Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Z.M.H Hammerman Ltd (TLV:ZMH) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Z.M.H Hammerman

What Is Z.M.H Hammerman's Debt?

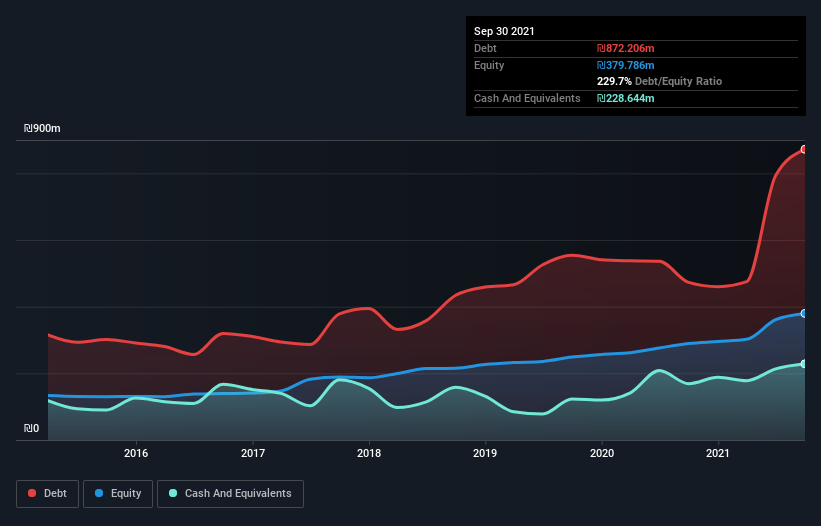

You can click the graphic below for the historical numbers, but it shows that as of September 2021 Z.M.H Hammerman had ₪872.2m of debt, an increase on ₪472.8m, over one year. On the flip side, it has ₪228.6m in cash leading to net debt of about ₪643.6m.

A Look At Z.M.H Hammerman's Liabilities

We can see from the most recent balance sheet that Z.M.H Hammerman had liabilities of ₪405.9m falling due within a year, and liabilities of ₪665.9m due beyond that. On the other hand, it had cash of ₪228.6m and ₪127.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₪715.8m.

This is a mountain of leverage relative to its market capitalization of ₪823.9m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With a net debt to EBITDA ratio of 10.6, it's fair to say Z.M.H Hammerman does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 3.6 times, suggesting it can responsibly service its obligations. Even more troubling is the fact that Z.M.H Hammerman actually let its EBIT decrease by 3.3% over the last year. If that earnings trend continues the company will face an uphill battle to pay off its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Z.M.H Hammerman will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Z.M.H Hammerman saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, Z.M.H Hammerman's net debt to EBITDA left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability to grow its EBIT isn't such a worry. Overall, it seems to us that Z.M.H Hammerman's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with Z.M.H Hammerman (at least 2 which can't be ignored) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Z.M.H Hammerman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ZMH

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives