- Israel

- /

- Specialty Stores

- /

- TASE:MRG

There's Reason For Concern Over Multi Retail Group Ltd's (TLV:MRG) Massive 28% Price Jump

Despite an already strong run, Multi Retail Group Ltd (TLV:MRG) shares have been powering on, with a gain of 28% in the last thirty days. The last 30 days were the cherry on top of the stock's 339% gain in the last year, which is nothing short of spectacular.

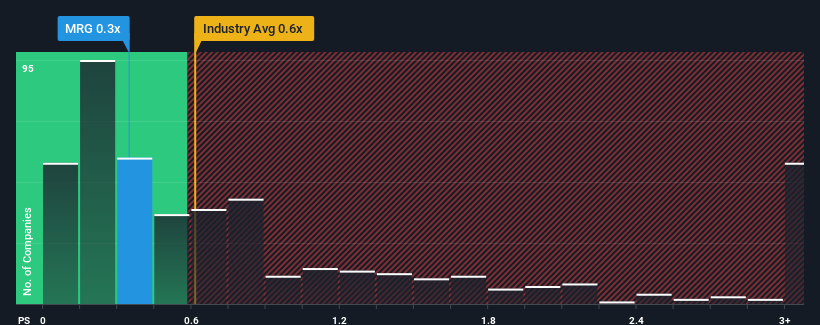

Even after such a large jump in price, it's still not a stretch to say that Multi Retail Group's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in Israel, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Multi Retail Group

How Multi Retail Group Has Been Performing

For instance, Multi Retail Group's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Multi Retail Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Multi Retail Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.9%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that Multi Retail Group's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Multi Retail Group's P/S?

Multi Retail Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Multi Retail Group revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Before you take the next step, you should know about the 3 warning signs for Multi Retail Group (1 is significant!) that we have uncovered.

If these risks are making you reconsider your opinion on Multi Retail Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MRG

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives