- Israel

- /

- Real Estate

- /

- TASE:MLSR

Melisron (TASE:MLSR): Evaluating Valuation Following Strong Share Price Momentum

Reviewed by Simply Wall St

Melisron (TASE:MLSR) has been on investors' radars lately, and with several shifts in the share price, the question arises: what’s really driving this momentum? While there may not be a single headline-grabbing event at play, the recent moves in the stock have prompted many to stop and reconsider its valuation and future prospects. For those weighing their portfolios, understanding what’s behind these fluctuations is as important as knowing where the stock could be headed.

Stepping back, Melisron’s performance over the past year has drawn plenty of attention. The company’s shares are up 45% in the last twelve months and have soared almost 25% over the past three months, with momentum showing little sign of slowing. There haven’t been dramatic one-off announcements, but consistent performance and steady gains have brought the stock near the top of its sector’s watchlists.

After such a strong run, is Melisron now an attractive entry point for value seekers, or are markets already anticipating further growth, leaving little room for upside?

Price-to-Earnings of 11.7x: Is it justified?

Melisron is currently trading at a price-to-earnings (P/E) ratio of 11.7x, which is below both the Israeli market average of 15.2x and the industry average of 14.1x. This signals that, based on earnings, the company is currently valued at a discount compared to its peers and the broader market.

The P/E ratio compares a company's share price to its earnings per share. In real estate and related sectors, this metric is commonly used to gauge whether a stock is expensive or cheap relative to its underlying profitability. It serves as a critical tool for investors assessing value and expectations.

Given Melisron's strong historical earnings growth, the relatively low P/E suggests that the market may be underpricing its expected future earnings or possibly factoring in uncertainty about the sustainability of recent profit margins. For investors, this presents a question: is the discount an opportunity or a signal for caution?

Result: Fair Value of ₪392.5 (ABOUT RIGHT)

See our latest analysis for Melisron.However, investors should note that potential industry headwinds or unexpected shifts in property demand could quickly alter Melisron's current valuation story.

Find out about the key risks to this Melisron narrative.Another View: Discounted Cash Flow Says Otherwise

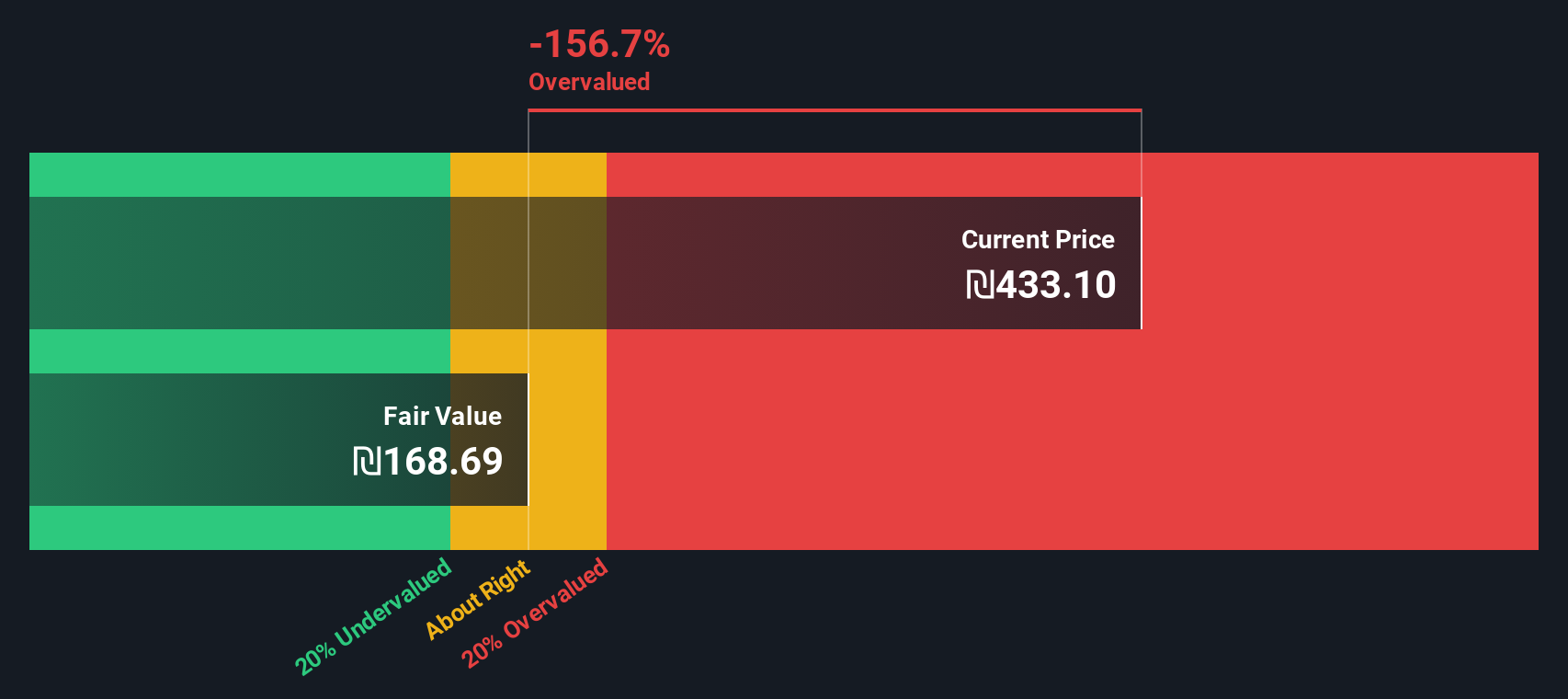

While earnings multiples present Melisron as attractively priced, our SWS DCF model offers a contrasting perspective and indicates that the market price may be well above the company's underlying value. Could this method be bringing attention to overlooked risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Melisron Narrative

If you find yourself drawing different conclusions or want to dig deeper into the numbers, you can easily shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Melisron research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the chance to broaden your portfolio with fresh opportunities. These categories could spotlight the next winners before most investors catch on. Let Simply Wall Street's screener show you where the action is.

- Amplify your returns by targeting assets with standout yields using our list of dividend stocks with yields > 3%.

- Ride the momentum in high-tech medicine by uncovering tomorrow’s breakthroughs through our guide to healthcare AI stocks.

- Pounce on value plays that others overlook with our curated picks of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MLSR

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives