- Israel

- /

- Real Estate

- /

- TASE:ISRS

Isras Investment (TASE:ISRS) Is Down 8.5% After Steep Third-Quarter Profit Drop - What's Changed

Reviewed by Sasha Jovanovic

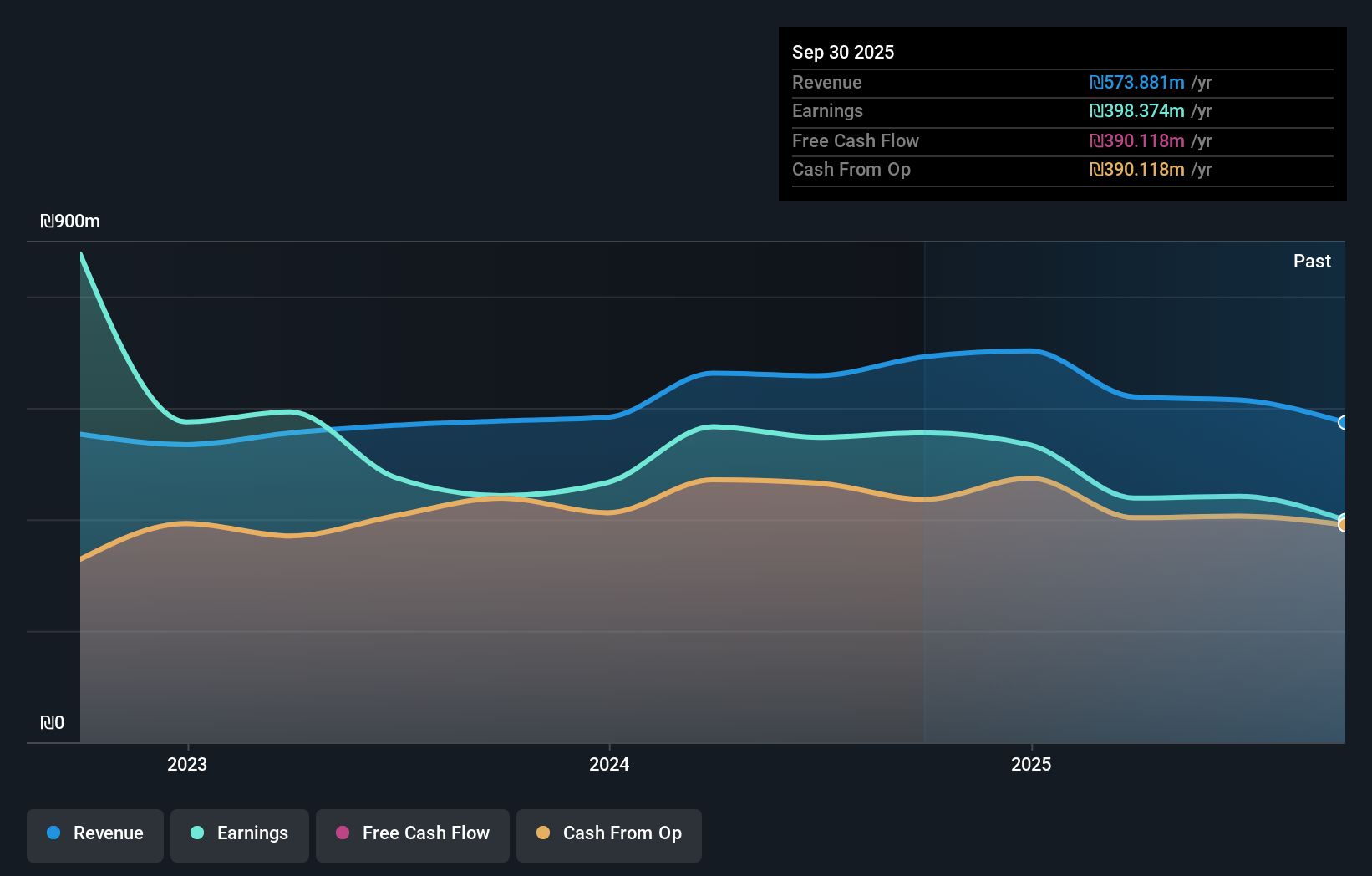

- Isras Investment Company Ltd recently reported earnings for the third quarter and the first nine months of 2025, revealing quarterly revenue of ILS 141.45 million and net income of ILS 25.36 million, both down significantly from the prior year.

- Despite sales holding relatively steady, the steep falls in net income and earnings per share highlight increased pressure on the company’s profitability.

- We’ll explore how the sharp year-over-year decline in earnings impacts Isras Investment’s investment narrative and future performance outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Isras Investment's Investment Narrative?

To be a shareholder in Isras Investment right now, you really have to believe in the company’s long-term potential to steady its fundamentals after a sharp and unexpected drop in profitability. The recent Q3 results, showing net income less than half of last year's, bring a real shift to the investment story and intensify focus on near-term risks. Previously, the biggest catalysts were the share buyback plan, seasoned management, and decent value metrics for its sector. Now, the larger question is whether declining revenue and earnings, exacerbated by one-off gains fading from the financial statements, will put more pressure on management’s ability to stabilize performance and maintain confidence with investors. Pressure on interest coverage and an unstable dividend track record have also come into sharper focus. The next few quarters could be pivotal for changing the risk-reward balance here.

However, interest payments not well covered by earnings are now a risk most investors should be aware of.

Exploring Other Perspectives

Explore another fair value estimate on Isras Investment - why the stock might be worth 31% less than the current price!

Build Your Own Isras Investment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Isras Investment research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Isras Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Isras Investment's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ISRS

Average dividend payer with slight risk.

Market Insights

Community Narratives