- Israel

- /

- Metals and Mining

- /

- TASE:HOD

We Think Hod Assaf Industries (TLV:HOD) Can Manage Its Debt With Ease

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Hod Assaf Industries Ltd. (TLV:HOD) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Hod Assaf Industries

How Much Debt Does Hod Assaf Industries Carry?

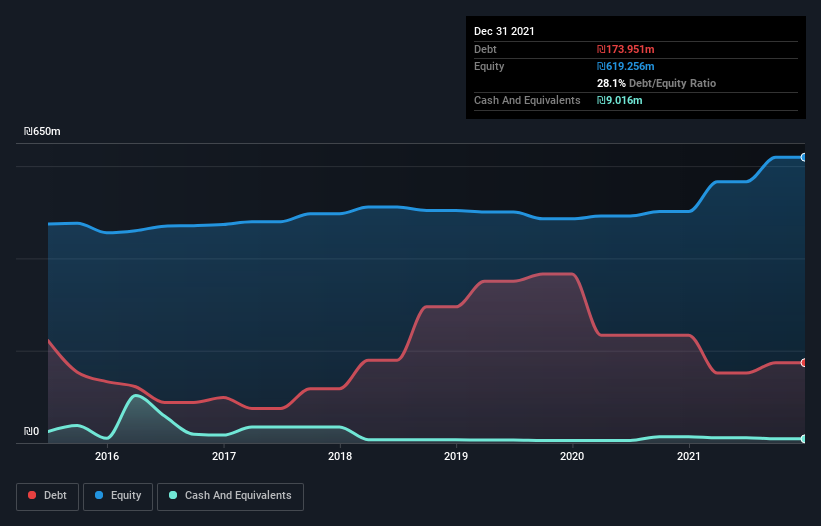

The image below, which you can click on for greater detail, shows that Hod Assaf Industries had debt of ₪174.0m at the end of December 2021, a reduction from ₪233.4m over a year. However, it does have ₪9.02m in cash offsetting this, leading to net debt of about ₪164.9m.

How Healthy Is Hod Assaf Industries' Balance Sheet?

We can see from the most recent balance sheet that Hod Assaf Industries had liabilities of ₪482.8m falling due within a year, and liabilities of ₪27.0m due beyond that. Offsetting these obligations, it had cash of ₪9.02m as well as receivables valued at ₪316.3m due within 12 months. So it has liabilities totalling ₪184.5m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Hod Assaf Industries is worth ₪651.8m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Hod Assaf Industries's net debt is only 0.91 times its EBITDA. And its EBIT covers its interest expense a whopping 19.4 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Even more impressive was the fact that Hod Assaf Industries grew its EBIT by 369% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Hod Assaf Industries will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last two years, Hod Assaf Industries actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Hod Assaf Industries's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Overall, we don't think Hod Assaf Industries is taking any bad risks, as its debt load seems modest. So the balance sheet looks pretty healthy, to us. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Hod Assaf Industries's earnings per share history for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Hod Assaf Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:HOD

Hod Assaf Industries

Engages in the production, processing, and sale of steel products in Israel and Romania.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026