- United Arab Emirates

- /

- Healthcare Services

- /

- ADX:GMPC

Discovering Middle East's Undiscovered Gems This July 2025

Reviewed by Simply Wall St

As the Gulf markets navigate mixed outcomes with strong earnings counterbalancing concerns over U.S. tariff changes, investors are keenly observing how these dynamics play out across key indices such as Saudi Arabia's benchmark index and Dubai's main share index. In this environment, identifying promising stocks often involves looking for companies that demonstrate resilience amid trade policy shifts and profit-taking pressures, making them potential gems in the Middle East market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Rimoni Industries | NA | 2.82% | 0.61% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.53% | 7.56% | 49.01% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Gulf Medical Projects Company (PJSC) (ADX:GMPC)

Simply Wall St Value Rating: ★★★★★★

Overview: Gulf Medical Projects Company (PJSC) operates hospitals in the United Arab Emirates and has a market capitalization of AED 1.50 billion.

Operations: Gulf Medical Projects Company derives its revenue primarily from Health Services, contributing AED 690.34 million, with additional income from Investments amounting to AED 37.79 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability and operational efficiency.

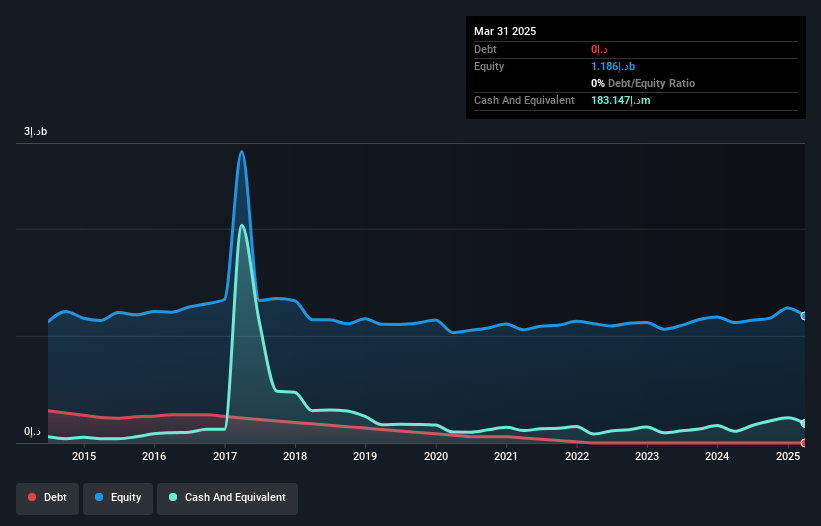

Gulf Medical Projects Company, a nimble player in the healthcare sector, is making waves with its impressive financial performance. Over the past year, earnings surged by 31.7%, outpacing the industry growth of 5%. The company boasts high-quality earnings and operates debt-free, a significant shift from five years ago when its debt to equity ratio was 7%. Recent results show net income climbing to AED 22.47 million from AED 16.83 million a year prior, with sales reaching AED 180.05 million up from AED 167.05 million last year. Trading at roughly 78% below estimated fair value suggests room for potential appreciation.

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Value Rating: ★★★★★★

Overview: Anadolu Hayat Emeklilik Anonim Sirketi operates in Turkey, offering individual and group insurance and reinsurance services across life, retirement, and personal accident sectors, with a market cap of TRY35.88 billion.

Operations: Anadolu Hayat Emeklilik generates revenue primarily from providing insurance and reinsurance services in life, retirement, and personal accident sectors. The company's net profit margin is a key financial metric to consider when evaluating its profitability within these segments.

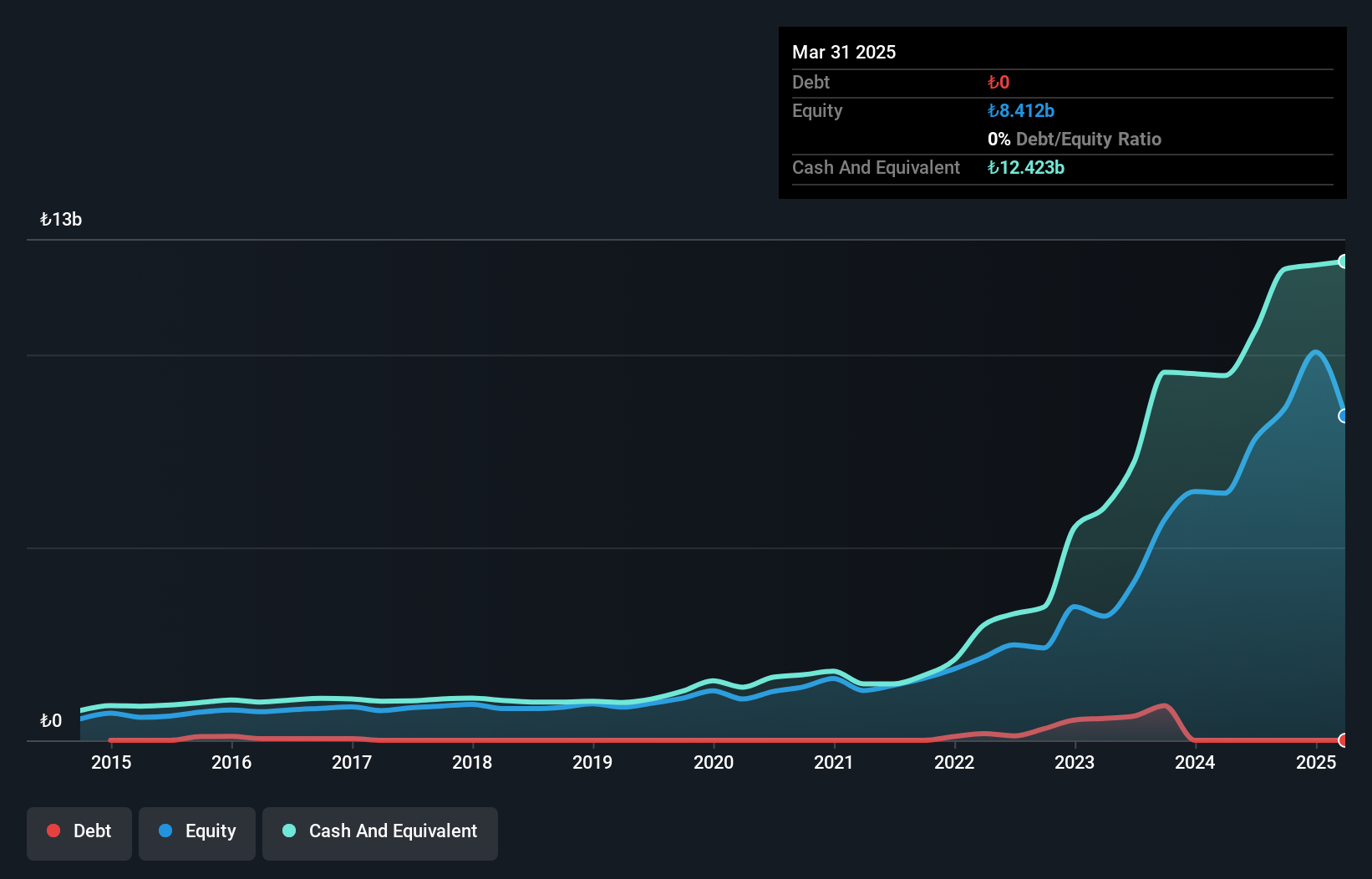

Anadolu Hayat Emeklilik, a notable player in the insurance sector, showcases a compelling profile with its debt-free status and high-quality earnings. Over the past five years, it has achieved an impressive 49% annual growth in earnings. Despite trailing behind the industry’s 36.5% growth last year with its own 27.5%, it remains competitive due to its attractive price-to-earnings ratio of 8.4x compared to the TR market's 18.8x. Recent results highlight net income reaching TRY 1,107 million for Q1 of this year, up from TRY 999 million previously, indicating steady progress and potential for future gains in this dynamic market space.

I.D.I. Insurance (TASE:IDIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: I.D.I. Insurance Company Ltd. offers a range of insurance products and services to both individual and corporate clients in Israel, with a market capitalization of ₪2.87 billion.

Operations: I.D.I. Insurance generates revenue primarily from health and life insurance, with health insurance contributing ₪282.21 million and life insurance and long-term savings adding ₪399.69 million.

I.D.I. Insurance stands out with its impressive earnings growth of 49.1% over the past year, surpassing the industry average of 45%. Its price-to-earnings ratio at 10.3x is notably lower than the IL market's 16.4x, suggesting potential undervaluation. The company has successfully reduced its debt to equity ratio from 82.7% to 42.2% in five years and maintains more cash than total debt, ensuring financial stability. Recent earnings reveal a net income increase to ILS 90.42 million from ILS 64.46 million last year, reflecting strong performance and confidence in future prospects with high-quality earnings and positive free cash flow.

Seize The Opportunity

- Delve into our full catalog of 224 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:GMPC

Gulf Medical Projects Company (PJSC)

Manages hospitals in the United Arab Emirates.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives