- Israel

- /

- Real Estate

- /

- TASE:MVNE

Mivne Real Estate (K.D) Ltd's (TLV:MVNE) Business Is Yet to Catch Up With Its Share Price

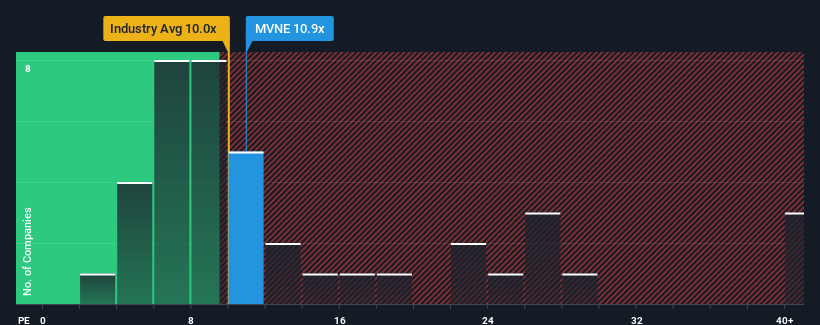

With a median price-to-earnings (or "P/E") ratio of close to 11x in Israel, you could be forgiven for feeling indifferent about Mivne Real Estate (K.D) Ltd's (TLV:MVNE) P/E ratio of 10.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that Mivne Real Estate (K.D)'s financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Mivne Real Estate (K.D)

Does Growth Match The P/E?

Mivne Real Estate (K.D)'s P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 45%. This means it has also seen a slide in earnings over the longer-term as EPS is down 4.2% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 22% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Mivne Real Estate (K.D) is trading at a fairly similar P/E to the market. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Mivne Real Estate (K.D) revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Mivne Real Estate (K.D) (1 is a bit unpleasant) you should be aware of.

If you're unsure about the strength of Mivne Real Estate (K.D)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MVNE

Mivne Real Estate (K.D)

Operates as a real estate development company in Israel, Switzerland, Ukraine, North America, and France.

Acceptable track record with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026