- Israel

- /

- Electronic Equipment and Components

- /

- TASE:ININ

3 Middle Eastern Penny Stocks With Market Caps Under US$600M

Reviewed by Simply Wall St

The Middle Eastern stock markets are currently experiencing mixed performances, influenced by softer oil prices and speculation around potential U.S. Federal Reserve rate cuts. For investors seeking opportunities in smaller or newer companies, penny stocks remain a relevant investment area despite the term's outdated connotations. These stocks can offer surprising value and potential for significant returns when backed by strong financial foundations, as we explore through three compelling examples from the region.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.34 | SAR1.33B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.794 | ₪272.01M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.02 | AED2.08B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.27 | AED14.03B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.794 | AED2.29B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.82 | AED498.77M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.70 | ₪211.95M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

E7 Group PJSC (ADX:E7)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E7 Group PJSC operates in the commercial printing, packaging, and distribution sectors within the United Arab Emirates and has a market cap of AED2.08 billion.

Operations: The company generates revenue from its operations in printing, which accounts for AED599.21 million, and distribution, contributing AED76.53 million.

Market Cap: AED2.08B

E7 Group PJSC, operating in the commercial printing and packaging sectors, reported a third-quarter sales decline to AED173.64 million from AED190.9 million a year ago, with net income dropping significantly to AED28.03 million from AED73.35 million. Despite this downturn, E7 remains debt-free with short-term assets of AED1.1 billion comfortably covering liabilities and boasts high non-cash earnings quality. The recent strategic alliance with 7I Holding aims to enhance its identity solutions segment and expand market presence globally, aligning with its organic growth strategy despite current share price volatility and management's limited experience tenure.

- Unlock comprehensive insights into our analysis of E7 Group PJSC stock in this financial health report.

- Evaluate E7 Group PJSC's prospects by accessing our earnings growth report.

Inter Industries Plus (TASE:ININ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inter Industries Plus Ltd., along with its subsidiaries, operates in the energy and infrastructure sectors in Israel with a market cap of ₪97.70 million.

Operations: The company generates revenue through two primary segments: Projects, contributing ₪363.88 million, and Trade and Services, accounting for ₪328.11 million.

