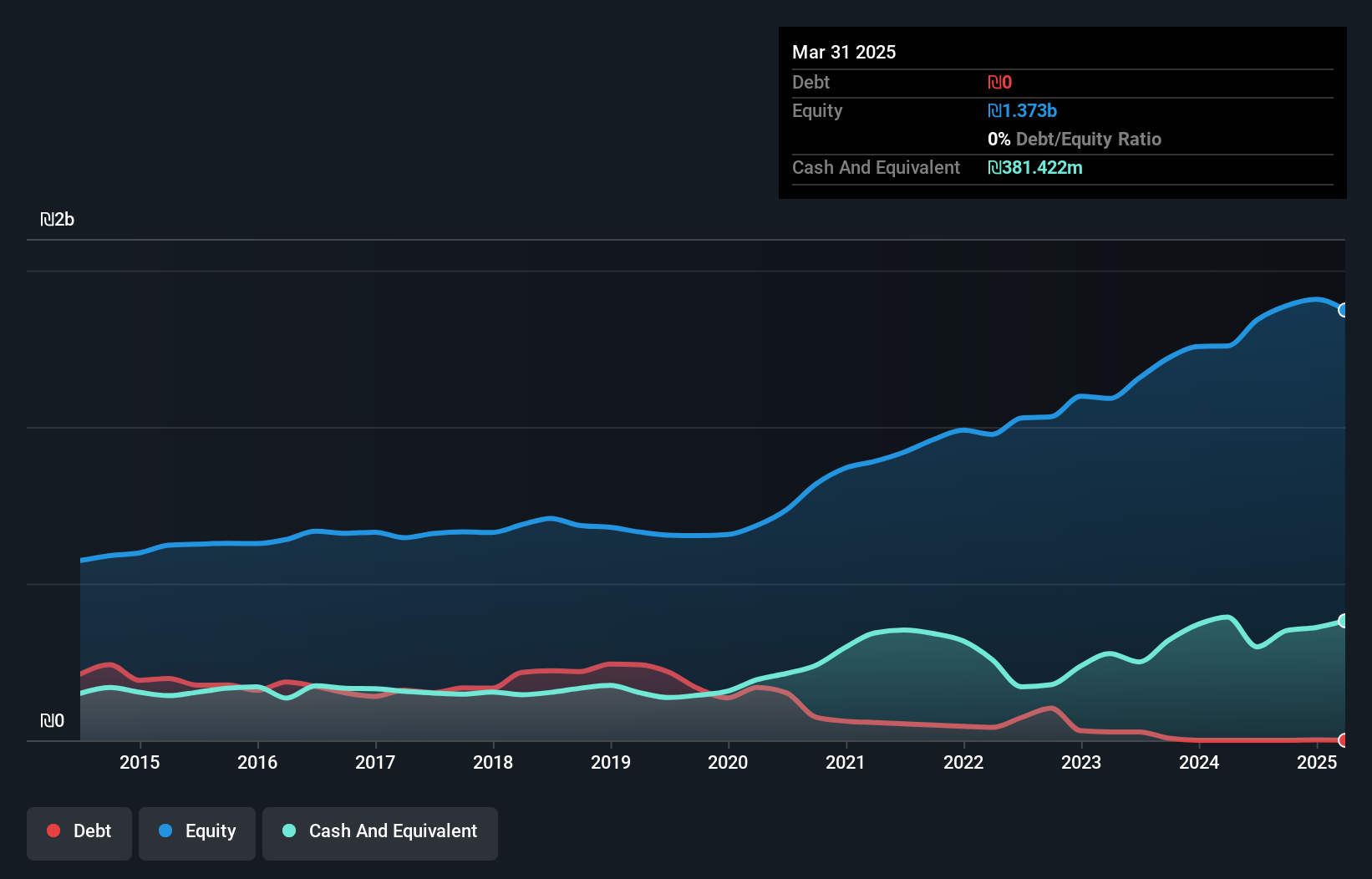

Palram Industries, a nimble player in the Middle East's chemicals sector, showcases robust financial health with no debt currently, a stark contrast to its 24.6% debt-to-equity ratio five years ago. The company's earnings surged by 13%, outpacing the industry average of 5%. Trading at an attractive valuation, it sits 44% below its estimated fair value. Despite recent first-quarter sales of ILS 438.73 million and net income of ILS 51.86 million showing slight dips from last year, Palram remains profitable with high-quality earnings and positive free cash flow at ILS 242.64 million as of March this year.

- Click here and access our complete health analysis report to understand the dynamics of Palram Industries (1990).

Understand Palram Industries (1990)'s track record by examining our Past report.

Seize The Opportunity

- Gain an insight into the universe of 216 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PLRM

Palram Industries (1990)

Operates as a manufacturer of extruded thermoplastic sheets and panel systems in Israel and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives