Menora Mivtachim (TASE:MMHD) Net Margin Improves to 13.6%, Reinforcing Quality Growth Narrative

Reviewed by Simply Wall St

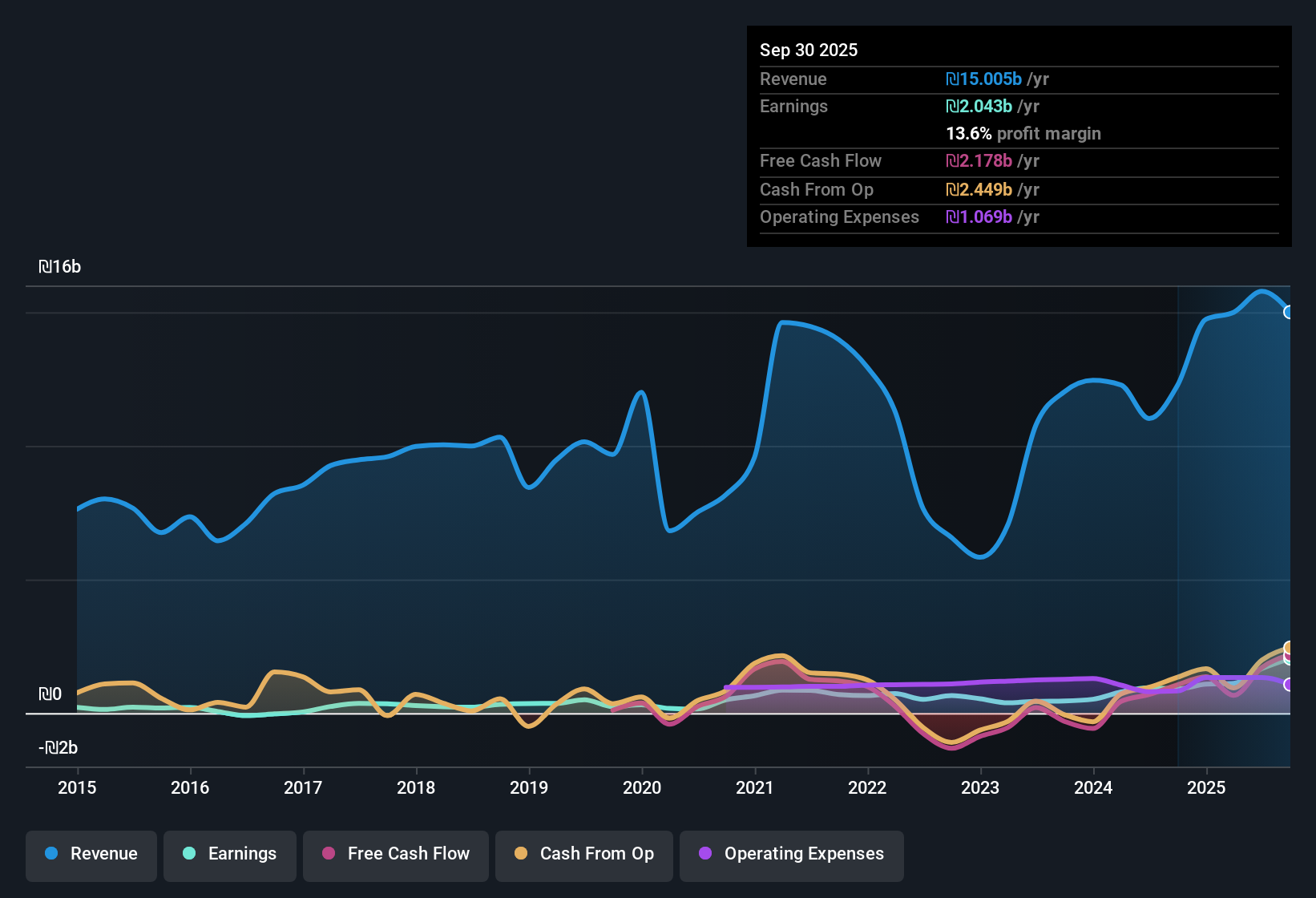

Menora Mivtachim Holdings (TASE:MMHD) just reported third-quarter revenue of ₪3.1 billion and Basic EPS of ₪9.44, alongside net income of ₪589 million for Q3 2025. Over recent quarters, the company has seen revenue move from ₪2.8 billion in Q1 2025 to ₪3.2 billion in Q2, then to the current figure, with EPS changing from ₪6.17 to ₪11.8 and now ₪9.44. Implied profit margins remain noteworthy, offering investors a solid vantage point on the earnings trajectory this period.

See our full analysis for Menora Mivtachim Holdings.Now, let's see how these headline figures compare to the prevailing narratives that have taken shape on Simply Wall St. Some expectations are likely to be confirmed while others may face new scrutiny.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Climb to 13.6% on TTM Basis

- Net profit margin rose to 13.6% in the last twelve months, an improvement over last year’s margin of 7.4%. This metric points to stronger operational efficiency and profitability as the company converts a larger percentage of revenue into net income than it did in the prior period.

- What is striking in the prevailing market view is that sustaining this margin gain supports the idea of Menora Mivtachim as a stable, high-quality performer in Israel’s financial sector.

- This margin growth is in line with a marked 126.5% increase in net profit year-over-year, aligning with the narrative that robust underlying fundamentals are at work.

- At the same time, the improvement provides tangible evidence that management actions such as diversified revenue streams and operational discipline are translating into more efficient value creation.

Share Price Leaps Ahead of DCF Fair Value

- The current share price stands at ₪378, significantly above the DCF fair value estimate of ₪180.69, even as the reported Price-to-Earnings ratio at 11.5x sits below the IL market average of 15.3x.

- Critics highlight the tension here: despite attractive relative valuation metrics, the share price’s premium over DCF fair value sparks debate about upside limits.

- Bulls may argue that strong multi-year profit growth (126.5% year-over-year, 19.7% annualized over five years) partially justifies the premium, yet the fair value gap remains difficult to ignore for value-focused investors.

- This disconnect between fundamentals and pricing underscores the importance of not relying on relative valuation alone, as robust results can already be priced in when enthusiasm is high.

EPS Growth Outpaces Top-Line Expansion

- Basic EPS climbed to ₪32.79 over the trailing twelve months, more than doubling from last year’s period, while total revenue for the same period reached ₪15.0 billion, up from ₪12.3 billion a year ago. This widening gap indicates that profit is growing faster than sales, a sign of margin leverage.

- The prevailing analysis suggests that this disproportionate earnings acceleration backs the argument for Menora Mivtachim’s “high quality” growth story.

- Bulls point to the synchronous rise in EPS and net profit margins (now 13.6%), emphasizing efficient business execution and scalability.

- Yet, a cautious takeaway is that sustaining such outperformance requires continued margin discipline and support from broader macroeconomic conditions.

If you want a deeper look at how these fundamentals fit into the bigger picture, check the full consensus narrative for more balanced market insights. 📊 Read the full Menora Mivtachim Holdings Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Menora Mivtachim Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust earnings growth, Menora Mivtachim’s share price currently trades at a steep premium to fair value, which raises concerns for value-focused investors.

If you’re looking to avoid stocks where high prices might limit future returns, check out these 930 undervalued stocks based on cash flows for opportunities that still trade below their estimated worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MMHD

Menora Mivtachim Holdings

Operates in insurance and finance sectors in Israel.

Outstanding track record with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026