Market Cap: ₪97.7M

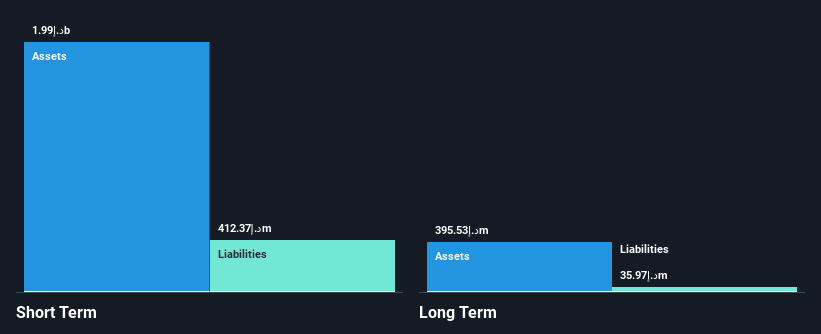

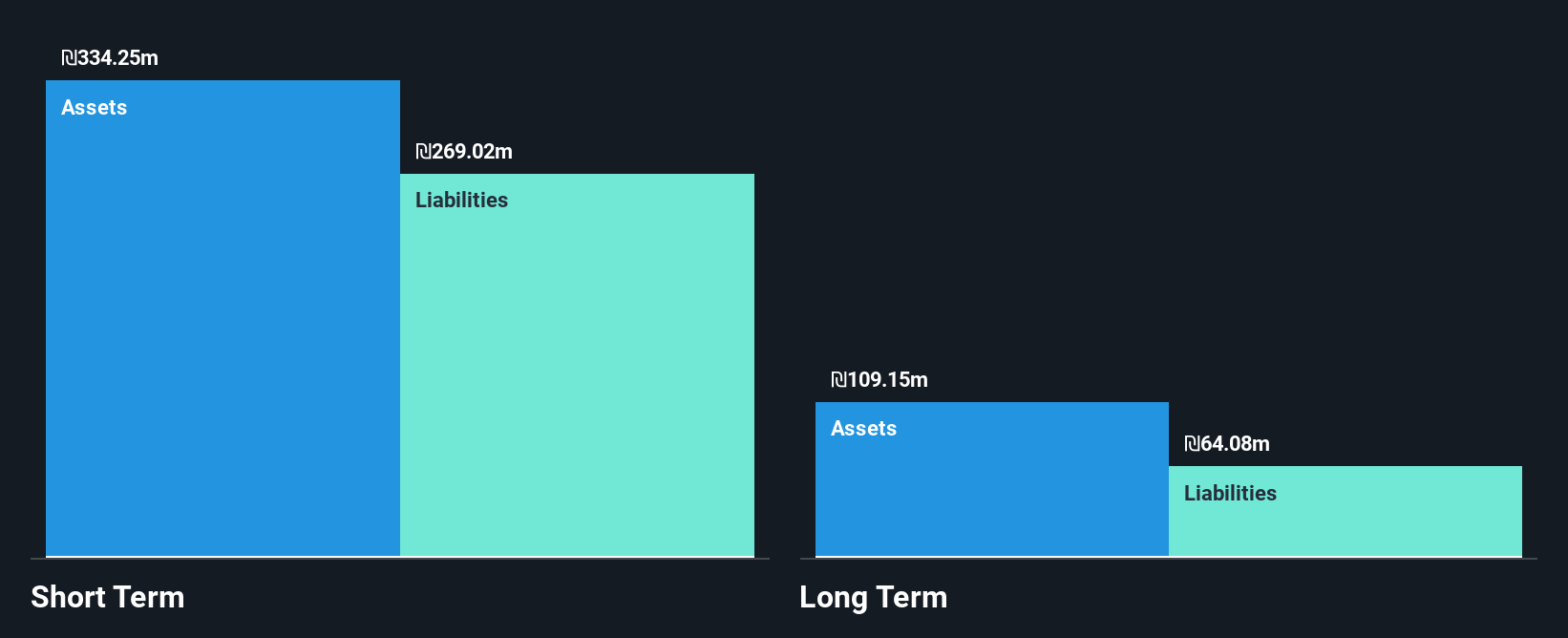

Inter Industries Plus Ltd. operates in Israel's energy and infrastructure sectors, with a market cap of ₪97.70 million and notable revenue from its Projects (₪363.88 million) and Trade and Services (₪328.11 million) segments. Despite being unprofitable, the company maintains a satisfactory net debt to equity ratio of 8.3% and has not significantly diluted shareholders recently. It possesses short-term assets of ₪334.2 million that exceed both its short-term liabilities (₪269 million) and long-term liabilities (₪64.1 million). However, the management team’s average tenure is only 1.8 years, indicating limited experience amidst ongoing losses.

- Navigate through the intricacies of Inter Industries Plus with our comprehensive balance sheet health report here.

- Explore historical data to track Inter Industries Plus' performance over time in our past results report.

PlantArc Bio (TASE:PLNT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PlantArc Bio Ltd. is an Ag-Bio company focused on crop protection and yield enhancement, with a market cap of ₪7.05 million.

Operations: The company generates revenue from its Agricultural Biotech segment, amounting to ₪3.07 million.

Market Cap: ₪7.05M

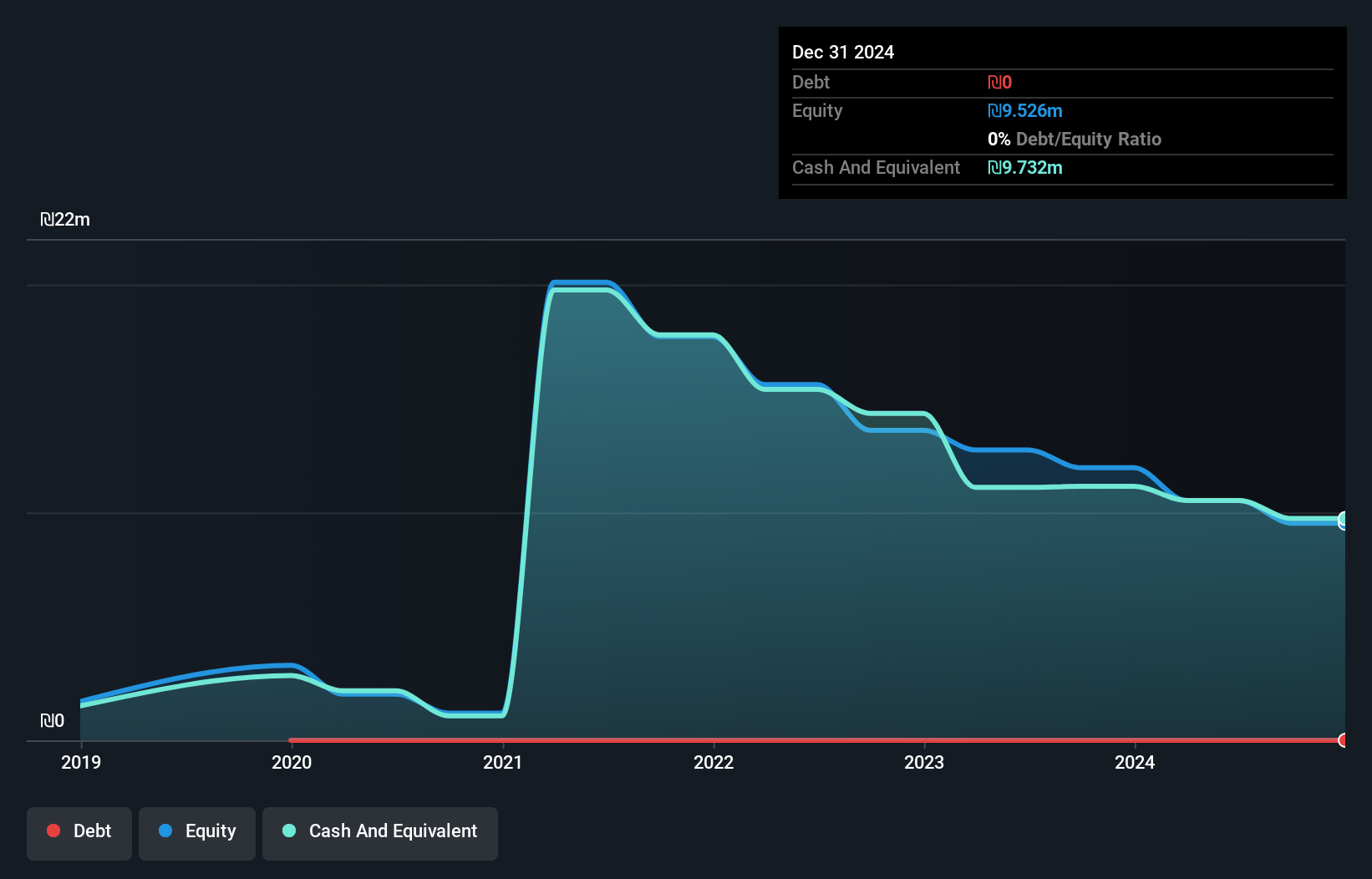

PlantArc Bio Ltd., with a market cap of ₪7.05 million, is pre-revenue and currently unprofitable. The company has no debt and its short-term assets of ₪8.0 million cover both short-term (₪757.0K) and long-term liabilities (₪20K). Despite high share price volatility, PlantArc Bio's cash runway exceeds three years at current free cash flow levels. Recent patent grants for its DIPPER™ platform in the U.S. and South Korea enhance its intellectual property portfolio, potentially accelerating crop trait development using gene-editing tools like CRISPR, which could improve future financial performance if successfully commercialized.

- Take a closer look at PlantArc Bio's potential here in our financial health report.

- Assess PlantArc Bio's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Dive into all 78 of the Middle Eastern Penny Stocks we have identified here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ININ

Inter Industries Plus

Engages in the energy and infrastructure businesses in Israel.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth