- Israel

- /

- Household Products

- /

- TASE:SANO1

Investors Met With Slowing Returns on Capital At Sano Bruno's Enterprises (TLV:SANO1)

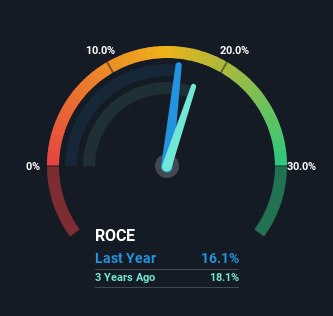

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. With that in mind, the ROCE of Sano Bruno's Enterprises (TLV:SANO1) looks decent, right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Sano Bruno's Enterprises:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = ₪340m ÷ (₪2.5b - ₪427m) (Based on the trailing twelve months to September 2024).

So, Sano Bruno's Enterprises has an ROCE of 16%. In absolute terms, that's a satisfactory return, but compared to the Household Products industry average of 11% it's much better.

View our latest analysis for Sano Bruno's Enterprises

Historical performance is a great place to start when researching a stock so above you can see the gauge for Sano Bruno's Enterprises' ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Sano Bruno's Enterprises.

The Trend Of ROCE

The trend of ROCE doesn't stand out much, but returns on a whole are decent. The company has consistently earned 16% for the last five years, and the capital employed within the business has risen 63% in that time. 16% is a pretty standard return, and it provides some comfort knowing that Sano Bruno's Enterprises has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

The Bottom Line

In the end, Sano Bruno's Enterprises has proven its ability to adequately reinvest capital at good rates of return. And the stock has followed suit returning a meaningful 85% to shareholders over the last five years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

If you're still interested in Sano Bruno's Enterprises it's worth checking out our FREE intrinsic value approximation for SANO1 to see if it's trading at an attractive price in other respects.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SANO1

Sano Bruno's Enterprises

Engages in the development, production, marketing, distribution, and sale of non-food household and commercial consumer products in Israel and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026