As the Middle East market experiences a boost in sentiment with the UAE index gaining on prospects of trade talks between the U.S. and China, investors are keenly observing how these developments might impact small-cap stocks across the region. With indices like Dubai's main index and Abu Dhabi's benchmark showing positive trends, identifying promising stocks requires a focus on companies that can leverage current economic conditions to enhance their growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Kerevitas Gida Sanayi ve Ticaret | 42.60% | 43.79% | 39.15% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.06% | 49.99% | 57.15% | ★★★★★★ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 29.47% | 42.38% | -38.36% | ★★★★★★ |

| Birikim Varlik Yonetim Anonim Sirketi | 35.08% | 46.79% | 47.74% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 14.46% | 58.05% | 72.63% | ★★★★★☆ |

| Ege Endüstri ve Ticaret | 19.99% | 43.25% | 22.60% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 53.26% | 26.61% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 8.11% | 55.10% | 73.88% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.68% | 12.49% | 49.63% | ★★★★★☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 91.93% | 46.59% | 3.35% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Yayla Agro Gida Sanayi ve Ticaret (IBSE:YYLGD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yayla Agro Gida Sanayi ve Ticaret A.S. is a company that produces and sells various food and grains both in Turkey and internationally, with a market capitalization of TRY10.37 billion.

Operations: Yayla Agro generates revenue primarily from its food business, amounting to TRY11.87 billion. The company's financial performance is reflected in its market capitalization of TRY10.37 billion.

Yayla Agro Gida Sanayi ve Ticaret, a promising player in the Middle East, boasts a price-to-earnings ratio of 9.7x, notably lower than the TR market average of 17.5x. The company's recent earnings growth of 60.1% significantly outpaced the food industry's -25.7%, highlighting its robust performance amid challenging conditions. While net income rose to TRY 1,064 million from TRY 665 million year-on-year, sales dipped to TRY 11.87 billion from TRY 23.64 billion, suggesting potential market shifts or strategic pivots impacting revenue streams despite high-quality non-cash earnings and improved debt management over five years.

El Al Israel Airlines (TASE:ELAL)

Simply Wall St Value Rating: ★★★★★☆

Overview: El Al Israel Airlines Ltd., along with its subsidiaries, operates in the passenger and cargo transportation sector with a market capitalization of ₪6.20 billion.

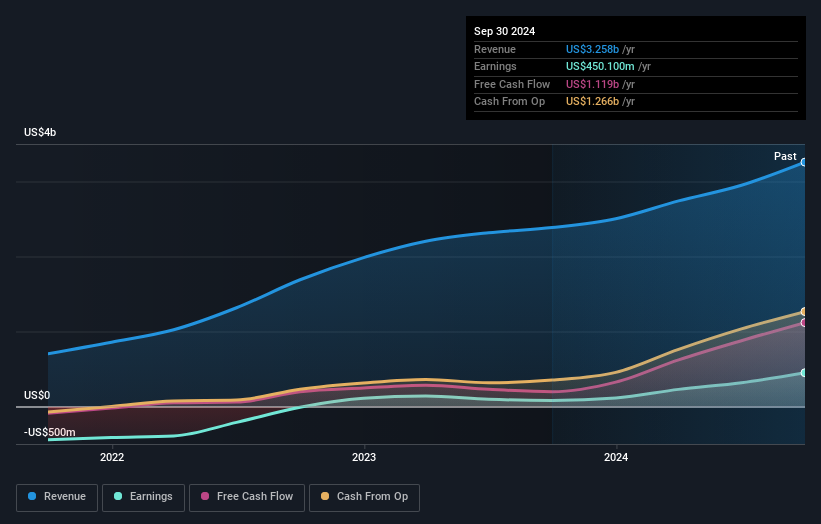

Operations: El Al generates revenue primarily from passenger aircraft services, contributing $3.08 billion, and cargo aircraft services, adding $266.80 million. The company also reports other income of $89.20 million.

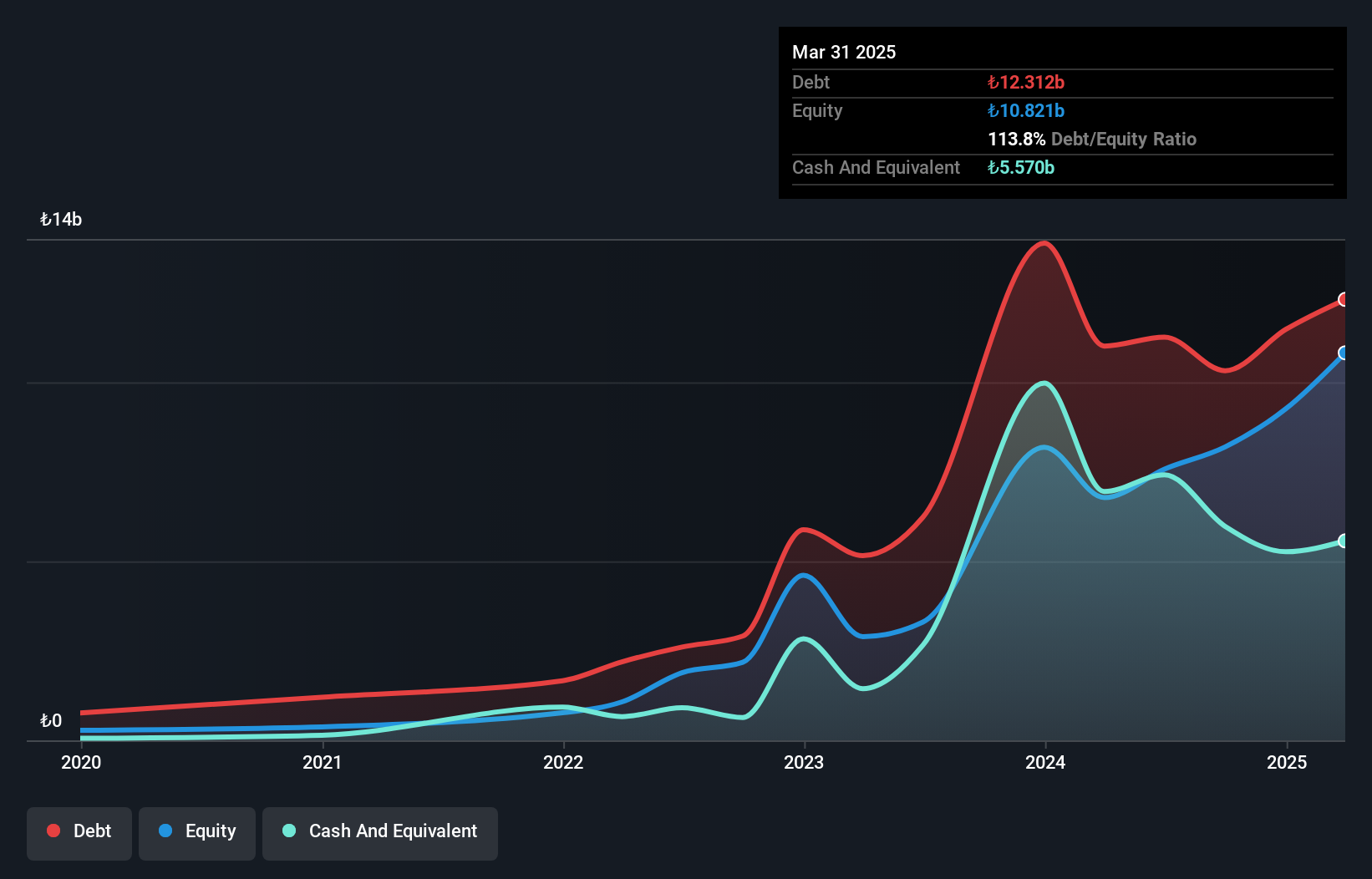

El Al Israel Airlines, a notable player in the Middle East aviation sector, has shown promising financial performance with its net income soaring to US$541.4 million from US$112.6 million last year. This growth is underscored by a significant earnings increase of 380.8%, outpacing the industry average of 9%. The airline's debt-to-equity ratio has impressively decreased from 724% to 158% over five years, reflecting improved financial health. Despite shareholder dilution and recent stock volatility, El Al remains undervalued at nearly 98% below fair value estimates and boasts robust interest coverage with EBIT covering interest payments more than sixteen times.

Fox-Wizel (TASE:FOX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fox-Wizel Ltd. is engaged in the design, purchasing, marketing, and distribution of a wide range of products including clothing, fashion accessories, underwear, footwear, home fashion items, and baby and children's products with a market cap of ₪4.32 billion.

Operations: Fox-Wizel's primary revenue streams include Sports, generating ₪2.41 billion, and Fashion and Home Fashion in Israel, contributing ₪2.15 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

Fox-Wizel, a notable player in the Middle East's retail sector, has shown impressive financial performance. Earnings surged by 95% over the past year, outpacing the Specialty Retail industry's 36.8% growth. The company's debt to equity ratio improved from 63.8% to 52.1% over five years, and its interest payments are well covered with EBIT at 3.9 times interest repayments. Trading at 55.1% below estimated fair value suggests potential undervaluation, while net income rose to ILS 290 million from ILS 149 million last year, highlighting strong profitability and high-quality earnings amidst industry challenges.

- Navigate through the intricacies of Fox-Wizel with our comprehensive health report here.

Review our historical performance report to gain insights into Fox-Wizel's's past performance.

Where To Now?

- Click here to access our complete index of 246 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if El Al Israel Airlines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ELAL

El Al Israel Airlines

Provides passenger and cargo transportation services.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives