- Israel

- /

- Real Estate

- /

- TASE:HGG

Hagag Group Real Estate Entrepreneurship (TLV:HGG) jumps 16% this week, though earnings growth is still tracking behind five-year shareholder returns

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Hagag Group Real Estate Entrepreneurship Ltd (TLV:HGG) stock is up an impressive 145% over the last five years. It's also good to see the share price up 22% over the last quarter. But this could be related to the strong market, which is up 24% in the last three months.

Since it's been a strong week for Hagag Group Real Estate Entrepreneurship shareholders, let's have a look at trend of the longer term fundamentals.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

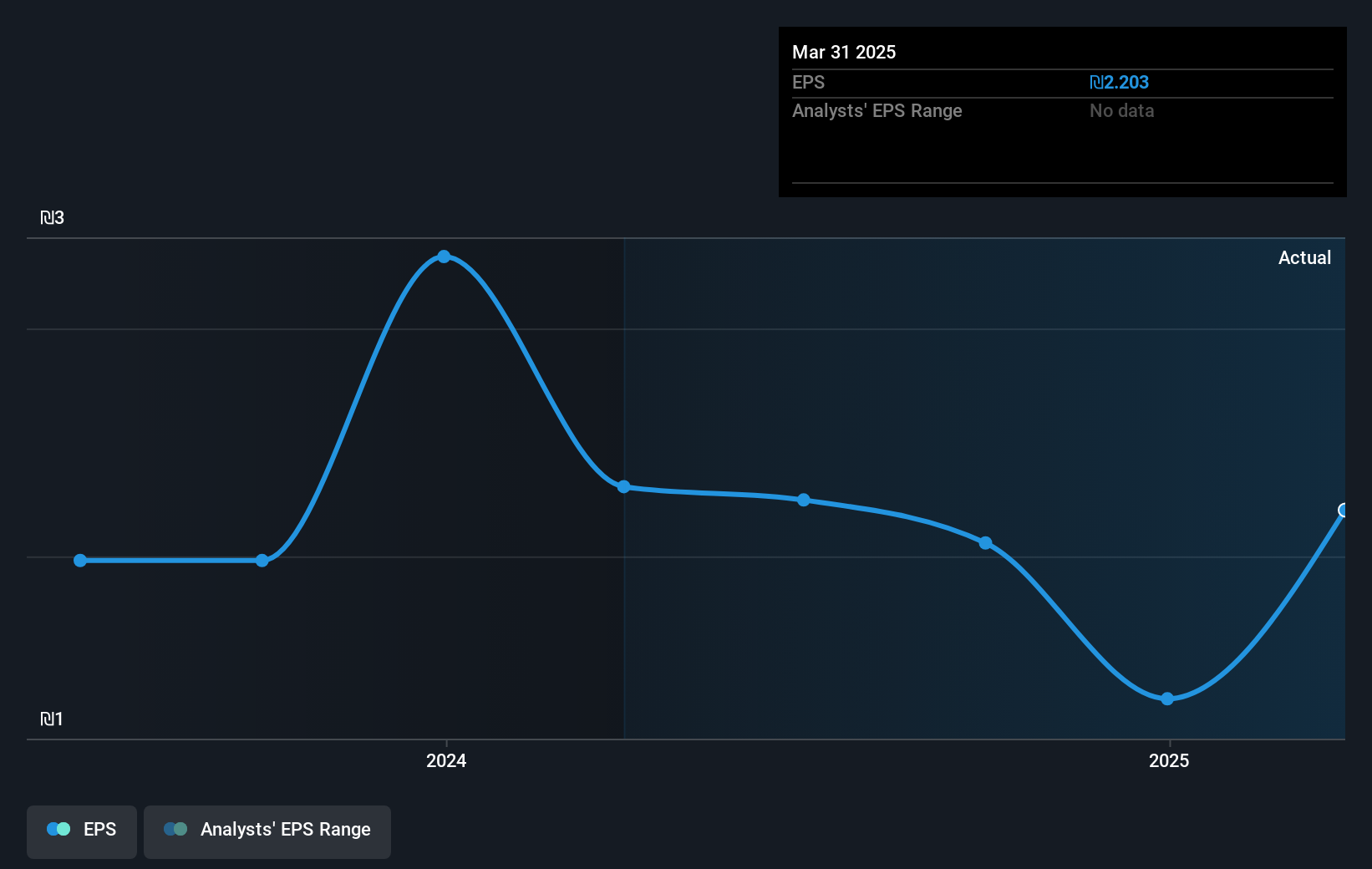

During five years of share price growth, Hagag Group Real Estate Entrepreneurship achieved compound earnings per share (EPS) growth of 8.3% per year. This EPS growth is lower than the 20% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Hagag Group Real Estate Entrepreneurship's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Hagag Group Real Estate Entrepreneurship's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Hagag Group Real Estate Entrepreneurship's TSR of 151% over the last 5 years is better than the share price return.

A Different Perspective

Hagag Group Real Estate Entrepreneurship shareholders gained a total return of 28% during the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 20% per year over five year. It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand Hagag Group Real Estate Entrepreneurship better, we need to consider many other factors. Even so, be aware that Hagag Group Real Estate Entrepreneurship is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hagag Group Real Estate Entrepreneurship might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:HGG

Hagag Group Real Estate Entrepreneurship

Engages in the development, management, and marketing of real estate projects in Israel.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives