Middle Eastern Opportunities: Gencell And 2 More Promising Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently seen a rise, buoyed by increasing oil prices and global market optimism ahead of the U.S. Federal Reserve's policy meeting. For investors looking beyond the well-known names, penny stocks can present intriguing opportunities, especially when they are supported by solid financials. While the term "penny stocks" might seem outdated, these smaller or newer companies continue to offer potential for growth and value that larger firms may not always provide.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.56 | SAR1.42B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.12B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.39 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.20 | AED369.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.33 | AED14.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.802 | AED3.39B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.83 | AED504.85M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.695 | ₪211.55M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 75 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Gencell (TASE:GNCL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GenCell Ltd. develops and produces fuel cell-based energy systems, with a market cap of ₪30.41 million.

Operations: The company's revenue is derived from its development and production of fuel cell-based energy systems, totaling $9.99 million.

Market Cap: ₪30.41M

GenCell Ltd. is navigating the penny stock landscape with a market cap of ₪30.41 million and recent revenue of US$0.715 million, indicating it is pre-revenue. The company has experienced significant volatility but maintains a strong financial position with short-term assets exceeding liabilities and no debt on its balance sheet. Despite being unprofitable, GenCell's strategic alliance for the EVOX system showcases potential in high-capacity power solutions for automotive logistics, which could drive future growth if market adoption follows successful demonstrations. However, its cash runway remains limited to less than a year under current conditions, highlighting financial sustainability concerns.

- Unlock comprehensive insights into our analysis of Gencell stock in this financial health report.

- Explore historical data to track Gencell's performance over time in our past results report.

Matricelf (TASE:MTLF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Matricelf Ltd (TASE:MTLF) is a biotechnology company focused on developing a platform for autologous tissue engineering to address various medical conditions, with a market cap of ₪69.36 million.

Operations: There are no reported revenue segments for Matricelf Ltd (TASE:MTLF).

Market Cap: ₪69.36M

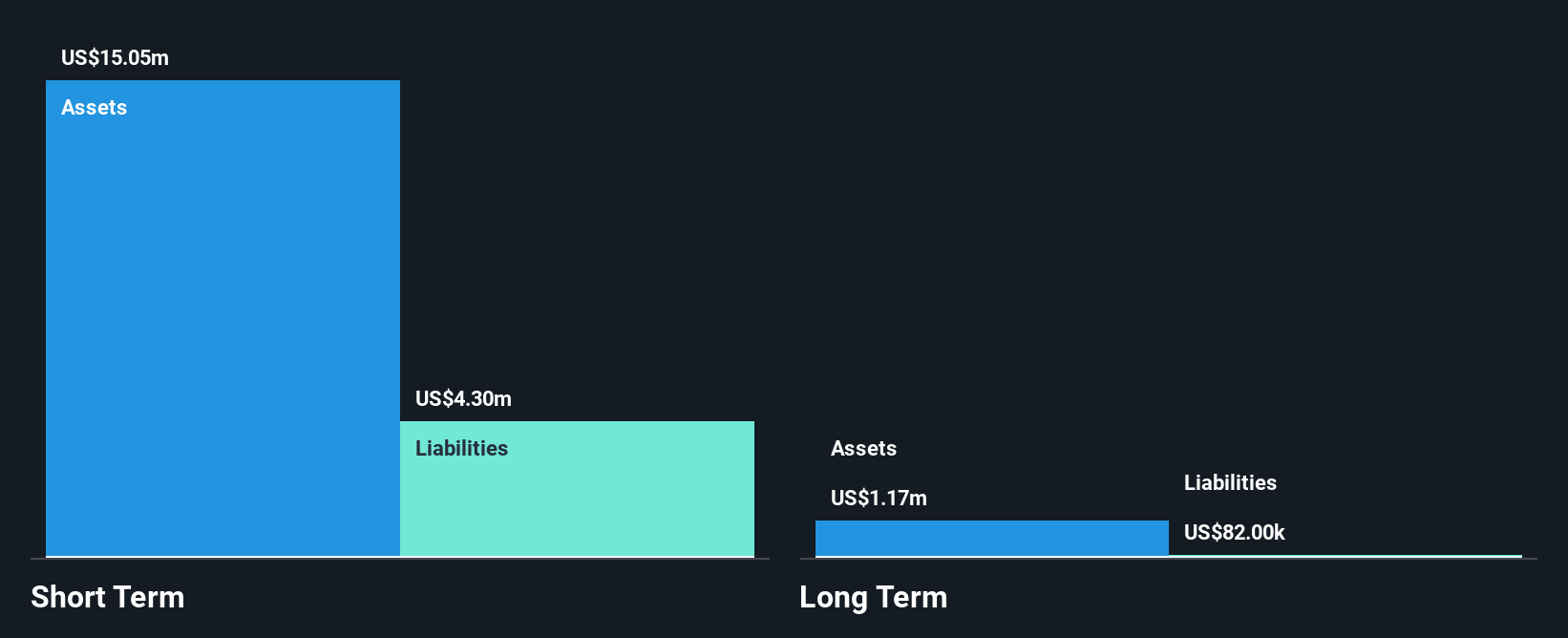

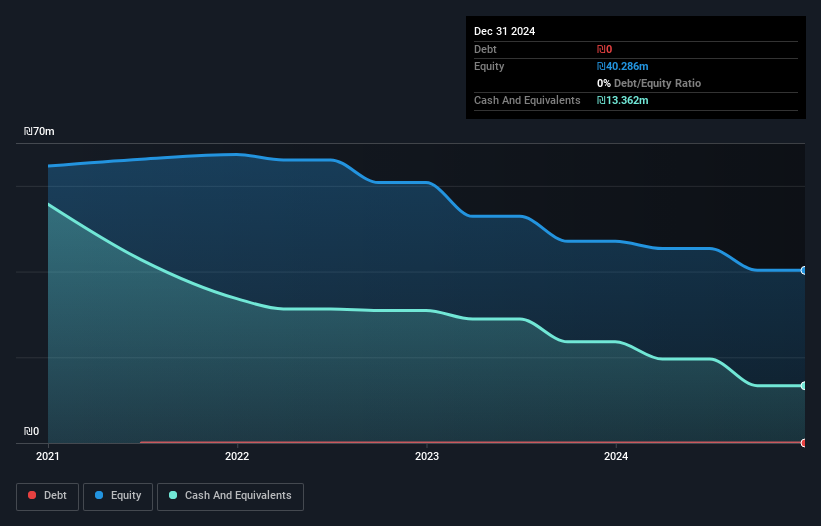

Matricelf Ltd, with a market cap of ₪69.36 million, is pre-revenue and unprofitable, reflecting its early-stage biotech status. The management team and board are considered experienced, with average tenures of 4.3 and 3.3 years respectively. Despite being debt-free and having short-term assets (₪5.8M) exceeding liabilities (₪2.1M), the company faces financial challenges with less than a year of cash runway if current cash flow trends persist. Share price volatility remains high, complicating investor sentiment in the penny stock arena while recent shareholder meetings could signal strategic shifts or capital restructuring efforts ahead.

- Take a closer look at Matricelf's potential here in our financial health report.

- Examine Matricelf's past performance report to understand how it has performed in prior years.

Unicorn Technologies - Limited Partnership (TASE:UNCT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Unicorn Technologies - Limited Partnership, based in Tel Aviv, Israel, is a principal investment firm with a market cap of ₪21.19 million.

Operations: Unicorn Technologies - Limited Partnership has not reported any revenue segments.

Market Cap: ₪21.19M

Unicorn Technologies - Limited Partnership, based in Tel Aviv with a market cap of ₪21.19 million, is pre-revenue and unprofitable, yet it remains debt-free and has short-term assets (₪9.0M) that far exceed its liabilities (₪341.0K). The company has a cash runway extending over two years if current cash flow trends continue. Recent events include a 1:8 stock split on September 7, 2025, which may impact share price volatility—a factor already heightened over the past three months. Despite financial challenges and increased weekly volatility from 9% to 15%, the experienced board offers some stability amid ongoing strategic evaluations.

- Click to explore a detailed breakdown of our findings in Unicorn Technologies - Limited Partnership's financial health report.

- Gain insights into Unicorn Technologies - Limited Partnership's historical outcomes by reviewing our past performance report.

Next Steps

- Click through to start exploring the rest of the 72 Middle Eastern Penny Stocks now.

- Ready To Venture Into Other Investment Styles? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MTLF

Matricelf

A biotechnology company, develops a platform for autologous tissue engineering for various medical conditions.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives