- Israel

- /

- Real Estate

- /

- TASE:CRSR

Carasso Real Estate (TASE:CRSR) Margin Miss Reinforces Cautious Narrative Despite Higher Q3 Revenue

Reviewed by Simply Wall St

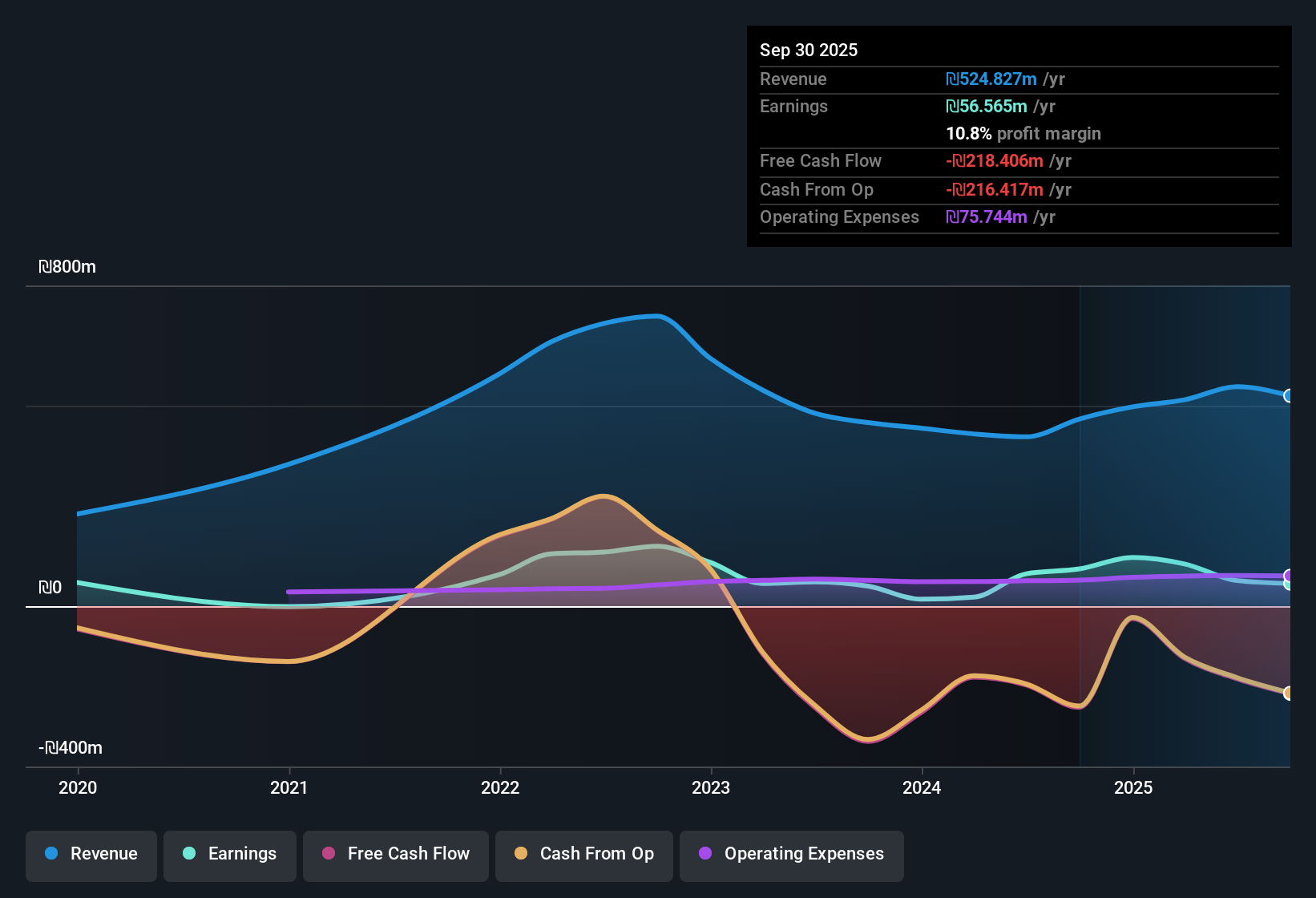

Carasso Real Estate (TASE:CRSR) just reported Q3 2025 results, posting revenue of ₪142.7 million and basic EPS of ₪0.11. The numbers reflect a quarter where overall revenue has trended higher this year, starting from ₪122.4 million in Q1 and moving through to ₪130.3 million in Q2. However, with EPS coming down from last quarter’s ₪0.53, investors will be watching how margins have played out this period.

See our full analysis for Carasso Real Estate.Next, we compare these latest earnings with the prevailing narratives to see how the market’s storylines hold up against the reported numbers.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slips to 11.6%

- Net profit margin for the trailing twelve months came in at 11.6%, down from 19.1% the prior year, as margins continue to tighten compared to both recent quarters and last year's levels.

- Margin compression stands out as a key trend, pushing the latest net income of ₪6.2 million far below Q2's figure of ₪29 million.

- This drop in profitability is amplified by the fact that the headline margin included a sizable one-off gain of ₪112.3 million, so core operating performance appears even weaker in context.

- Persistent negative earnings growth over the period underlines why analysts are cautious, even though revenue has trended higher each quarter.

Premium Valuation vs Peers

- Carasso Real Estate trades at a price-to-earnings ratio of 30.3x, more than double the Israeli real estate industry average of 15x and peer average of 15.1x.

- Market observers highlight how the current share price of ₪34.92 stands well above an internally estimated DCF fair value of ₪9.86 per share.

- This significant premium suggests investors are paying up for growth or perceived stability, even as earnings have slipped year-over-year and one-off items have boosted reported profit.

- The elevated multiple heightens the risk if margins stay compressed or non-operating gains do not repeat in future periods.

Dividend Yield Not Fully Covered

- The latest dividend yield sits at 3.21%, but coverage is stretched with payouts not well supported by either earnings or free cash flow, and earnings not fully covering interest obligations.

- While the yield may initially attract income-oriented investors, cash flow strains and weaker debt coverage in the past year point to lingering doubts about how sustainable shareholder returns will be going forward.

- The pressure on coverage ratios is especially notable given weaker profitability and margin trends this reporting cycle.

- With interest payments outpacing earnings coverage, as shown in the analysis, this remains a growing risk even at a time of higher revenues.

For more on how these margin and valuation shifts play into the bigger picture for Carasso Real Estate, check out the full range of consensus perspectives for a neutral, balanced view of the road ahead. 📊 Read the full Carasso Real Estate Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Carasso Real Estate's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Carasso Real Estate’s premium valuation and falling profits indicate that investors face higher risks if margins remain weak or one-off gains do not repeat.

To sidestep these valuation concerns and discover companies that may offer better value for your money, check out opportunities uncovered with these 932 undervalued stocks based on cash flows today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CRSR

Carasso Real Estate

Engages in developing, planning, and constructing residential projects in Israel.

Medium-low risk with imperfect balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026