- Turkey

- /

- Electric Utilities

- /

- IBSE:IZENR

Exploring Undiscovered Gems in the Middle East This November 2025

Reviewed by Simply Wall St

As the Middle East markets navigate the uncertainty surrounding potential U.S. interest rate cuts, with most Gulf indices ending lower recently, investors are keenly observing how these macroeconomic shifts might influence small-cap stocks in the region. In this environment, identifying promising stocks often involves looking for companies with strong fundamentals and resilience to external economic pressures, making them potential hidden gems in a fluctuating market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 19.37% | 17.10% | 23.35% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

IZDEMIR Enerji Elektrik Uretim (IBSE:IZENR)

Simply Wall St Value Rating: ★★★★★☆

Overview: IZDEMIR Enerji Elektrik Uretim A.S. is engaged in the production and sale of electricity generated from coal, with a market capitalization of TRY23.56 billion.

Operations: IZDEMIR Enerji Elektrik Uretim generates revenue primarily from the sale of electricity produced from coal. The company has a market capitalization of TRY23.56 billion, reflecting its significant presence in the energy sector.

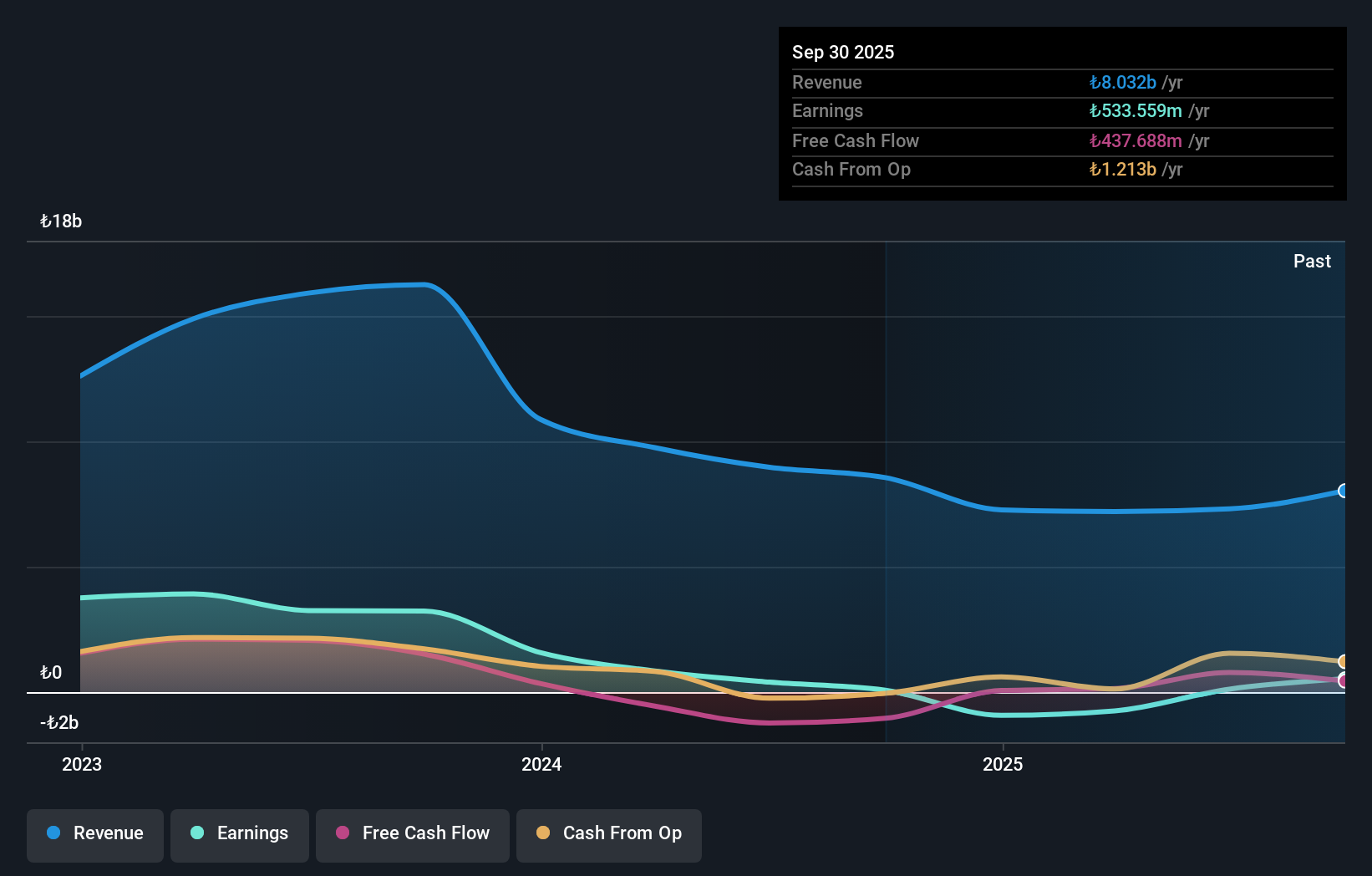

IZDEMIR Enerji Elektrik Uretim, a smaller player in the energy sector, has shown impressive earnings growth of 592% over the past year, outpacing its industry peers. Despite a one-off loss of TRY240.9 million impacting recent financials, the company reported net income of TRY548.85 million for Q3 2025 compared to TRY154.71 million last year. With sales at TRY2,457.58 million for Q3 and a satisfactory net debt to equity ratio of 3.9%, IZDEMIR's interest payments are well covered by EBIT at 5.4 times coverage, indicating robust financial health despite some volatility in share price recently.

Nofoth Food Products (SASE:9556)

Simply Wall St Value Rating: ★★★★★★

Overview: Nofoth Food Products Company operates in Saudi Arabia, specializing in the production and sale of bakery products, with a market capitalization of SAR1.10 billion.

Operations: Nofoth Food Products generates revenue through the production and sale of bakery products in Saudi Arabia. The company's net profit margin has shown fluctuations, reflecting changes in cost management and pricing strategies.

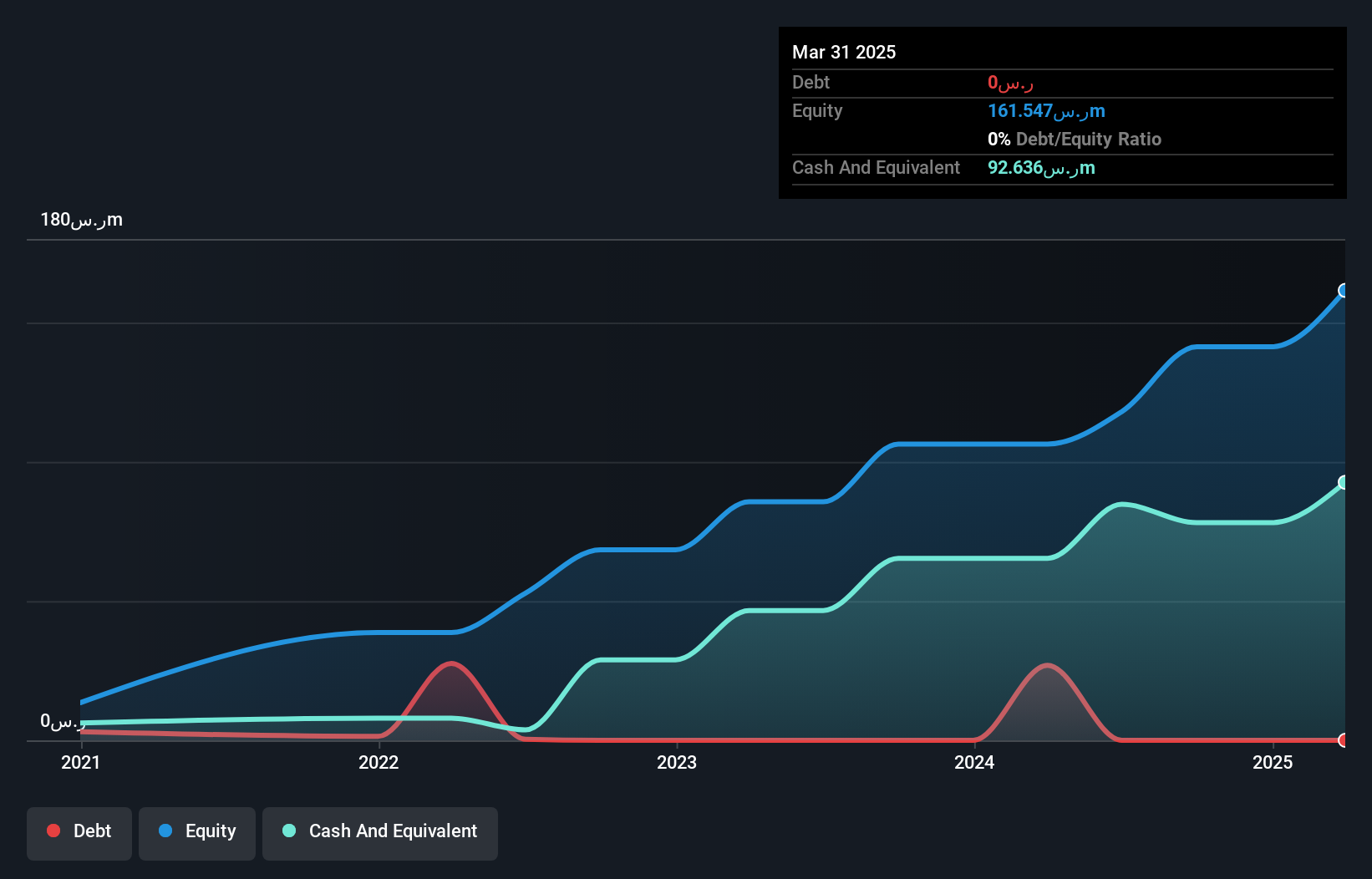

Nofoth Food Products, a small yet promising player in the Middle East, has been making strides with its robust financial health. The company is debt-free and boasts a 19.8% earnings growth over the past year, outpacing the food industry's 6.3%. Trading at 31.9% below estimated fair value, it seems undervalued for potential investors. Recent results show impressive sales of SAR 105 million for Q2 2025 compared to SAR 84 million last year, with net income rising to SAR 12 million from SAR 10 million previously. With high-quality non-cash earnings and no interest payment concerns due to zero debt, Nofoth appears well-positioned in its sector.

- Navigate through the intricacies of Nofoth Food Products with our comprehensive health report here.

Explore historical data to track Nofoth Food Products' performance over time in our Past section.

Malam - Team (TASE:MLTM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Malam - Team Ltd is an Israeli company that offers a range of information technology services, with a market capitalization of ₪3.09 billion.

Operations: Malam - Team Ltd generates revenue primarily from three segments: Infrastructure and Cloud (₪2.13 billion), and Software, Projects, and Business Solutions (₪1.45 billion), with additional income from Payroll Service, Human Resources, and Long-Term Savings (₪332.28 million).

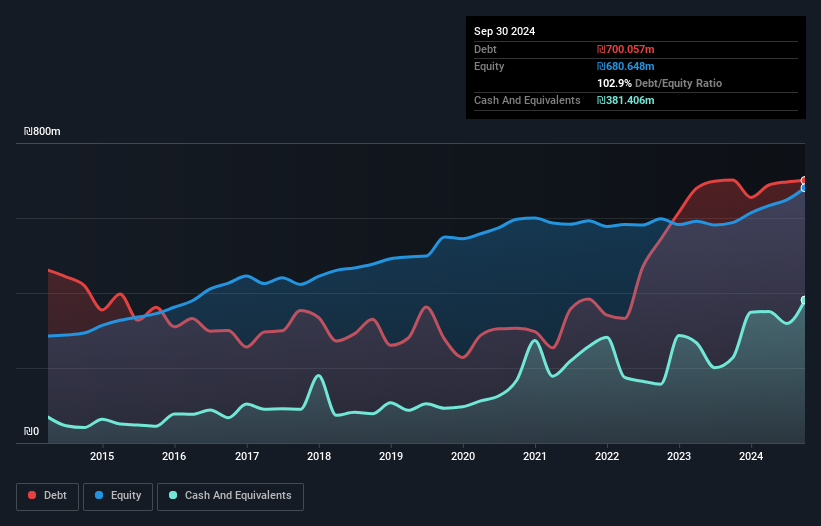

Malam - Team, a notable player in the Middle East IT sector, has demonstrated robust earnings growth of 45% over the past year, outpacing the industry average of 26.6%. The company reported second-quarter sales of ILS 910.61 million and net income of ILS 16.6 million, reflecting solid performance compared to last year's figures. Despite a high net debt to equity ratio at 44.7%, its interest payments are well covered with an EBIT coverage ratio of 4.1x, indicating financial stability amidst expansion efforts. Recently added to the S&P Global BMI Index, Malam - Team is gaining recognition on a global scale.

- Click here to discover the nuances of Malam - Team with our detailed analytical health report.

Examine Malam - Team's past performance report to understand how it has performed in the past.

Key Takeaways

- Unlock our comprehensive list of 210 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:IZENR

IZDEMIR Enerji Elektrik Uretim

Produces and sells electricity through coal.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives