- Israel

- /

- Real Estate

- /

- TASE:ZMH

I Built A List Of Growing Companies And Z.M.H Hammerman (TLV:ZMH) Made The Cut

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Z.M.H Hammerman (TLV:ZMH). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Z.M.H Hammerman

How Quickly Is Z.M.H Hammerman Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Z.M.H Hammerman grew its EPS by 8.6% per year. That growth rate is fairly good, assuming the company can keep it up.

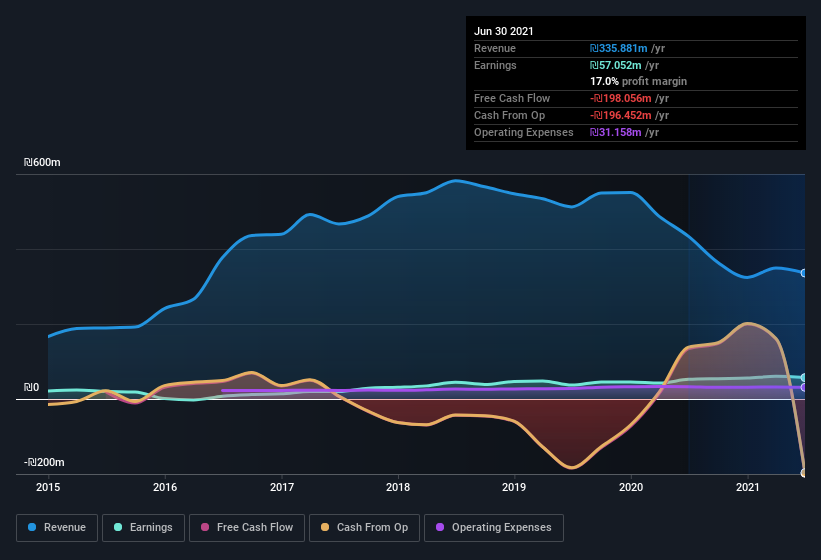

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Z.M.H Hammerman's EBIT margins have actually improved by 4.0 percentage points in the last year, to reach 19%, but, on the flip side, revenue was down 23%. That's not ideal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Z.M.H Hammerman isn't a huge company, given its market capitalization of ₪552m. That makes it extra important to check on its balance sheet strength.

Are Z.M.H Hammerman Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Z.M.H Hammerman shares worth a considerable sum. Indeed, they hold ₪137m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 25% of the company; visible skin in the game.

Does Z.M.H Hammerman Deserve A Spot On Your Watchlist?

As I already mentioned, Z.M.H Hammerman is a growing business, which is what I like to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Z.M.H Hammerman (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Z.M.H Hammerman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:ZMH

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives