- Israel

- /

- Renewable Energy

- /

- TASE:KEN

Exploring Three Undiscovered Gems in the Middle East Market

Reviewed by Simply Wall St

As the Middle East markets navigate the complexities of global trade tensions and economic fluctuations, investors are keenly observing movements within key indices like Abu Dhabi's benchmark, which recently settled slightly lower amid anticipation of U.S.-China trade talks. In such a dynamic environment, identifying stocks with strong fundamentals and potential for resilience can be crucial for those looking to uncover hidden opportunities in this vibrant region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Kerevitas Gida Sanayi ve Ticaret | 42.60% | 43.79% | 39.15% | ★★★★★★ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 29.47% | 42.38% | -38.36% | ★★★★★★ |

| Birikim Varlik Yonetim Anonim Sirketi | 35.08% | 46.79% | 47.74% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 14.46% | 58.05% | 72.63% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 91.93% | 46.59% | 3.35% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 53.26% | 26.61% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 8.11% | 55.10% | 73.88% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.68% | 12.49% | 49.63% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Ray Sigorta Anonim Sirketi (IBSE:RAYSG)

Simply Wall St Value Rating: ★★★★★★

Overview: Ray Sigorta Anonim Sirketi operates in the non-life insurance sector in Turkey with a market capitalization of TRY39.06 billion.

Operations: Ray Sigorta Anonim Sirketi generates revenue primarily through its non-life insurance offerings in Turkey. The company's net profit margin has shown a notable trend, reflecting its operational efficiency and cost management strategies.

Ray Sigorta has shown impressive earnings growth, with a 70.8% annual increase over the last five years, yet its recent net profit margin of 12.8% is down from 28.2% the previous year. Despite this dip, the company remains debt-free and boasts high-quality earnings, providing a strong foundation for future stability. The firm reported TRY 812 million in net income for Q1 2025, a decrease from TRY 924 million in the same period last year. While its share price has been volatile recently, Ray Sigorta's robust free cash flow and profitability suggest resilience amid industry challenges.

- Unlock comprehensive insights into our analysis of Ray Sigorta Anonim Sirketi stock in this health report.

Learn about Ray Sigorta Anonim Sirketi's historical performance.

I.D.I. Insurance (TASE:IDIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: I.D.I. Insurance Company Ltd. offers a range of insurance products and services to both individuals and corporate clients in Israel, with a market capitalization of ₪2.68 billion.

Operations: Revenue streams for I.D.I. Insurance are primarily derived from General Insurance, with Automobile Property Insurance contributing ₪1.95 billion and Compulsory Vehicle Insurance adding ₪642.83 million. Life Insurance and Long-Term Savings generate ₪373.32 million, while Health insurance accounts for ₪279 million in revenue.

I.D.I. Insurance stands out with a price-to-earnings ratio of 10.4x, which is below the IL market average of 14.3x, indicating potential value for investors. The company has reduced its debt to equity ratio from 81.4% to 48.7% over five years and holds more cash than its total debt, suggesting financial prudence. Despite earnings growth not keeping pace with the insurance industry last year, net income surged to ILS 257 million from ILS 139 million in the previous year, reflecting robust profitability improvements alongside high-quality past earnings and strong interest coverage at 21 times EBIT.

Kenon Holdings (TASE:KEN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kenon Holdings Ltd. is engaged in owning, developing, and operating power generation facilities in Israel and the United States through its subsidiaries, with a market capitalization of ₪5.96 billion.

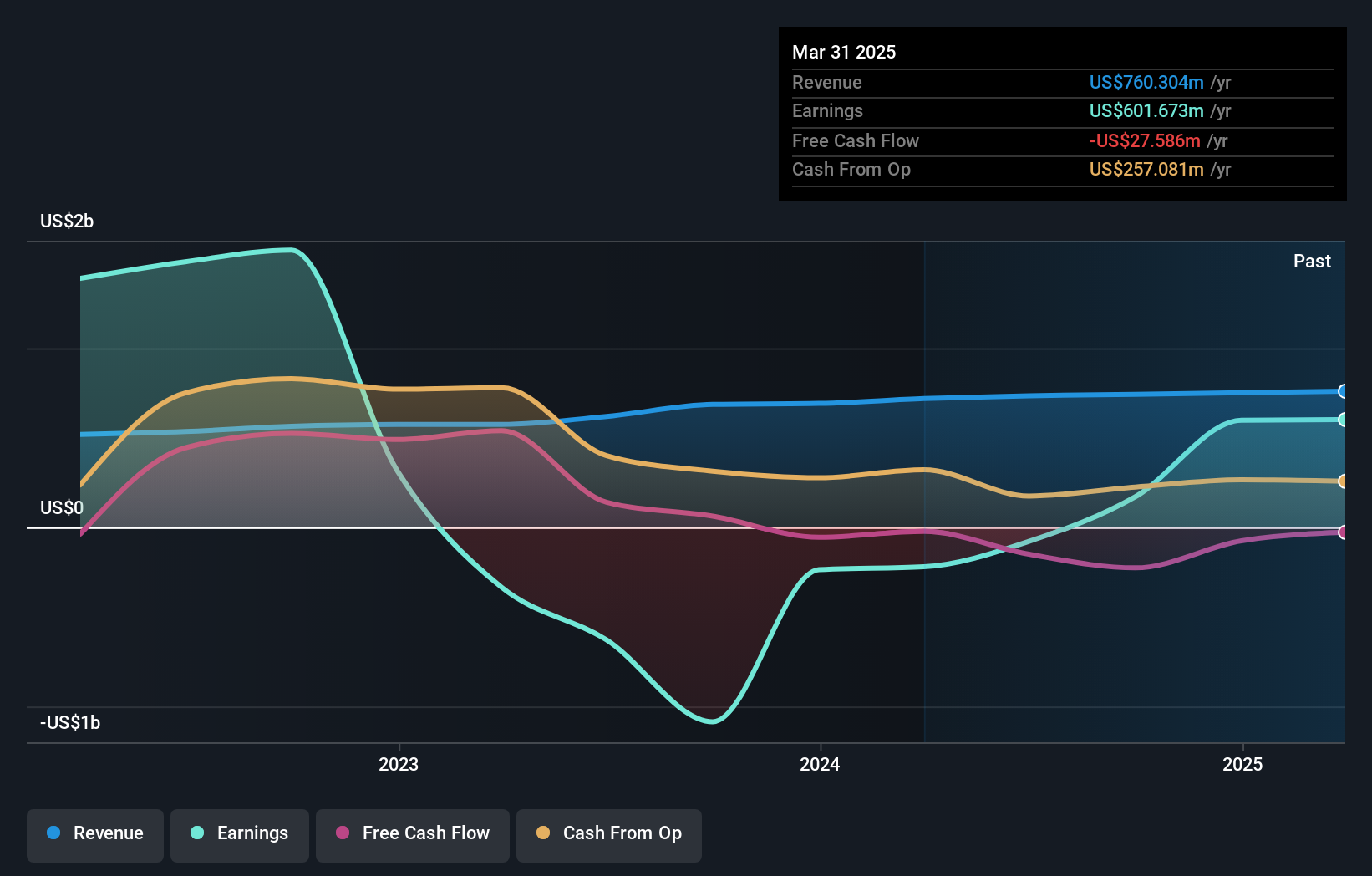

Operations: Kenon Holdings generates revenue primarily from its subsidiaries, with OPC Israel contributing $624.96 million and CPV Group adding $126.35 million. The company's net profit margin is a key financial metric to consider when evaluating its performance.

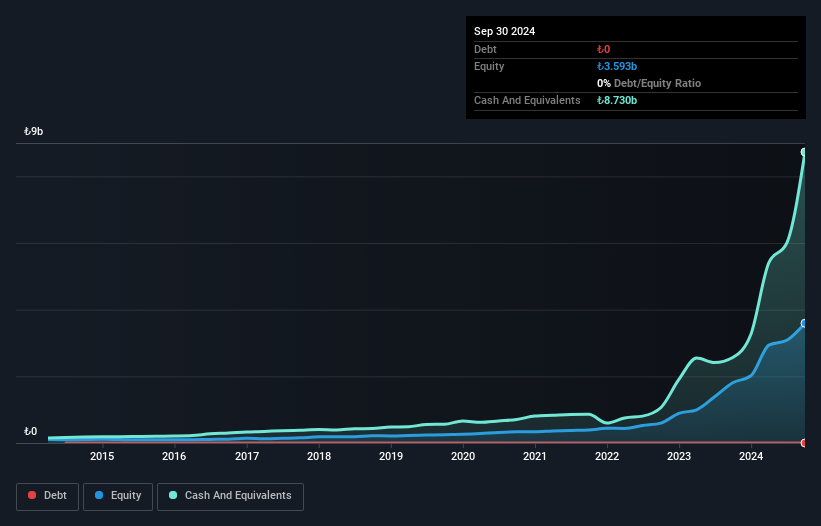

Kenon Holdings seems to be navigating its financial landscape with notable improvements. Over the past five years, its debt to equity ratio has decreased from 87.4% to 47.6%, indicating a more balanced financial structure. The company also reported a significant turnaround with net income of US$597 million for 2024, compared to a net loss of US$236 million the previous year, and basic earnings per share at US$11.34. Despite these gains, interest payments remain poorly covered by EBIT at just 1x coverage, highlighting an area for potential improvement in financial health management.

- Get an in-depth perspective on Kenon Holdings' performance by reading our health report here.

Review our historical performance report to gain insights into Kenon Holdings''s past performance.

Taking Advantage

- Click this link to deep-dive into the 242 companies within our Middle Eastern Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kenon Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:KEN

Kenon Holdings

Through its subsidiaries, operates as an owner, developer, and operator of power generation facilities in Israel and the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives