Assessing Turpaz Industries (TASE:TRPZ) Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

Turpaz Industries (TASE:TRPZ) shares have moved up recently, building on momentum seen across the month. Investors may be taking note of the company’s performance, with the stock gaining 20% over the past month.

See our latest analysis for Turpaz Industries.

Turpaz Industries’ 7.93% share price jump in the last day caps off a remarkable run, with the 30-day share price return nearing 20%. Momentum has been strong all year, as shown by the 210.77% year-to-date share price surge and a 212.23% total shareholder return across the past twelve months, outpacing most peers and hinting at shifting investor sentiment.

If you’re searching for more stocks defying expectations, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With such impressive gains on the board, investors are left wondering whether Turpaz Industries’ stock still offers upside potential or if the market has already priced in all the expected future growth.

Price-to-Earnings of 127.1x: Is it justified?

Turpaz Industries is trading at a sky-high price-to-earnings (P/E) ratio of 127.1x, with the last close at ₪60.01. This level far exceeds typical peer and industry valuations, suggesting that the market is pricing in a substantial growth premium.

The price-to-earnings ratio tells us how much investors are willing to pay for each shekel of earnings. For a chemicals company like Turpaz, where growth may not be as explosive as in other sectors, such a steep multiple usually reflects high expectations for future profit increases.

At 127.1x, Turpaz’s P/E ratio is much higher than the Asian chemicals industry average of 22.6x and the average of its closest peers at 15.2x. This points to a share price that is significantly more expensive than sector standards. If the market reprices toward more typical levels, the stock could face a substantial reset.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 127.1x (OVERVALUED)

However, elevated valuations could attract profit-taking, and any slowdown in earnings growth might quickly reduce the current bullish momentum.

Find out about the key risks to this Turpaz Industries narrative.

Another View: What Does Our DCF Model Say?

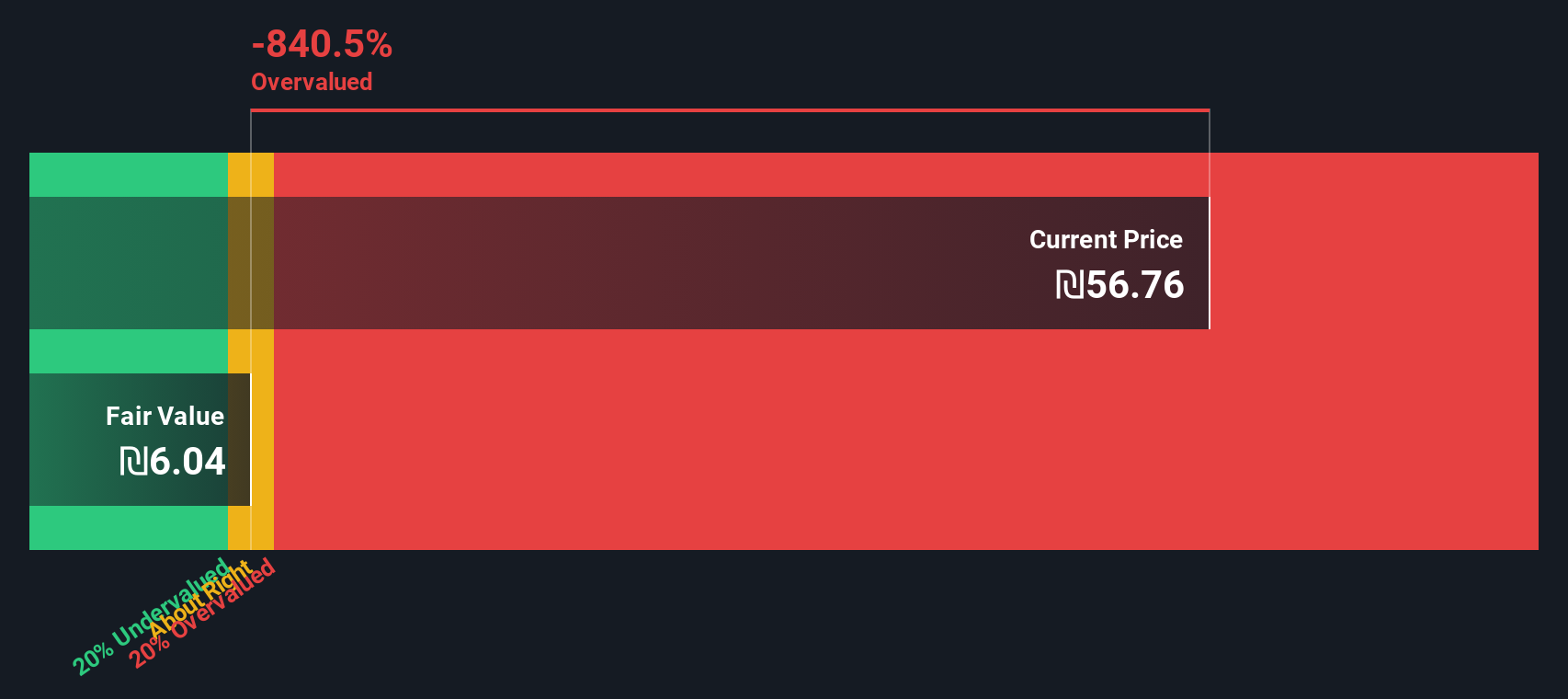

Looking at Turpaz Industries through the lens of our SWS DCF model, the outlook becomes even more challenging for optimistic investors. With shares trading at ₪60.01, the DCF model places fair value far lower, at just ₪3.28. If the market begins to care about fundamentals, there could be a sharp adjustment ahead. So, is the momentum story at risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Turpaz Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Turpaz Industries Narrative

If you think the numbers tell a different story, or want to draw your own insights, it only takes a few minutes to build your perspective. Do it your way

A great starting point for your Turpaz Industries research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait for the next big trend to pass you by. Smart investors are already finding exciting stocks across emerging sectors with the help of our screener tools.

- Grow your passive income by targeting steady earners with these 14 dividend stocks with yields > 3% that consistently offer yields above 3%.

- Expand your portfolio with the latest innovations in medicine and biotech by selecting from these 32 healthcare AI stocks, leaders in healthcare AI.

- Capitalize on opportunities others overlook by uncovering these 865 undervalued stocks based on cash flows, which trade at attractive valuations based on their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turpaz Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TRPZ

Turpaz Industries

Engages in the development, production, marketing, and sale of scents in Israel, the Middle East, North America, Europe, Africa, Asia, and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives