- Israel

- /

- Real Estate

- /

- TASE:MSLA

Subdued Growth No Barrier To Maslavi Construction Company Ltd (TLV:MSLA) With Shares Advancing 32%

Maslavi Construction Company Ltd (TLV:MSLA) shares have continued their recent momentum with a 32% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

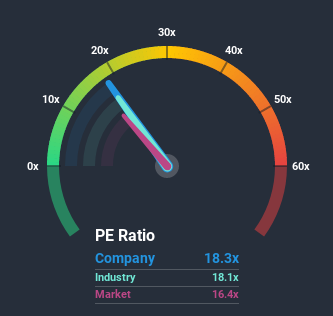

Even after such a large jump in price, it's still not a stretch to say that Maslavi Construction's price-to-earnings (or "P/E") ratio of 18.3x right now seems quite "middle-of-the-road" compared to the market in Israel, where the median P/E ratio is around 16x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Maslavi Construction certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Maslavi Construction

Does Growth Match The P/E?

In order to justify its P/E ratio, Maslavi Construction would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 51% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 63% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Maslavi Construction's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Maslavi Construction appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Maslavi Construction revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Maslavi Construction that you should be aware of.

If you're unsure about the strength of Maslavi Construction's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade Maslavi Construction, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:MSLA

Maslavi Construction

Operates in the construction and real estate industry in Israel.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives