The Middle Eastern stock markets have shown mixed performances recently, influenced by weak corporate earnings and uncertainties surrounding U.S. interest rate cuts. Despite these challenges, investors continue to explore opportunities within the region's diverse sectors. Penny stocks, though considered a niche area today, remain relevant as they often represent smaller or newer companies with potential for growth when backed by strong financials. We'll explore three such penny stocks in the Middle East that may offer both stability and upside potential for investors seeking promising opportunities in less-established companies.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.55 | SAR1.41B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.05 | AED2.1B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.39 | AED703.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED381.15M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.25 | AED13.78B | ✅ 3 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.795 | AED2.28B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.824 | AED501.81M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.726 | ₪213.99M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 77 stocks from our Middle Eastern Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ajman Bank PJSC offers a range of banking products and services to individuals, businesses, and government institutions in the United Arab Emirates, with a market capitalization of AED3.98 billion.

Operations: The company's revenue is derived from Treasury (AED184.52 million), Consumer Banking (AED279.19 million), and Wholesale Banking (AED447.74 million) segments.

Market Cap: AED3.98B

Ajman Bank PJSC, with a market capitalization of AED3.98 billion, has shown significant financial developments as a penny stock in the Middle East. The bank's recent earnings report highlighted an increase in net income to AED134.88 million for Q3 2025, up from AED74 million the previous year, indicating profitability growth despite a decline in net interest income. The company's Loans to Assets ratio is appropriate at 54%, and it primarily relies on low-risk customer deposits for funding. However, challenges include a high level of bad loans at 8.9% and an unstable dividend track record despite having high-quality past earnings and no recent shareholder dilution.

- Click to explore a detailed breakdown of our findings in Ajman Bank PJSC's financial health report.

- Evaluate Ajman Bank PJSC's historical performance by accessing our past performance report.

Akfen Gayrimenkul Yatirim Ortakligi (IBSE:AKFGY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Akfen Gayrimenkul Yatirim Ortakligi, operating as Akfen Real Estate Investment Trust Inc., focuses on real estate investments following its transformation from Aksel Tourism Investments and Management Inc., with a market capitalization of TRY10.88 billion.

Operations: Akfen Real Estate Investment Trust Inc. has not reported any specific revenue segments.

Market Cap: TRY10.88B

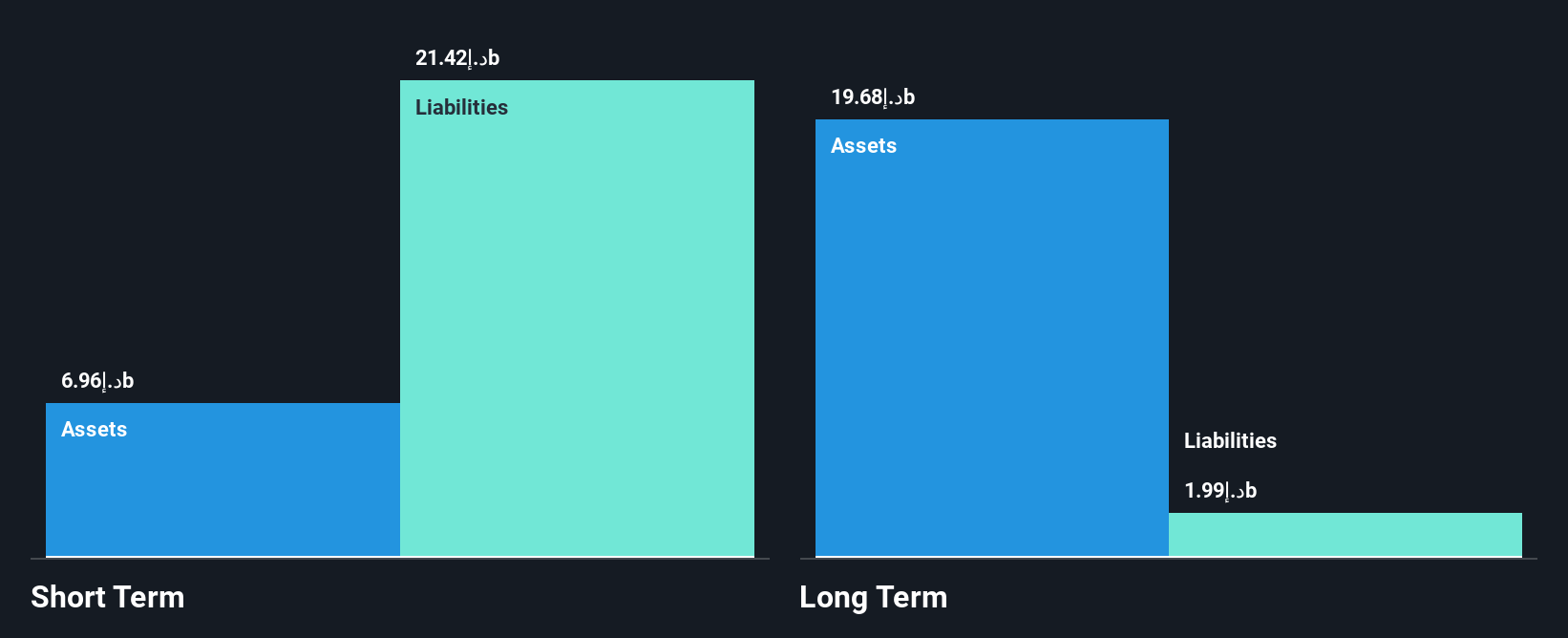

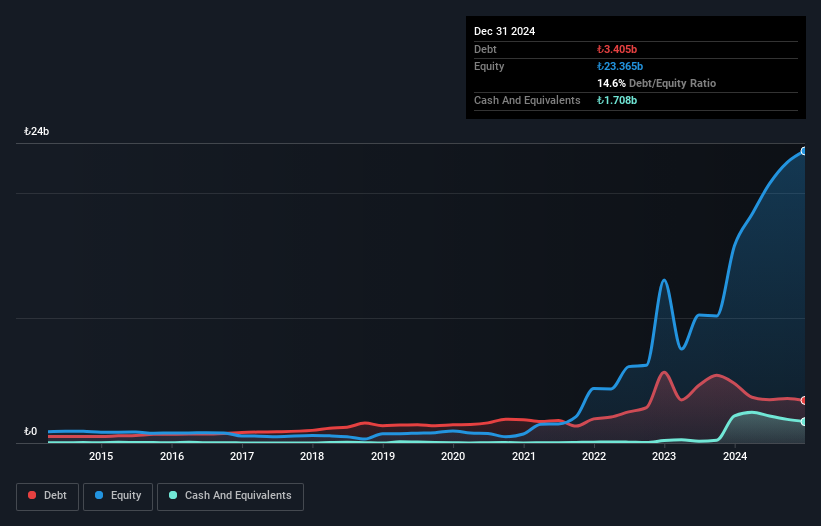

Akfen Gayrimenkul Yatirim Ortakligi, with a market cap of TRY10.88 billion, has transitioned to profitability recently but faces challenges in covering interest payments with EBIT only 1.9 times its interest obligations. The company's short-term assets of TRY5.2 billion exceed its short-term liabilities, yet long-term liabilities remain uncovered by these assets. Despite a low Return on Equity at 4.7%, Akfen's debt situation has improved significantly over the past five years, reducing from 381.1% to a satisfactory net debt to equity ratio of 9%. Recent earnings reports show stable sales figures and increased quarterly net income compared to the previous year, although nine-month results reflect a decrease in net income year-on-year due to large one-off gains impacting financials.

- Take a closer look at Akfen Gayrimenkul Yatirim Ortakligi's potential here in our financial health report.

- Explore historical data to track Akfen Gayrimenkul Yatirim Ortakligi's performance over time in our past results report.

Bram Industries (TASE:BRAM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bram Industries Ltd. operates through its subsidiaries to develop, produce, and market plastic products using injection-molding technology in Israel, with a market cap of ₪29.01 million.

Operations: Bram Industries generates revenue primarily from its Packaging for the Food Industry segment, which accounts for ₪53.99 million, and its Home Essentials Products - Plastic Products segment, contributing ₪0.67 million.

Market Cap: ₪29.01M

Bram Industries Ltd., with a market cap of ₪29.01 million, recently reported improved financial results for the second quarter of 2025, achieving a net income of ₪0.015 million compared to a significant loss last year. Despite this progress, the company remains unprofitable overall, with losses increasing at an annual rate of 8.5% over five years. While Bram's short-term assets exceed its liabilities and its debt level is satisfactory with a net debt to equity ratio of 23.8%, cash flow coverage for debt is weak at only 7.8%. The board exhibits experience with an average tenure of 4.8 years.

- Unlock comprehensive insights into our analysis of Bram Industries stock in this financial health report.

- Learn about Bram Industries' historical performance here.

Where To Now?

- Dive into all 77 of the Middle Eastern Penny Stocks we have identified here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bram Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:BRAM

Bram Industries

Through its subsidiaries, engages in the development, production, and marketing of plastic products using injection-molding technology in Israel.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives