- Israel

- /

- Real Estate

- /

- TASE:GVYM

How Investors May Respond To Gav-Yam Lands (TASE:GVYM) Surging Q3 Earnings and Doubling EPS

Reviewed by Sasha Jovanovic

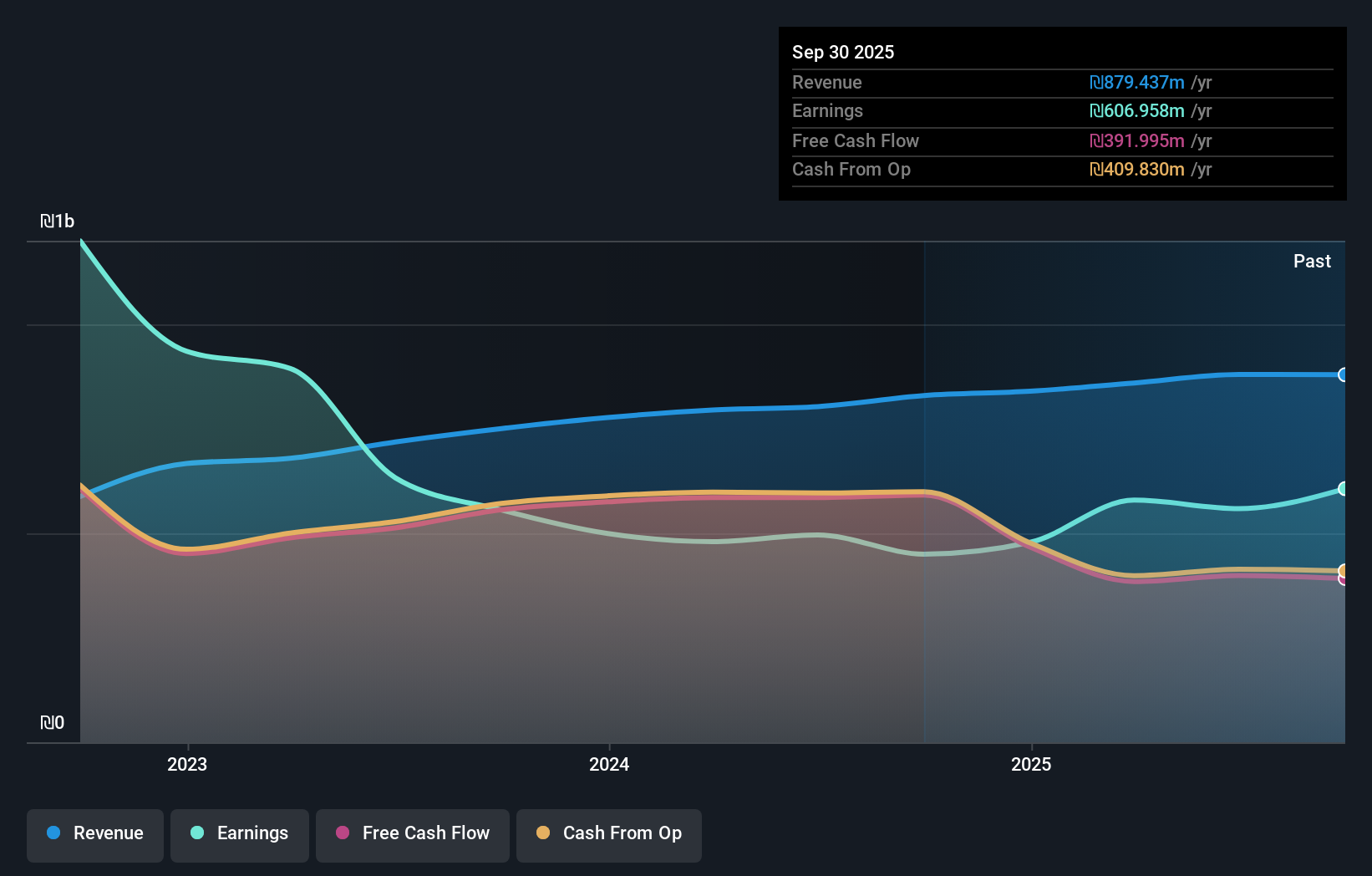

- Gav-Yam Lands Corp. Ltd recently announced financial results for the third quarter and first nine months of 2025, highlighting revenue of ILS 303 million and net income of ILS 89.93 million for the quarter, both higher than the prior year.

- An interesting highlight is the significant increase in diluted earnings per share from continuing operations to ILS 0.41 for the quarter, more than doubling compared to last year.

- Let's explore how this period of robust earnings growth may shape Gav-Yam Lands' investment narrative and future outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Gav-Yam Lands' Investment Narrative?

To be a Gav-Yam Lands shareholder, you need to believe in the company’s ability to sustain its earnings momentum after a particularly impressive quarter. The latest results show a robust jump in both revenue and net income for Q3 2025, suggesting the business is currently operating from a position of strength. This performance could influence short-term catalysts, such as market sentiment and dividend expectations, potentially offsetting concerns around one-off gains and historically unstable dividends. However, this step up in profitability doesn’t erase the ongoing risk tied to the company’s low board independence and high exposure to non-recurring earnings items, both of which have previously clouded the quality of reported results. The recent quarterly surge, while positive, may shift focus toward whether these gains are repeatable or simply a strong temporary upswing.

However, the company’s low board independence remains a concern investors should keep on their radar.

Exploring Other Perspectives

Explore another fair value estimate on Gav-Yam Lands - why the stock might be worth as much as 8% more than the current price!

Build Your Own Gav-Yam Lands Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gav-Yam Lands research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Gav-Yam Lands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gav-Yam Lands' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:GVYM

Average dividend payer with slight risk.

Market Insights

Community Narratives