Formula Systems (1985) (TLV:FORTY) Is Paying Out A Larger Dividend Than Last Year

Formula Systems (1985) Ltd. (TLV:FORTY) has announced that it will be increasing its dividend on the 22nd of September to ₪2.53. Although the dividend is now higher, the yield is only 1.6%, which is below the industry average.

See our latest analysis for Formula Systems (1985)

Formula Systems (1985) Is Paying Out More Than It Is Earning

Even a low dividend yield can be attractive if it is sustained for years on end. Prior to this announcement, Formula Systems (1985)'s dividend was comfortably covered by both cash flow and earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Looking forward, EPS could fall by 9.2% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 165%, which is definitely a bit high to be sustainable going forward.

Dividend Volatility

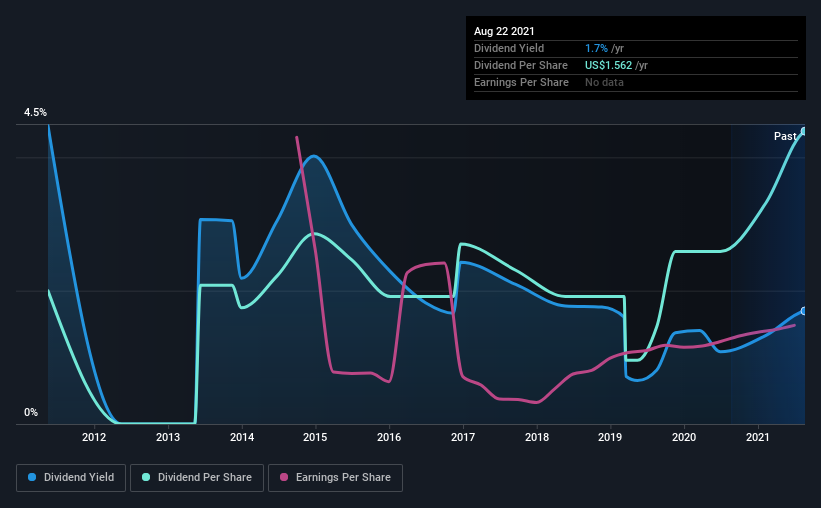

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. The first annual payment during the last 10 years was US$0.71 in 2011, and the most recent fiscal year payment was US$1.56. This means that it has been growing its distributions at 8.2% per annum over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Formula Systems (1985) might have put its house in order since then, but we remain cautious.

Dividend Growth May Be Hard To Come By

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Formula Systems (1985) has seen earnings per share falling at 9.2% per year over the last five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Formula Systems (1985)'s payments are rock solid. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for Formula Systems (1985) that investors should take into consideration. We have also put together a list of global stocks with a solid dividend.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:FORTY

Formula Systems (1985)

Through its subsidiaries, provides proprietary and non-proprietary software solutions and information technologies (IT) professional services in Israel, the United States, Europe, Africa, Japan, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives