- Israel

- /

- Real Estate

- /

- TASE:VILR

Undiscovered Gems in Middle East Stocks to Explore November 2025

Reviewed by Simply Wall St

As the Middle East markets experience a downturn, with UAE shares dropping due to hawkish signals from the U.S. Federal Reserve, investors are closely monitoring economic indicators and broader market sentiment impacting small-cap stocks. In this climate of cautious optimism, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential for growth amidst shifting monetary policies and global economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.85% | 5.17% | 7.38% | ★★★★★★ |

| Rimoni Industries | NA | 1.42% | -1.24% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.46% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 29.00% | 42.23% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Y.D. More Investments | 50.84% | 28.28% | 35.02% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 55.06% | 42.78% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 16.16% | 34.64% | 61.21% | ★★★★★☆ |

| Blume Metal Kimya Anonim Sirketi | 10.19% | 37.56% | 43.39% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

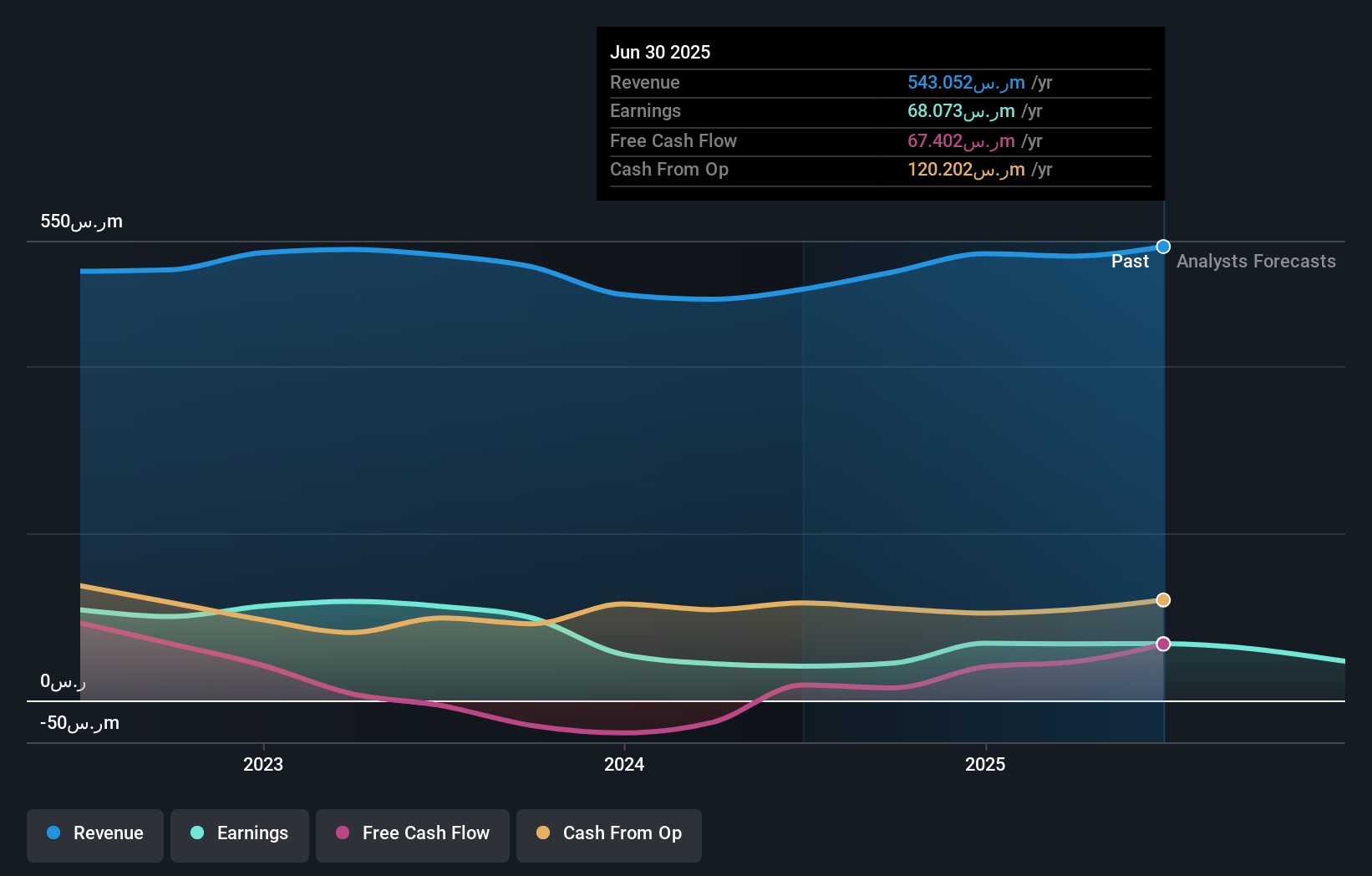

Najran Cement (SASE:3002)

Simply Wall St Value Rating: ★★★★★★

Overview: Najran Cement Company is involved in the manufacture and sale of cement products within Saudi Arabia, with a market capitalization of SAR1.18 billion.

Operations: Najran Cement generates revenue primarily from manufacturing cement, with this segment contributing SAR543.05 million.

Najran Cement, a modestly sized player in the cement industry, has seen its earnings soar by 66.5% over the past year, significantly outpacing the industry's 5.9% growth. With a net debt to equity ratio of 13.8%, its financial structure appears robust and satisfactory. The company also boasts high-quality earnings and maintains an attractive price-to-earnings ratio of 17.3x, which is below the broader Saudi Arabian market's average of 18.8x. Recent leadership changes include Engr. Ataa Abdulqader Bakkar stepping in as CEO, bringing extensive experience to guide future strategic directions amidst evolving market dynamics.

- Get an in-depth perspective on Najran Cement's performance by reading our health report here.

Gain insights into Najran Cement's past trends and performance with our Past report.

SofWave Medical (TASE:SOFW)

Simply Wall St Value Rating: ★★★★★★

Overview: SofWave Medical Ltd. focuses on developing, producing, marketing, supporting, and distributing ultrasound technology for non-invasive skin rejuvenation and firming treatments globally, with a market cap of ₪1.04 billion.

Operations: SofWave Medical generates revenue primarily from the sale of its ultrasound technology products for non-invasive skin treatments. The company incurs costs related to production, marketing, and distribution. Gross profit margin trends can provide insights into the company's pricing strategy and cost management effectiveness over time.

SofWave Medical, a nimble player in the medical equipment sector, has recently turned profitable with net income reaching US$0.98 million for Q3 2025, compared to a loss of US$1.33 million the previous year. The company's sales surged to US$21.07 million from US$13.51 million year-on-year, indicating robust growth momentum. With no debt on its balance sheet and trading at 42% below estimated fair value, SofWave appears undervalued relative to its potential market position. Recent FDA clearance for their Pure Impact VIP™ device further enhances their product portfolio and suggests promising future prospects in the medical technology space.

- Click to explore a detailed breakdown of our findings in SofWave Medical's health report.

Examine SofWave Medical's past performance report to understand how it has performed in the past.

Villar International (TASE:VILR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Villar International Ltd., with a market cap of ₪3.51 billion, operates in the acquisition, development, and construction of real estate properties both in Israel and internationally through its subsidiaries.

Operations: Villar International generates revenue primarily from the rental of buildings (₪257.98 million), construction of buildings (₪68.81 million), and provision of archival services (₪93.85 million).

Villar International, a dynamic player in the Middle East real estate sector, has shown impressive financial resilience. With earnings surging by 46% over the past year, it outpaced industry growth of 31.6%. The company's debt management is commendable; its net debt to equity ratio stands at a satisfactory 11.8%, down from 35.3% five years ago. Villar's interest payments are well-covered with an EBIT coverage of 11x, indicating robust financial health. Despite a one-off gain of ₪236M impacting recent results, its price-to-earnings ratio remains attractive at 10x compared to the IL market average of 16x.

Seize The Opportunity

- Get an in-depth perspective on all 197 Middle Eastern Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:VILR

Villar International

Engages in acquisition, development, and construction of real estate properties in Israel and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives